Sigma Lithium Intrinsic Value Calculation – Sigma Lithium Corp Stock Soars 9.86% in a Week, Receives Bullish Rating from InvestorsObserver Sentiment Indicator

May 18, 2023

Trending News 🌥️

Sigma Lithium ($TSXV:SGML) Corp is a Canadian based company specializing in the exploration and development of lithium brine deposits. The company’s primary focus is its Pozuelos-Pastos Grandes project located in Argentina, and it holds several properties in other countries as well. Recently, the stock of Sigma Lithium Corp has seen a 9.86% increase in the past week, and has received a very bullish rating from InvestorsObserver Sentiment Indicator. This could be an indication that the stock is undervalued and could be a great buying opportunity for investors. InvestorsObserver Sentiment Indicator is a tool used to measure the sentiment of investors towards a stock.

It makes use of several different data points such as recent stock price movements, historical price trends, analyst ratings and more. Therefore, it may be a good idea to consider buying this stock. This could be a sign that the stock is undervalued and could offer good returns in the near future. Therefore, it may be a good idea to consider investing in this stock.

Analysis – Sigma Lithium Intrinsic Value Calculation

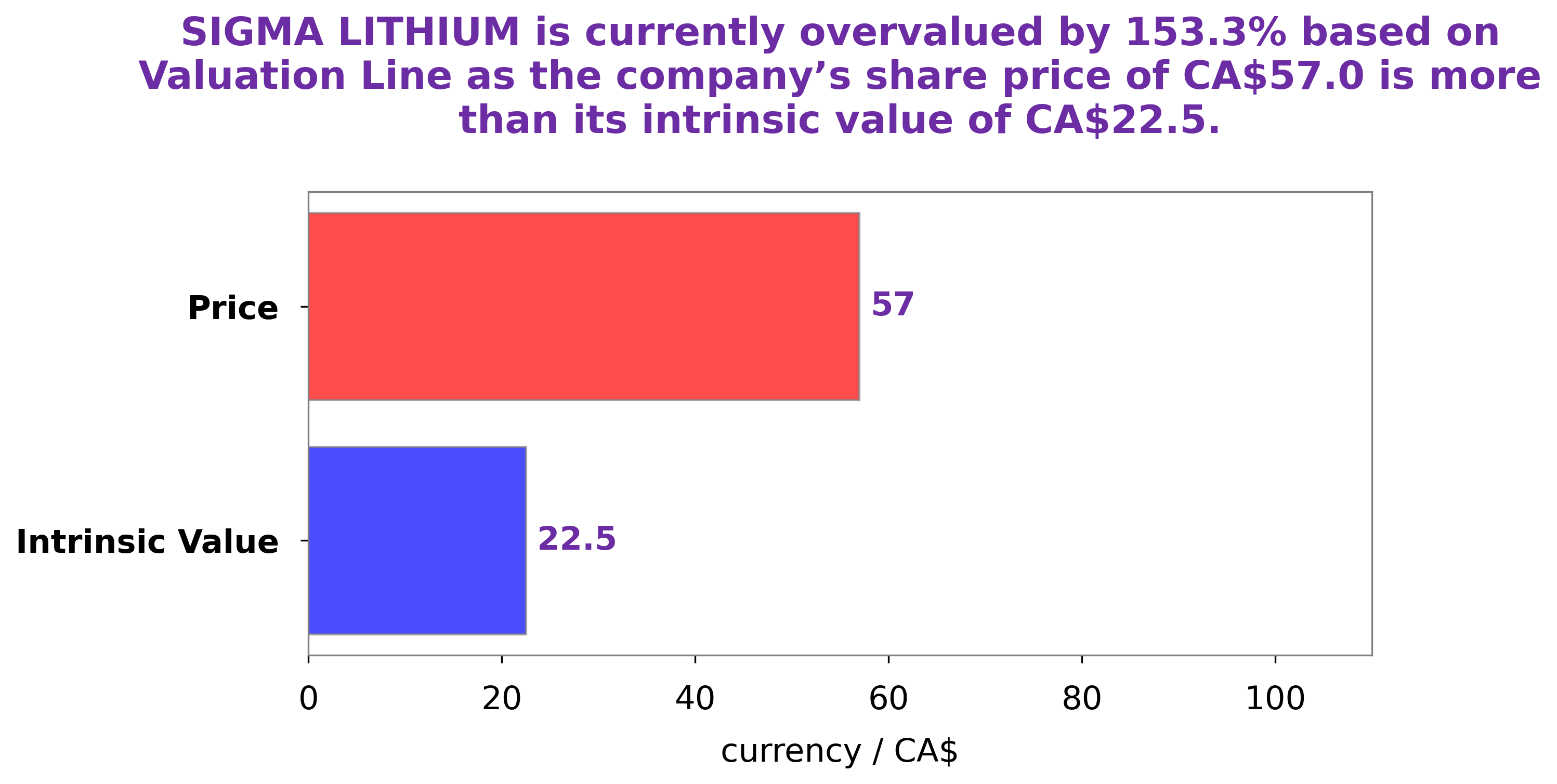

GoodWhale has conducted an in-depth analysis of SIGMA LITHIUM‘s wellbeing and have calculated the company’s intrinsic value to be around CA$22.5. This value was determined through our proprietary Valuation Line, which takes into consideration multiple factors such as the company’s financials, competitive landscape, and industry trends. At this time, SIGMA LITHIUM stock is being traded at CA$57.0, representing an overvaluation of 153.4%. Going forward, investors should be aware of this discrepancy and consider their investments carefully. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sigma Lithium. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -56.92 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sigma Lithium. More…

| Operations | Investing | Financing |

| -8.03 | -39.43 | 130.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sigma Lithium. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 193.32 | 14.29 | 1.78 |

Key Ratios Snapshot

Some of the financial key ratios for Sigma Lithium are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | – |

| FCF Margin | ROE | ROA |

| – | -19.3% | -18.3% |

Peers

The competition in the lithium industry has been fierce in recent years, with Sigma Lithium Corp vying for market share against its top competitors Infinity Lithium Corp Ltd, Ion Energy Ltd, and Grounded Lithium Corp. All four companies have been striving to produce the highest quality lithium products and services, while also looking for innovative ways to stay ahead of the competition.

– Infinity Lithium Corp Ltd ($ASX:INF)

Infinity Lithium Corp Ltd is an exploration and development company focused on emerging lithium opportunities in Europe. The company’s market cap as of 2022 is 97.14M, which is largely reflective of its current standing in the industry. The return on equity (ROE) for Infinity Lithium Corp Ltd stands at -15.26%, indicating that the company is not generating sufficient returns on its equity investments. This could be due to a variety of factors, such as higher costs of production or reduced demand for the company’s products and services. Despite these issues, Infinity Lithium Corp Ltd remains a viable option for investors interested in getting exposure to the burgeoning European lithium market.

– Ion Energy Ltd ($TSXV:ION)

Ion Energy Ltd is a leading energy storage solutions provider that develops, manufactures, and markets lithium-ion batteries and associated systems. The company has a market cap of 11.52M as of 2022, which reflects its steady growth in the energy storage industry. Its Return on Equity (ROE) of 225.6% demonstrates the company’s successful management strategy, as well as its ability to generate returns for its shareholders. Ion Energy Ltd is well-positioned to capitalize on the growing demand for energy storage solutions and continue to expand its presence in the market.

Summary

Sigma Lithium Corp is a publicly traded company that has seen its stock price increase by 9.86% in the past week. According to InvestorsObserver Sentiment Indicator, the stock is rated as “Bullish”. Investors should carefully analyze the company and its performance to decide whether to invest in it or not. It is important to consider factors such as recent financial performance, management team, competitive landscape, and risk profiles before making an investment decision.

Additionally, investors should pay close attention to the company’s long-term prospects and any new developments that may affect its future performance. Ultimately, analyzing Sigma Lithium Corp’s fundamentals and assessing its potential risks and rewards are key to making an informed investment decision.

Recent Posts