Sunpower Corporation Stock Fair Value – Jefferies Financial Group Gives SunPower Corporation a Boost with Coverage Initiation

December 21, 2023

☀️Trending News

SUNPOWER ($NASDAQ:SPWR): SunPower Corporation is a leading global solar energy company, headquartered in San Jose, California. The company designs, manufactures and delivers high-performance solar systems including components, services, and solutions for residential, commercial, and utility customers. Recently, Jefferies Financial Group began analysing SunPower’s performance, giving them a boost with their coverage initiation. Jefferies is a leading global investment bank that provides financial advice and solutions to clients in the healthcare, technology, media, and consumer sectors.

Additionally, this news has boosted SunPower’s stock price as investors are confident that a respected institution such as Jefferies is paying attention to the company’s performance. The company has a long history in the solar energy industry and this news is just another indication of their promising future. Investors would be wise to take note of this news and consider SunPower as a possible investment option.

Price History

On Monday, SUNPOWER CORPORATION stock opened at $4.7 and closed at $4.2, plunging by 31.3% from last closing price of 6.1. This was a major hit for the company’s stock, signaling an uncertain future for the solar energy and storage provider. This potential upside encouraged investors to buy into the stock, pushing its value up and giving SunPower a much-needed boost of confidence. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sunpower Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 1.83k | -106.59 | -5.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sunpower Corporation. More…

| Operations | Investing | Financing |

| -123.67 | 14.5 | -213.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sunpower Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.45k | 1.02k | 2.41 |

Key Ratios Snapshot

Some of the financial key ratios for Sunpower Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.3% | 5.2% | -4.1% |

| FCF Margin | ROE | ROA |

| -9.9% | -10.4% | -3.2% |

Analysis – Sunpower Corporation Stock Fair Value

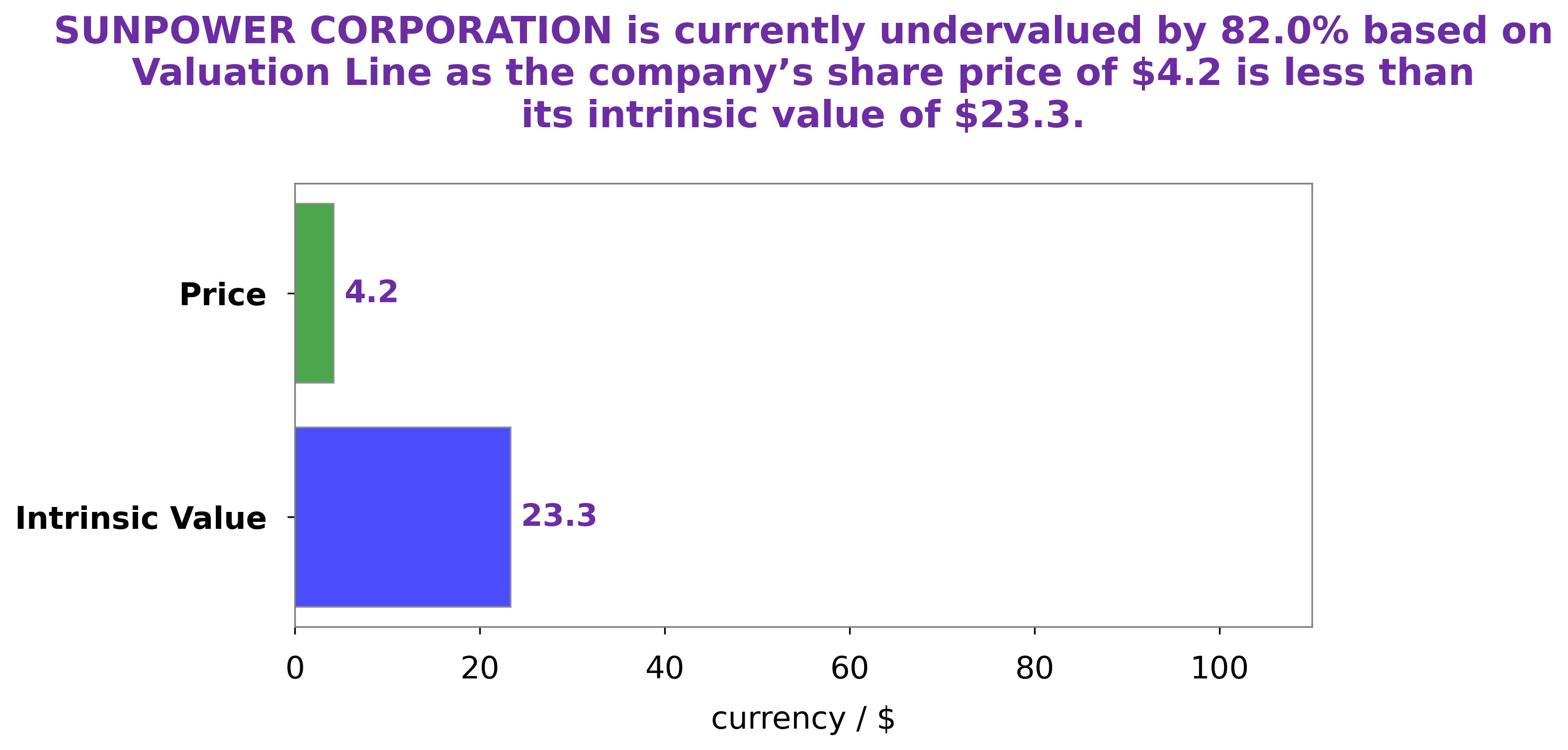

At GoodWhale, we have recently analyzed the fundamentals of SUNPOWER CORPORATION. After thorough evaluation, our proprietary Valuation Line has concluded that the fair value of SUNPOWER CORPORATION stock is around $23.3. This is in comparison to the current market price of $4.2, indicating an 82.0% undervaluation. In light of these findings, we recommend adding SUNPOWER CORPORATION stock to your portfolio. More…

Peers

Solar panel technology has come a long way in recent years, and SunPower Corp has been at the forefront of this innovation. The company’s unique technology has allowed it to become one of the leading manufacturers of solar panels in the world. However, SunPower Corp is not without competition. Enphase Energy Inc, Central Development Holdings Ltd, and PT Sky Energy Indonesia Tbk are all leading solar panel manufacturers that are vying for market share.

– Enphase Energy Inc ($NASDAQ:ENPH)

Enphase Energy Inc is a publicly traded company that designs, manufactures and sells microinverters for the solar photovoltaic industry. Enphase has a market cap of $32.82B as of 2022 and a Return on Equity of 58.92%. The company was founded in 2006 and is headquartered in Fremont, CA.

– Central Development Holdings Ltd ($SEHK:00475)

Central Development Holdings Ltd is a property development and investment company based in Hong Kong. The company’s market cap as of 2022 was 251.92M and its ROE was -15.66%. Central Development Holdings Ltd’s primary business activity is the development of residential and commercial properties in Hong Kong. The company also has a portfolio of investment properties in Mainland China.

– PT Sky Energy Indonesia Tbk ($IDX:JSKY)

Sky Energy Indonesia Tbk is the largest Indonesian-based integrated energy company with operations in exploration and production, refining, marketing and trading, power generation, and mining. The company has a market capitalization of $105.69 billion as of 2022 and a return on equity of -22.56%.

Sky Energy Indonesia Tbk is a vertically integrated energy company with operations in exploration and production, refining, marketing and trading, power generation, and mining. The company has a strong presence in the Indonesian energy market and is the largest Indonesian-based integrated energy company. The company has a market capitalization of $105.69 billion as of 2022 and a return on equity of -22.56%. Sky Energy Indonesia Tbk is a well-positioned to benefit from the growing demand for energy in Indonesia and the Asia Pacific region.

Summary

SunPower Corporation (NASDAQ: SPWR) has been garnering attention from investors due to its recent coverage initiation by Jefferies Financial Group. The solar energy solutions provider’s stock price dropped the same day as the announcement, which may be indicative of the mixed sentiment in the market. Analysts suggest that SunPower’s strong financial performance and attractive growth prospects make it an attractive investment for long-term investors. Additionally, the company’s strategic partnerships with leading names in the industry have given it greater visibility in the market and new opportunities. SunPower’s ability to tap into new markets and secure competitive advantages may be a major factor driving its future growth.

However, investors should be aware that SunPower’s exposure to fluctuations in energy prices and government regulations could lead to significant volatility in its stock price.

Recent Posts