SIMO Stock Fair Value Calculation – China’s Regulatory Delays Cause Silicon Motion and Tower Semiconductor Stocks to Dip

April 5, 2023

Trending News 🌥️

The recent news that the Chinese government has delayed the review of a number of deals has caused Silicon Motion Technology ($NASDAQ:SIMO) Corp. and Tower Semiconductor Ltd. stocks to dip. This is having a direct and negative impact on the two technology firms. Silicon Motion Technology Corp. is a leader in the design, development, and marketing of NAND flash controllers and specialty radio frequency (RF) semiconductors. Silicon Motion also provides comprehensive total solutions for NAND flash storage, including firmware and software development, validation, and product certification. Tower Semiconductor Ltd., is a global specialty foundry leader, providing high-value analog and mixed-signal integrated circuits (ICs) for a wide range of industry segments.

The company’s shares are traded on the Nasdaq Global Select Market and the Tel Aviv Stock Exchange (TASE). The regulatory delays in China have caused some concern among investors, leading to a significant dip in both Silicon Motion and Tower Semiconductor stocks. As the companies continue to search for new opportunities and growth in different markets, this setback may be only temporary.

Price History

On Tuesday, SILICON MOTION TECHNOLOGY’s stock opened at $65.6, but dipped by 1.8% to close at $64.6. Investors are hoping for a quick resolution to the delay, as it has been a key factor affecting the stock prices of both companies. It remains to be seen how the situation will play out and what the ultimate impact will be on the stocks of both Silicon Motion Technology and Tower Semiconductor. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SIMO. More…

| Total Revenues | Net Income | Net Margin |

| 945.92 | 172.51 | 18.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SIMO. More…

| Operations | Investing | Financing |

| 83.75 | -32.78 | -183.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SIMO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 961.25 | 228.65 | 19.9 |

Key Ratios Snapshot

Some of the financial key ratios for SIMO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 27.4% | 46.5% | 22.7% |

| FCF Margin | ROE | ROA |

| 5.4% | 20.4% | 13.9% |

Analysis – SIMO Stock Fair Value Calculation

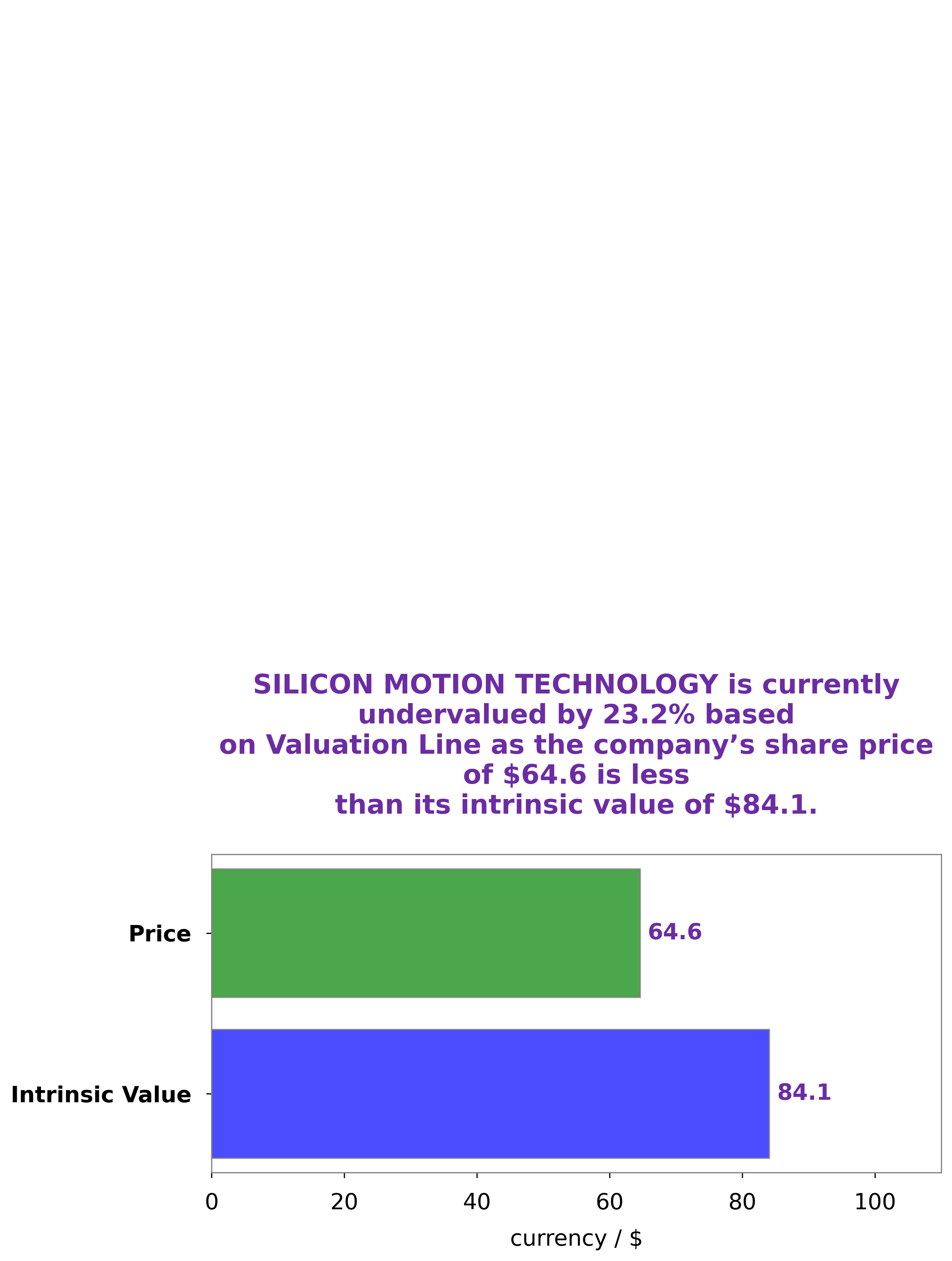

At GoodWhale, we conducted an analysis of SILICON MOTION TECHNOLOGY’s wellbeing and our proprietary Valuation Line came up with a fair value of the company’s share of around $84.1. However, at the moment, the SILICON MOTION TECHNOLOGY stock is traded at $64.6, meaning our analysis shows it is currently undervalued by 23.1%. This presents a great opportunity to investments in the company to yield good returns in the future. More…

Peers

The company’s products are used in a wide range of devices, including digital cameras, camcorders, MP3 players, USB flash drives, and solid state drives. Silicon Motion Technology Corp competes with Marvell Technology Inc, Qualcomm Inc, and Microchip Technology Inc in the development and manufacture of NAND flash controllers.

– Marvell Technology Inc ($NASDAQ:MRVL)

With a market cap of 33.23B as of 2022 and a ROE of 0.5%, Marvell Technology Inc is a company that designs, develops, and markets analog, mixed-signal, digital signal processing, and embedded and standalone integrated circuits. The company’s products are used in a variety of end markets, including data storage, enterprise, cloud, automotive, industrial, consumer, mobile, and networking.

– Qualcomm Inc ($NASDAQ:QCOM)

Qualcomm Inc is a global semiconductor company that designs, manufactures, and markets digital wireless telecommunications products and services. The company has a market capitalization of 119.6 billion as of 2022 and a return on equity of 56.84%. Qualcomm’s products and services include wireless voice and data communications, multimedia, and business solutions. The company’s products are used in a variety of mobile devices, including cell phones, tablets, laptops, and cars.

– Microchip Technology Inc ($NASDAQ:MCHP)

Microchip Technology Inc. is a leading provider of microcontroller, mixed-signal, analog and Flash-IP solutions, providing low-risk product development, lower total system cost and faster time to market for thousands of diverse customer applications worldwide.

Summary

Silicon Motion Technology (SIMO) has seen its share price fall on reports of a slowdown in the Chinese government’s review of a major deal. Analysts are cautious on the stock due to the uncertain regulatory environment, with some believing that the deal may not go through. Many investors are worried about potential headwinds, including potential tariffs and trade tensions, as well as a slowdown in the Chinese economy.

The company’s competitive products and solid cash flow may be positive factors to consider. Overall, investors have mixed views on the stock, and should keep an eye on industry news for additional insight.

Recent Posts