Spire Inc Intrinsic Stock Value – Despite Price Target Dip, Spire Inc’s Potential Upside Remains High: Mizuho Research Report

May 20, 2023

Trending News 🌥️

On Friday, Mizuho released a research report indicating that renowned utilities provider Spire Inc ($NYSE:SR)’s price target had dipped; however, the potential for upside remains high. Spire Inc is a St. Louis, Missouri-based company that is a leading provider of energy and energy services in the United States. The company also provides energy efficiency programs, renewable energy solutions, and natural gas storage services.

In addition, the report stated that given the company’s strong operational performance and long-term outlook, the stock is likely to continue to demonstrate strong growth in the near future. The report also expressed confidence in Spire Inc’s ability to navigate the current market conditions, citing its strong balance sheet and diversified energy portfolio as reasons for optimism. This optimism is further supported by a series of strategic investments and partnerships that Spire Inc has made in recent years, which are expected to drive long-term value for shareholders. Overall, despite some short-term price volatility, Mizuho’s research report concludes that there is still significant potential for upside for investors in Spire Inc. With its strong performance over the past year and its long-term outlook, the company appears well-positioned to continue its growth in the future.

Stock Price

On Monday, SPIRE INC‘s stock opened at $69.3 and closed at $68.0, down by 1.5% from the previous closing price of 69.1. The report highlights several positive factors, such as the company’s strong market position, robust growth prospects, and innovative products. As such, the report reaffirms SPIRE INC’s positive outlook and suggests that current investors should remain confident in its stock and its future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Spire Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.7k | 246.4 | 9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Spire Inc. More…

| Operations | Investing | Financing |

| 79.8 | -614.2 | 540.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Spire Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.05k | 7.04k | 54.51 |

Key Ratios Snapshot

Some of the financial key ratios for Spire Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.9% | 16.7% | 17.7% |

| FCF Margin | ROE | ROA |

| -18.7% | 10.2% | 3.0% |

Analysis – Spire Inc Intrinsic Stock Value

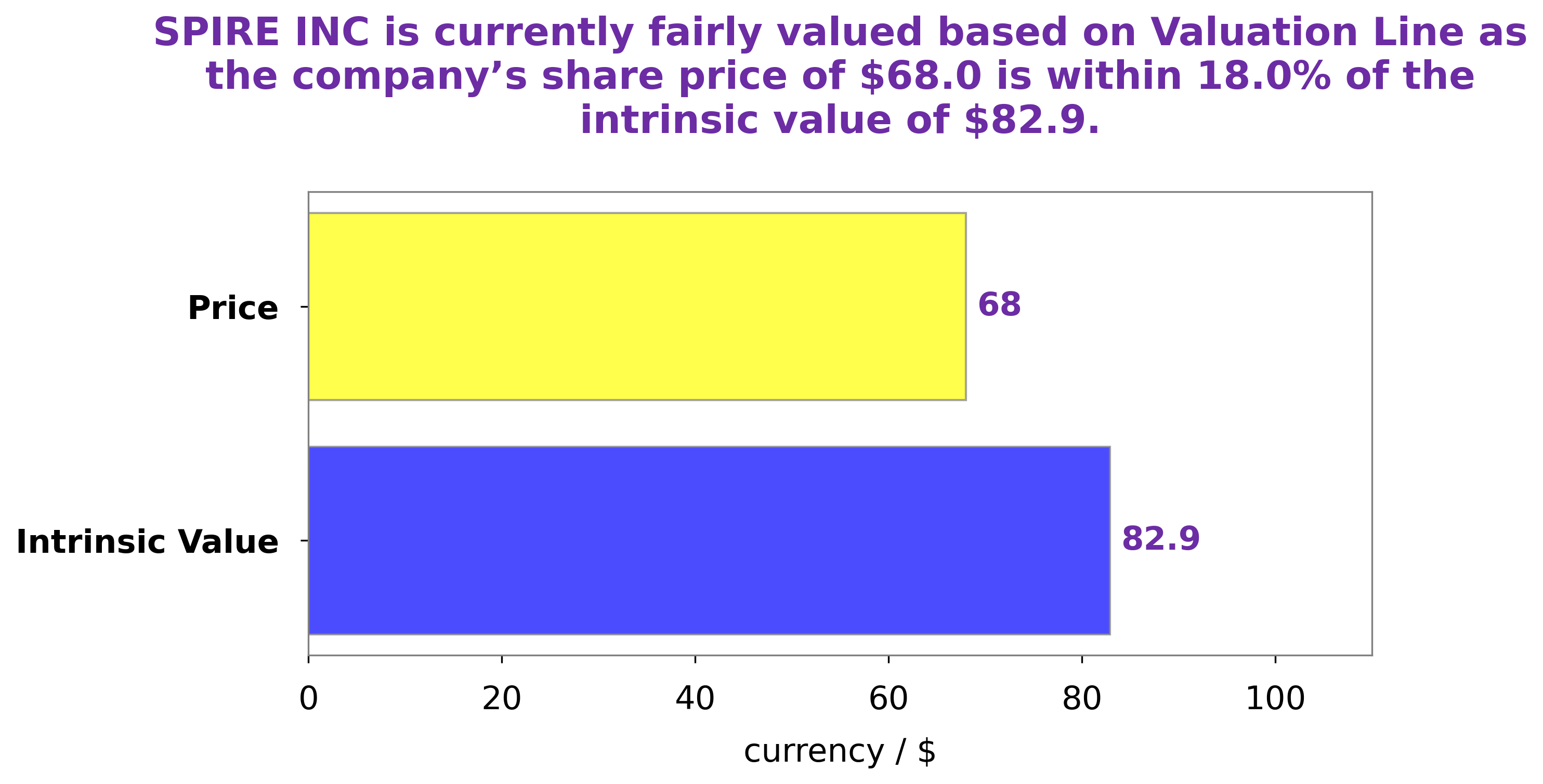

At GoodWhale, we conducted an analysis of SPIRE INC‘s wellbeing and determined the fair value of their share to be around $82.9. This number was based on our proprietary Valuation Line approach that takes into account multiple factors including the company’s financials, market conditions, and overall industry outlook. Currently, SPIRE INC’s stock is being traded at $68.0, making it a fair price that is undervalued by 17.9%. This could be a great opportunity for investors to get in at a lower cost. More…

Peers

It is the largest natural gas distribution company in Missouri. Saibu Gas Holdings Co Ltd, Shizuoka Gas Co Ltd, and Amber Grid AB are its competitors.

– Saibu Gas Holdings Co Ltd ($TSE:9536)

Saibu Gas Holdings Co Ltd is a Japanese company that is engaged in the provision of natural gas and heat supply services. The company has a market capitalization of 62.02 billion as of 2022 and a return on equity of 2.31%. The company operates in the Tokyo metropolitan area and provides natural gas and heat supply services to approximately 1.4 million customers.

– Shizuoka Gas Co Ltd ($TSE:9543)

Shizuoka Gas Co Ltd is a Japanese company that provides gas and electricity to residential and commercial customers in Shizuoka Prefecture. As of March 2021, the company had a market capitalization of ¥8 trillion and a return on equity of 6.15%. The company was founded in 1951 and is headquartered in Shizuoka, Japan.

– Amber Grid AB ($LTS:0QGQ)

Amber Grid AB is a world leader in energy storage solutions. The company has a market cap of 217.63M as of 2022 and a return on equity of 7.09%. Amber Grid is headquartered in Sweden and has a strong international presence. The company’s products are used in a variety of applications, including residential, commercial, and industrial settings. Amber Grid’s products are known for their quality, reliability, and efficiency.

Summary

Investment analysts have recently lowered their price target on Spire Inc., a utility provider. According to a research report issued by Mizuho on Friday, Spire’s share price has seen a dip, yet there is still potential for upside. Investors should consider the current market conditions, financial statements, and risk factors when making decisions regarding the company’s shares. Analysts suggest that investors should take a cautious approach to investing in Spire, as there are no guarantees of future returns.

Recent Posts