Smoore International Intrinsic Value Calculation – Smoore International Holdings Ltd. Fair Value Estimated at HK$9.26, Trading at HK$8.60/Share

May 26, 2023

Trending News ☀️

Smoore International ($SEHK:06969) Holdings Limited is a leading e-cigarette technology company with a global presence. According to a 2 Stage Free Cash Flow to Equity calculation, the fair value of Smoore International Holdings Limited is estimated to be HK$9.26. This indicates that the company is currently undervalued, with its share price trading below its estimated fair value. This presents a potential opportunity for investors to capitalize on this discrepancy and benefit from potential upside in the stock price.

The company’s strong fundamentals, promising growth prospects, and attractive valuation make it an attractive investment for investors looking to capitalize on the growth potential of the e-cigarette industry. Furthermore, analysts expect Smoore International Holdings Limited to continue to deliver positive earnings growth in the coming years, which could further support its share price appreciation in the long term.

Price History

On Monday, SMOORE INTERNATIONAL HOLDINGS LTD. opened at HK$8.7 and closed at HK$8.7, up by 1.3% from the previous closing price of 8.6. The fair value of the company’s stock was estimated at HK$9.26, meaning that the current trading price of HK$8.60 per share is below the estimated fair value. This suggests that SMOORE INTERNATIONAL HOLDINGS LTD. is undervalued in the market, presenting a buying opportunity for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Smoore International. More…

| Total Revenues | Net Income | Net Margin |

| 12.14k | 2.51k | 20.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Smoore International. More…

| Operations | Investing | Financing |

| 469.86 | -2.42k | 276.19 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Smoore International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 24.36k | 3.98k | 3.28 |

Key Ratios Snapshot

Some of the financial key ratios for Smoore International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.9% | -1.8% | 24.6% |

| FCF Margin | ROE | ROA |

| -10.1% | 9.3% | 7.7% |

Analysis – Smoore International Intrinsic Value Calculation

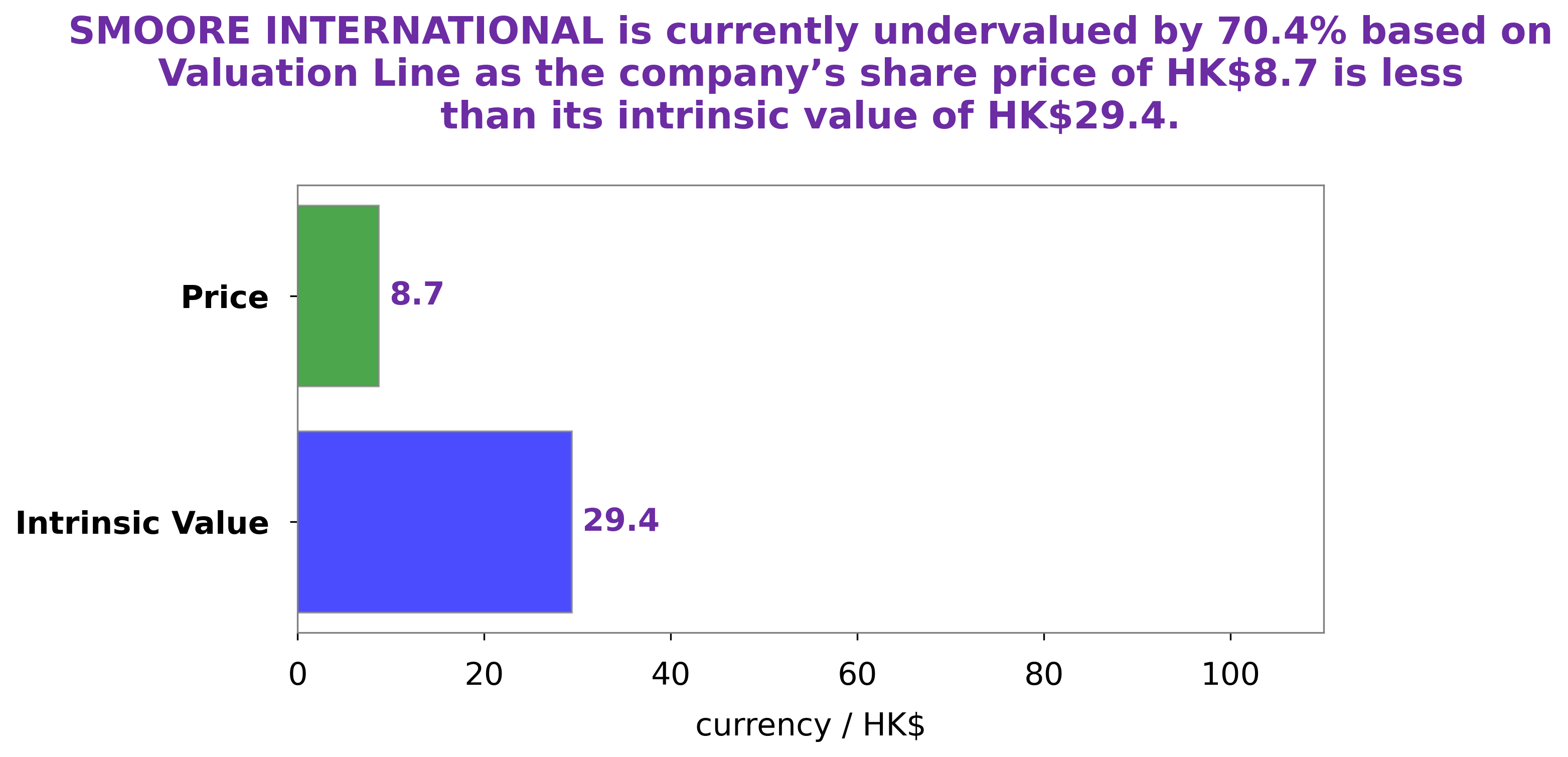

We at GoodWhale have conducted an analysis of SMOORE INTERNATIONAL‘s financials. Our proprietary Valuation Line has calculated the intrinsic value of SMOORE INTERNATIONAL share to be around HK$29.4. Currently, SMOORE INTERNATIONAL stock is trading at HK$8.7, representing a 70.4% discount from its intrinsic value, which means the stock is heavily undervalued. More…

Peers

The vaping industry is highly competitive, with Smoore International Holdings Ltd competing against the likes of Vapor Hub International Inc, CEC International Holdings Ltd, and Turning Point Brands Inc. All four companies are vying for a share of the growing market for electronic cigarettes and related products. While each company has its own strengths and weaknesses, Smoore International Holdings Ltd has emerged as a leading player in the industry.

– Vapor Hub International Inc ($SEHK:00759)

CEC International Holdings Ltd is a Hong Kong-based investment holding company principally engaged in the production and sales of aluminum products. The Company operates its business through two segments. The Aluminum Extrusion Segment is engaged in the production and sales of aluminum extrusions, including aluminum alloy profiles, solar panel frames, LED heat sinks and other customized aluminum products. The Aluminum Fabrication Segment is engaged in the production and sales of customized aluminum products, including aluminum alloy doors and windows, curtain walls, aluminum furniture and exhibition equipments.

– CEC International Holdings Ltd ($NYSE:TPB)

Turning Point Brands, Inc. engages in the manufacture and sale of cigarettes and other tobacco products under the Stoker’s, Zig-Zag, and other brands in the United States. It offers cigarettes, roll-your-own tobacco products, smokeless tobacco products, large machine-made cigars, and pipe tobacco. The company sells its products to wholesale distributors, including national and regional chains, wholesalers, and independent tobacco product retailers. Turning Point Brands, Inc. was incorporated in 2009 and is headquartered in Louisville, Kentucky.

Summary

Smoore International Holdings Limited (SMOORE) is a compelling investment opportunity for those looking to diversify their portfolio. An analysis of the company using two-stage free cash flow to equity has indicated that its estimated fair value is HK$9.26. Furthermore, SMOORE has a strong balance sheet with low debt and a profitable business model.

Furthermore, its revenue and net income have grown significantly over the last three years, indicating future growth potential. As such, investors should consider allocating a portion of their portfolio to SMOORE in order to capture potential upside or long-term growth.

Recent Posts