Sweetgreen Intrinsic Stock Value – Sweetgreen Shares Plummet After Chipotle Files Lawsuit

April 7, 2023

Trending News ☀️

Sweetgreen ($NYSE:SG), a fast-casual chain of salad restaurants, recently saw its shares plummet after Chipotle filed a lawsuit against them. Sweetgreen is a chain of salad restaurants that strives to make eating healthy a convenient and enjoyable experience by providing simple, seasonal salads and bowls made from ingredients that are minimally processed.

However, Chipotle filed a lawsuit against Sweetgreen for trademark infringement, alleging that Sweetgreen’s logo and design of its restaurant were similar to Chipotle’s. This caused shares of Sweetgreen to drop significantly as investors were concerned about the potential financial implications of the lawsuit. Although Sweetgreen has yet to comment on the lawsuit, it is expected that the case will be closely watched by the business world.

Share Price

On Wednesday, the stock of SWEETGREEN saw a massive plunge. At the opening, SWEETGREEN was trading at $7.2 but at the end of the day, the stock closed at $6.9, a decline of 6.3% from its previous closing price of $7.4. The decline was attributed to Chipotle filing a lawsuit against SWEETGREEN, alleging patent infringement and false advertising. This marks a huge dip in SWEETGREEN’s stock and has investors worried about how this might affect the company’s future. Sweetgreen_Shares_Plummet_After_Chipotle_Files_Lawsuit”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sweetgreen. More…

| Total Revenues | Net Income | Net Margin |

| 470.11 | -190.44 | -38.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sweetgreen. More…

| Operations | Investing | Financing |

| -43.17 | -102.02 | 4.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sweetgreen. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 908.93 | 367.71 | 4.87 |

Key Ratios Snapshot

Some of the financial key ratios for Sweetgreen are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.7% | – | -40.2% |

| FCF Margin | ROE | ROA |

| -30.9% | -21.0% | -13.0% |

Analysis – Sweetgreen Intrinsic Stock Value

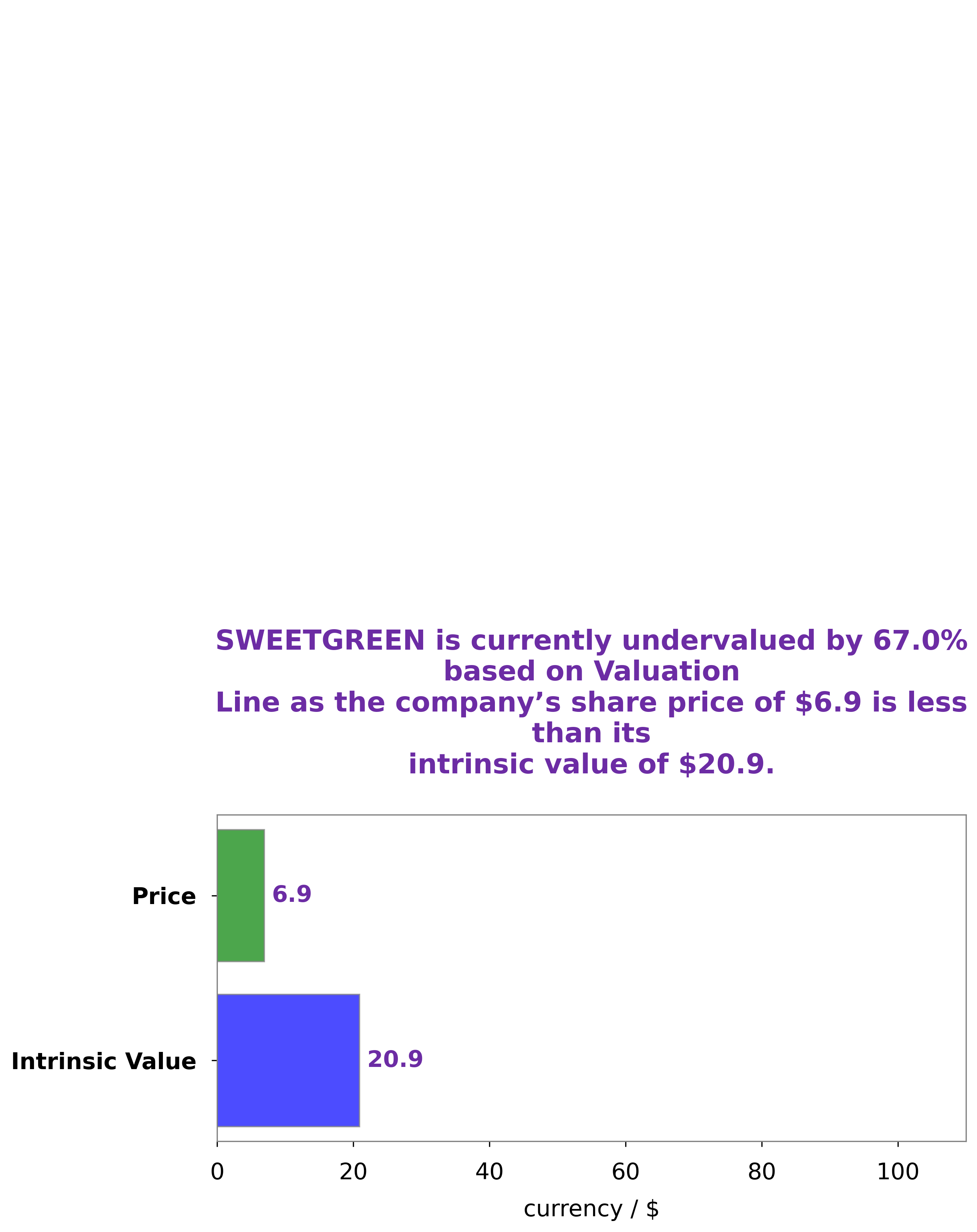

At GoodWhale, we have conducted an analysis of SWEETGREEN’s wellbeing. After careful scrutiny of the company’s financial performance and investments, we have determined that the fair value of a SWEETGREEN share is around $20.9. This estimate has been calculated by our proprietary Valuation Line. Interestingly though, SWEETGREEN stock is currently traded at only $6.9, meaning that it is undervalued by a staggering 66.9%. This presents a great opportunity for investors to make long-term gains. Sweetgreen_Shares_Plummet_After_Chipotle_Files_Lawsuit”>More…

Peers

Its competitors are BT Brands Inc, Doutor Nichires Holdings Co Ltd, and Odd Burger Corp. Sweetgreen Inc has an edge over its competitors because it offers a variety of healthy food options that are affordable and convenient.

– BT Brands Inc ($NASDAQ:BTBD)

L Brands, Inc. is an American fashion retailer based in Columbus, Ohio. The company was founded in 1963 by Leslie Wexner. It owns and operates several retail chains, including Victoria’s Secret, Bath & Body Works, La Senza, Henri Bendel, and Mast General Store. L Brands posted revenue of $12.5 billion in 2016. The company has a market cap of $13.89 million and a return on equity of 2.15%.

– Doutor Nichires Holdings Co Ltd ($TSE:3087)

Doutor Nichires Holdings Co Ltd is a Japanese company that manufactures and sells pharmaceuticals and health foods. The company has a market cap of 72.34B as of 2022 and a Return on Equity of 2.52%. Doutor Nichires Holdings Co Ltd is a publicly traded company listed on the Tokyo Stock Exchange. The company was founded in 1934 and is headquartered in Tokyo, Japan.

– Odd Burger Corp ($TSXV:ODD)

Odd Burger Corp is a publicly traded company with a market capitalization of $27.57 million as of January 2022. The company has a negative return on equity of -120.07%, meaning that it has lost more money than it has made in the past year. Odd Burger Corp is a fast food company that specializes in burgers and fries. The company has locations in the United States and Canada.

Summary

Investing in Sweetgreen has been a bit of a rollercoaster ride recently. Analysts have remained positive about Sweetgreen’s long-term prospects, but investors should be aware of this recent volatility. In the short term, it may be prudent for investors to wait for additional clarity on the outcome of the lawsuit before considering an investment in Sweetgreen.

Recent Posts