Sse Plc Intrinsic Value Calculator – SSE PLC Shares Drop 1.78% to £17.06 on a Difficult Day for the FTSE 100 Index in 2023.

March 30, 2023

Trending News 🌧️

On Friday, energy giant SSE PLC ($LSE:SSE) (SSE) saw shares drop to £17.06, underperforming the FTSE 100 Index which had a generally difficult day of trading. Overall, the company’s stock fell 1.78%, a significant hit to their value. This comes as SSE’s previous months had seen a steady climb in their stock prices. It is unclear what has caused the sudden drop in their stock prices and what impact it could have in the near future.

The FTSE 100 Index was the leading index for the UK market in 2023, and with SSE’s falling a total of 1.78%, it is clear that the energy giant is not faring as well as other companies in the same index. This could be due to a number of factors, such as political instability or changes in regulations, but further investigation would be needed to determine the exact cause. Investors remain cautious as to what this could mean for their stock prices in the coming months, and it will be interesting to see how the company fares over time.

Stock Price

This was a significant departure from the generally positive news sentiment surrounding the company’s stock, which had opened that morning at £17.1 and closed at £17.3, representing a 1.3% increase from its previous closing price of £17.1. Despite the stock’s strong performance earlier in the week, the day of losses left investors shaken and wondering if this was a sign of things to come for the stock in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sse Plc. More…

| Total Revenues | Net Income | Net Margin |

| 10.69k | 1.64k | 5.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sse Plc. More…

| Operations | Investing | Financing |

| 1.45k | -1.57k | 173.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sse Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 28.53k | 18.69k | 9.02 |

Key Ratios Snapshot

Some of the financial key ratios for Sse Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.8% | -11.8% | 15.3% |

| FCF Margin | ROE | ROA |

| -1.4% | 10.8% | 3.6% |

Analysis – Sse Plc Intrinsic Value Calculator

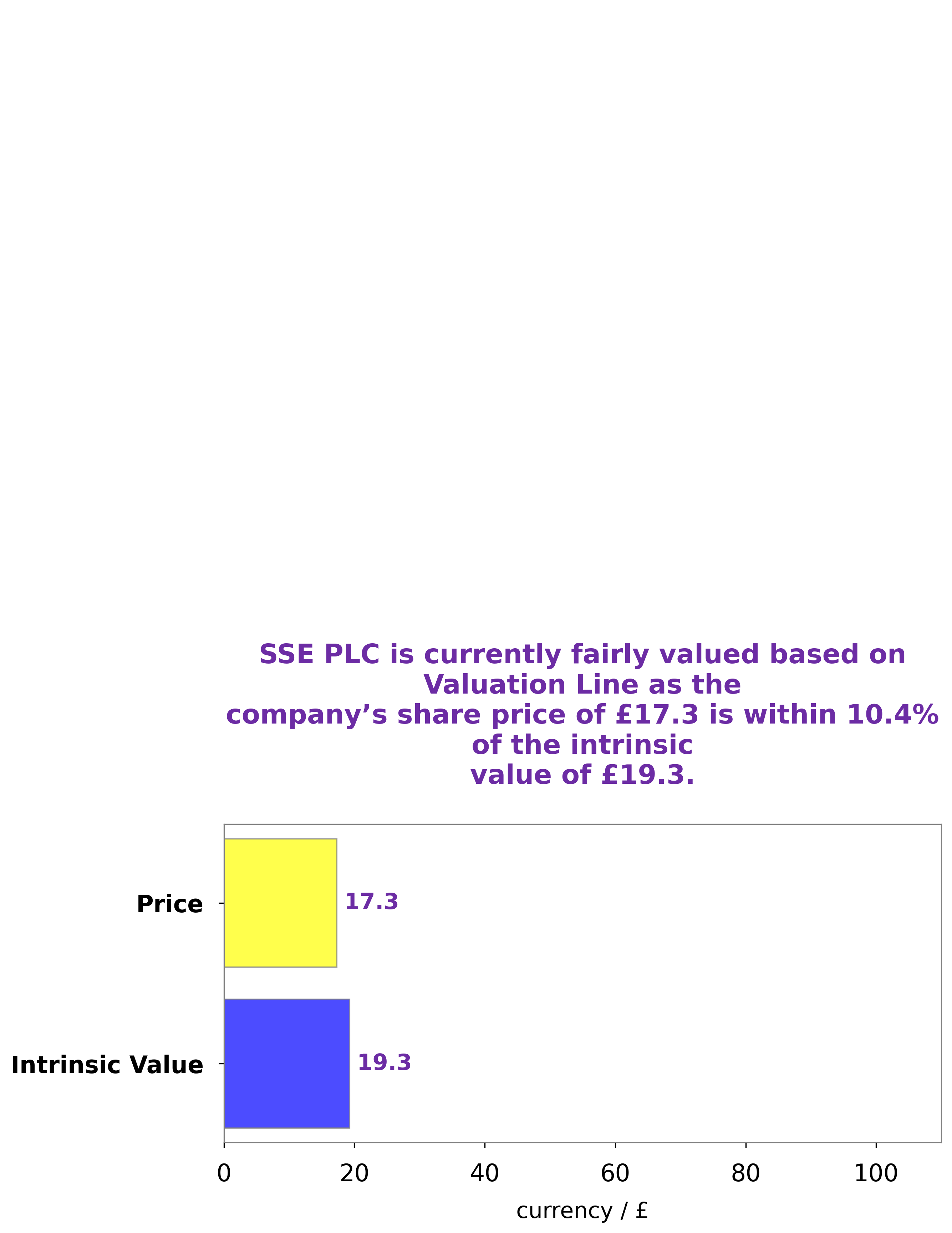

At GoodWhale, we have conducted an analysis on SSE PLC‘s wellbeing and intrinsic value. Our proprietary Valuation Line has concluded that the intrinsic value of SSE PLC share is around £19.3. Currently, SSE PLC stock is being traded at £17.3, which is a fair price, however it is undervalued by 10.5%. This presents an opportunity for investors who are looking to buy into the company at a cheaper price. More…

Peers

In the United Kingdom, SSE PLC is one of the “big six” energy suppliers that compete against each other to provide electricity and gas to residential and commercial customers. The other five companies are REN-Redes Energeticas Nacionais Sgps SA, NorthWestern Corp, OGE Energy Corp, and EDP Distribuicao SA. SSE PLC is the second largest electricity generator in the UK. The company also has gas production, storage, and distribution assets.

– REN-Redes Energeticas Nacionais Sgps SA ($LTS:0KBT)

REN-Redes Energeticas Nacionais Sgps SA is a Portugal-based holding company engaged in the electricity sector. The Company, through its subsidiaries, is active in the generation, transmission, distribution and commercialization of electricity, as well as in the natural gas sector. The Company operates a power grid of approximately 24,000 kilometers in mainland Portugal, the Madeira and Azores archipelagos, totaling around 5.5 million customers. As of December 31, 2011, REN-Redes Energeticas Nacionais Sgps SA had interests in 12 companies, including EDP Distribuicao SA, EDP Gases do Amazonas Ltda, EDP Gases do Nordeste Ltda and EDP Geração SA.

– NorthWestern Corp ($NASDAQ:NWE)

NorthWestern Corp is a holding company that provides electric and natural gas service to residential, commercial, and industrial customers in Montana, South Dakota, and Nebraska in the United States. The company has a market cap of $3.21 billion and a return on equity of 6.65%. NorthWestern Corp is a regulated utility company and is one of the largest providers of electricity and natural gas in the Northwest.

– OGE Energy Corp ($NYSE:OGE)

Duke Energy Corporation is an American electric power holding company headquartered in Charlotte, North Carolina. The company is the largest utility in the United States, with a generating capacity of over 49,000 megawatts. Duke Energy provides electricity to approximately 7.4 million customers in six states: North Carolina, South Carolina, Florida, Indiana, Ohio, and Kentucky. The company also has a commercial business that provides electricity and natural gas to approximately 2 million customers in the United States and Canada.

Duke Energy’s market cap is 7.86B as of 2022. The company has a Return on Equity of 18.73%. Duke Energy is the largest utility in the United States and provides electricity to approximately 7.4 million customers in six states. The company also has a commercial business that provides electricity and natural gas to approximately 2 million customers in the United States and Canada.

Summary

Investing in SSE PLC has been a difficult process in the last year with shares dropping 1.78% to £17.06 in 2023. Despite this, market sentiment has generally remained positive as investors continue to view the company as a sound long-term investment. SSE PLC has a diversified portfolio of energy-related assets and services including electricity, gas, telecommunications, and renewable energy sources. The company is currently focusing on expanding its renewable energy sources and green initiatives, as well as reducing its carbon footprint.

Furthermore, SSE PLC is continuing to implement cost-cutting measures and is investing in new technologies to improve its efficiency and profitability. With these initiatives in place, SSE PLC is well-positioned for continued growth and potential future success in the near future.

Recent Posts