Skeena Resources Intrinsic Stock Value – SKEENA RESOURCES Shares Drop 5% After Hours After Announcing C$64 Million Bought Deal Financing

May 24, 2023

Trending News 🌥️

Skeena Resources ($TSX:SKE) Ltd. Skeena Resources is a Vancouver based exploration and development company focused on advancing its portfolio of precious and base metals projects in British Columbia and the Yukon. The company’s most advanced project is the Eskay Creek project located in northwest British Columbia, which is a gold-silver property. Skeena intends to use the net proceeds from this offering to fund exploration and evaluation activities on the Eskay Creek property and for general corporate purposes. This news caused a selloff in Skeena shares, which dropped 5% in after-hours trading after the announcement. This financing provides Skeena with additional capital to further advance its projects, which will be beneficial for the company’s long-term outlook.

However, investors were disappointed in the drop in value of Skeena’s shares following the announcement of the bought deal financing.

Analysis – Skeena Resources Intrinsic Stock Value

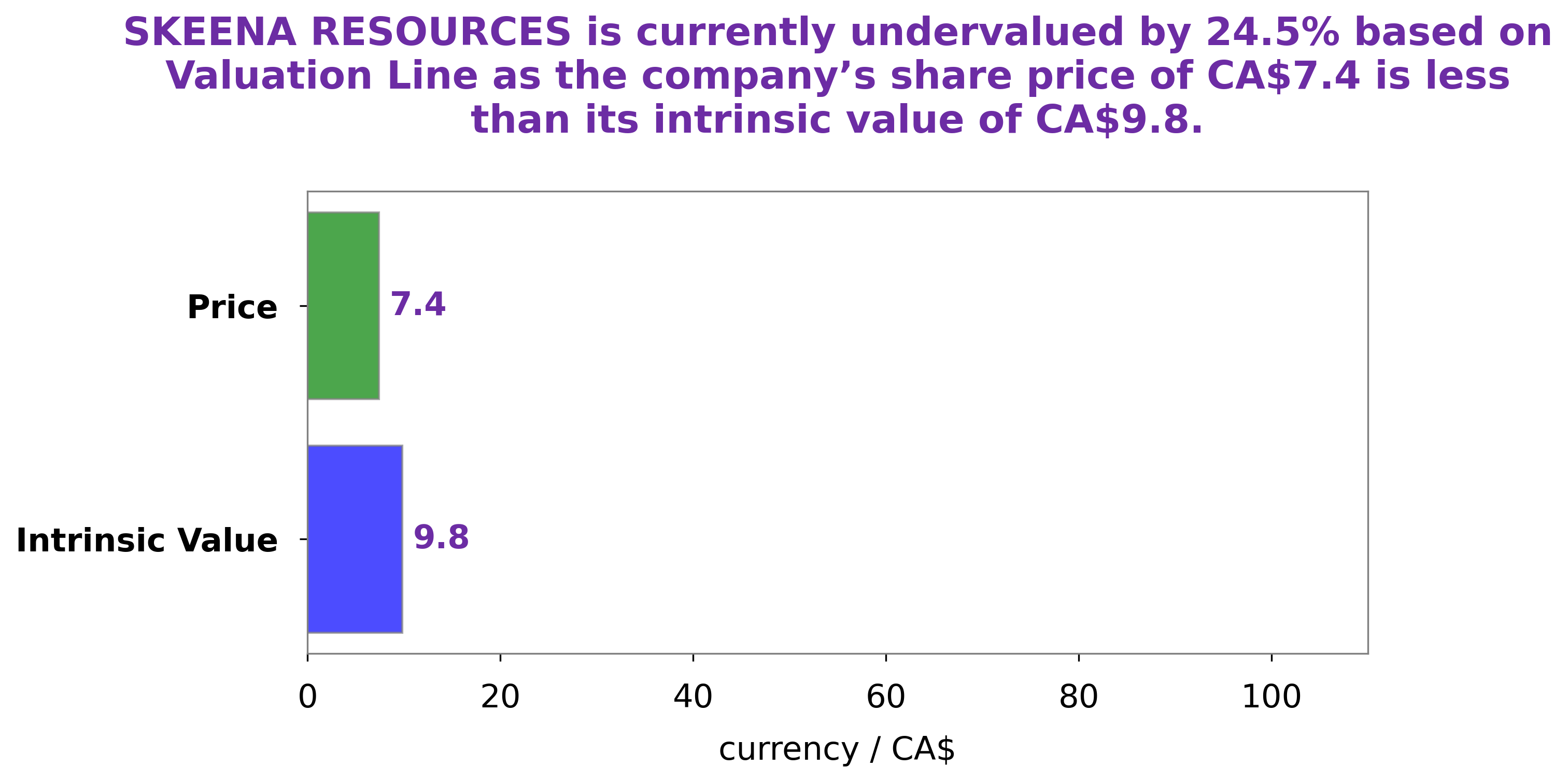

We at GoodWhale have conducted an analysis of SKEENA RESOURCES‘s wellbeing. After careful consideration, our proprietary Valuation Line has calculated the fair value of SKEENA RESOURCES’s share to be around CA$9.8. However, at this time, SKEENA RESOURCES stock is being traded at CA$7.4, undervalued by 24.4%. This presents an attractive opportunity for investors to get in on a potentially undervalued stock. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Skeena Resources. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -86.62 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Skeena Resources. More…

| Operations | Investing | Financing |

| -95.61 | 9.92 | 50.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Skeena Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 151.24 | 27.23 | 1.59 |

Key Ratios Snapshot

Some of the financial key ratios for Skeena Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | – |

| FCF Margin | ROE | ROA |

| – | -50.8% | -43.9% |

Peers

Its competitors include Flying Nickel Mining Corp, AsiaBaseMetals Inc, and Silver Bull Resources Inc.

– Flying Nickel Mining Corp ($TSXV:FLYN)

The company’s market cap is 9M as of 2022. It is a Canadian mining company that is engaged in the business of exploring, developing and mining natural resources. The company’s primary focus is on the mining and processing of nickel, copper, cobalt and precious metals.

– AsiaBaseMetals Inc ($TSXV:ABZ)

Aurania Resources Ltd. is a Canadian mineral exploration company engaged in the identification, evaluation, acquisition and exploration of mineral property interests, with a focus on precious metals and copper in South America. Its principal asset, and the focus of its exploration activities, is The Lost Cities – Cutucu Project located in southeastern Ecuador. The company also owns interests in projects in Peru and Brazil.

– Silver Bull Resources Inc ($OTCPK:SVBL)

Founded in 2004, Silver Bull Resources Inc is a Canadian-based exploration and development company with silver and gold properties in Mexico. The company has a market cap of 4.38M as of 2022 and a Return on Equity of -19.77%. Silver Bull Resources Inc is focused on the development of its Sierra Mojada project in Coahuila, Mexico.

Summary

Skeena Resources Limited (TSXV: SKE) has seen share price drop 5% in US after hours trading following the announcement of a bought deal financing for C$64 million. While the financing is expected to strengthen Skeena’s balance sheet and support future development projects, analysts are concerned that the dilution of shares may pressure the stock in the near term. Looking ahead, investors will have to weigh the near term risk against the long term prospects of further growth for Skeena Resources.

Recent Posts