Sitime Corporation Intrinsic Value Calculator – ProShare Advisors LLC Invests $312000 in SiTime Corporation

May 4, 2023

Trending News 🌥️

SITIME ($NASDAQ:SITM): SiTime Corporation is a leading provider of MEMS-based silicon timing solutions that replace legacy quartz products. The company offers a comprehensive portfolio of silicon timing solutions, including programmable oscillators, clock buffer products and multi-output clock generators. Recently, ProShare Advisors LLC announced that it had invested $312000 worth of stocks in SiTime Corporation. The news was reported by Defense World. SiTime Corporation has seen explosive growth over the past few years, becoming one of the largest providers of silicon timing solutions. The company’s products are used in a variety of industries and applications, from automotive and industrial to networking and communication.

Thanks to its innovative products, the company has become a trusted partner for many customers worldwide. The recent investment from ProShare Advisors LLC is yet another sign of the confidence that the market has in SiTime Corporation. This new injection of funds will help the company further expand its operations and continue to lead the way in silicon timing solutions. With this newfound support, SiTime Corporation is well-positioned to capitalize on the growing demand for MEMS-based silicon timingsolutions.

Share Price

As a result, the stock of SiTime Corporation opened at $106.4 and closed at $106.5, with a slight increase of 0.1% from its previous closing price of 106.4. The investment marks a significant milestone for SiTime Corporation and its shareholders, as it helps to strengthen their financial position and further solidify their position in the industry. This is an indication of investors’ confidence in the company’s promising future prospects, and will likely help fuel further growth for the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sitime Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 283.61 | 23.25 | 8.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sitime Corporation. More…

| Operations | Investing | Financing |

| 39.75 | -560.09 | -4.52 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sitime Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 750.62 | 42.14 | 32.65 |

Key Ratios Snapshot

Some of the financial key ratios for Sitime Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 50.0% | – | 5.7% |

| FCF Margin | ROE | ROA |

| 1.4% | 1.4% | 1.3% |

Analysis – Sitime Corporation Intrinsic Value Calculator

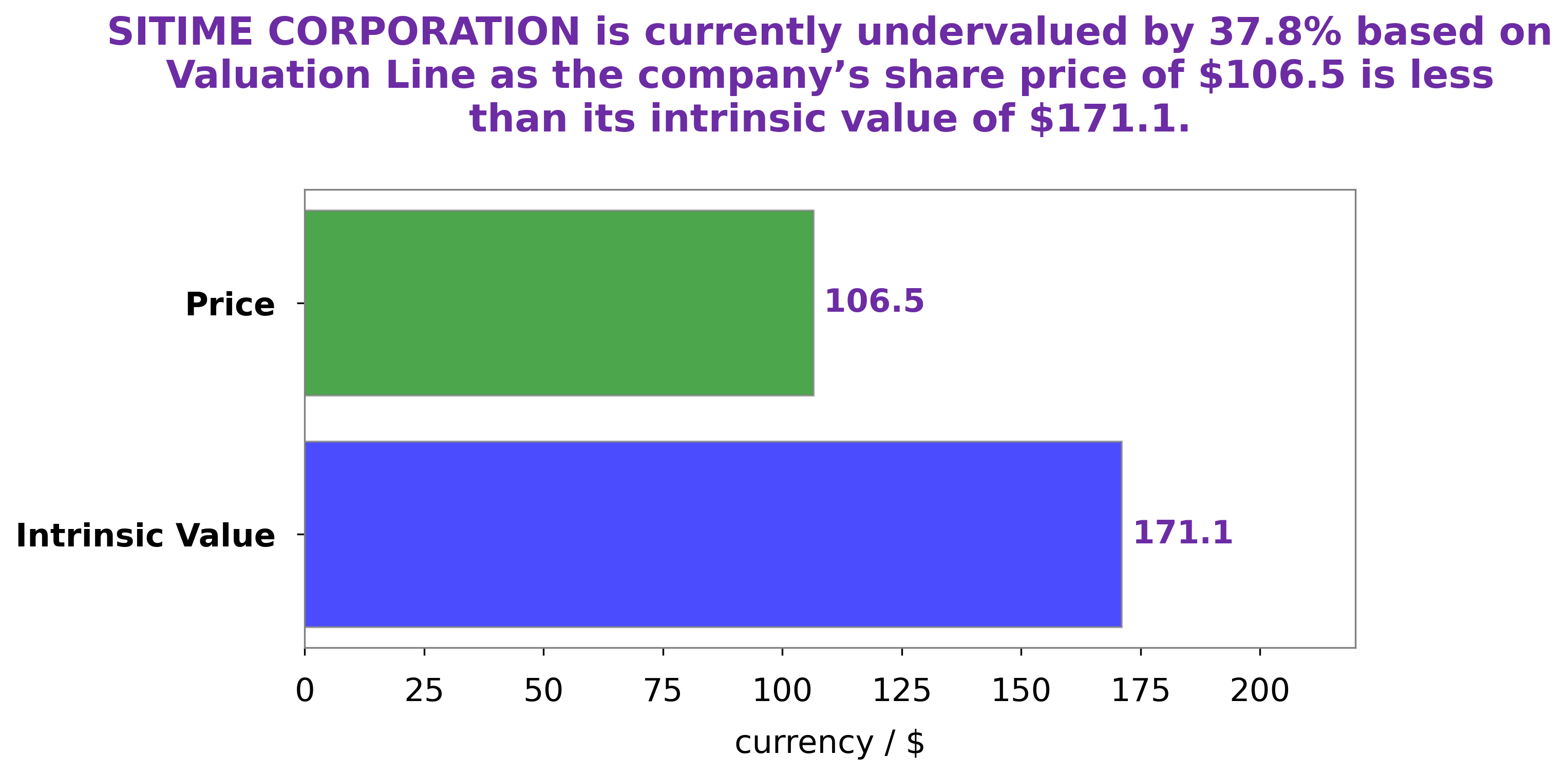

At GoodWhale, we conducted a comprehensive review of SITIME CORPORATION‘s financials. After analyzing all the data, we determined that the fair value of SITIME CORPORATION’s share is around $171.1, using our proprietary Valuation Line. Interestingly, SITIME CORPORATION’s stock is currently trading at $106.5, meaning it is undervalued by 37.8%. This presents a significant opportunity for potential investors. More…

Peers

The competition between SiTime Corp and its competitors is fierce.

– Semiconductor Manufacturing International Corp ($SEHK:00981)

Semiconductor Manufacturing International Corporation is a foundry that designs and manufactures semiconductor products for clients in the global electronics industry. The company has a market capitalization of $176.68 billion as of 2022 and a return on equity of 8.15%. SMIC is the largest foundry in China and the fourth largest in the world. The company’s clients include some of the world’s leading semiconductor companies.

– Supreme Electronics Co Ltd ($TWSE:8112)

Supreme Electronics Co Ltd is a leading provider of electronic components and solutions. The company has a market cap of 14.06B as of 2022 and a Return on Equity of 24.78%. Supreme Electronics Co Ltd is a diversified company that offers a wide range of products and services to its customers. The company’s product portfolio includes semiconductors, passive components, interconnects, and electromechanical products. Supreme Electronics Co Ltd is a publicly traded company listed on the Hong Kong Stock Exchange.

– Monolithic Power Systems Inc ($NASDAQ:MPWR)

Monolithic Power Systems Inc is a leading provider of power solutions for the computing, consumer, industrial, and automotive markets. The company’s products are used in a wide range of applications, including servers, storage, networking, and communications equipment; PCs, laptops, and tablets; smartphones and other handheld devices; video game consoles; and a variety of other consumer electronics. Monolithic Power Systems Inc has a market cap of 15.57B as of 2022, a Return on Equity of 18.16%. The company’s products are used in a wide range of applications, including servers, storage, networking, and communications equipment; PCs, laptops, and tablets; smartphones and other handheld devices; video game consoles; and a variety of other consumer electronics.

Summary

SiTime Corporation is a publicly traded company specializing in MEMS-based timing solutions for analog and mixed-signal semiconductor products. SiTime’s products are widely used in the automotive, industrial, computing, communications, and consumer markets, which provides a solid source of income for investors. With operations expanding in China and India, SiTime’s global reach is continuing to increase. All in all, the strong fundamentals of SiTime Corporation make it an attractive investment opportunity.

Recent Posts