Shopify Inc Stock Fair Value – Shopify Re-prioritizes Main Quests: Time to Shop for the Shares!

May 17, 2023

Trending News ☀️

Shopify Inc ($NYSE:SHOP). is a leading e-commerce platform for businesses of all sizes. It provides a comprehensive suite of tools and services for merchants to start, manage and scale their businesses. Recently, Shopify has re-prioritized its main quests and resources to focus on its core objectives. This move by the company is an indication that the current market conditions are favorable for investing in Shopify shares. The reallocation of resources will enable Shopify to increase its profitability and deliver better customer experience. With this move, Shopify is gearing up to provide a powerful e-commerce platform that can help businesses of all sizes to achieve success. Furthermore, Shopify’s leadership team is confident that this shift will help them to maintain their competitive edge in the market. Shopify’s shares have been performing well over the past few months.

Therefore, now is the perfect time to shop for the shares and make a profitable investment. With the reallocation of resources, Shopify is likely to continue its upward trajectory. Moreover, Shopify is committed to providing top-notch services and innovative solutions to its customers. This commitment from the company makes it a great long-term investment option. In conclusion, investors should definitely consider investing in Shopify shares following its reallocation of resources to core objectives. With this move, Shopify is set to deliver better customer experience and increased profitability.

Share Price

On Tuesday, Shopify Inc. took a hit to its stock, with shares opening at $61.2 and closing at $60.1. This marks a decrease of 2.4% from its previous closing price of $61.6, indicating that the company is re-prioritizing its main objectives. This shift has come at an opportune time for investors, who have the chance to buy shares in one of the most successful e-commerce platforms in the world. Shopify Inc. is renowned for its innovative solutions for online businesses and its user-friendly platform, which makes it easy for small businesses to set up and manage an online store. The company’s dedication to providing the best possible customer experience has made them a leader in their field, and their recent stock dip will likely only be temporary.

Investors should take this opportunity as a time to shop for the shares, taking into account the company’s strong track record of success. Shopify Inc. continues to be a leader in its industry and is poised to take advantage of the current surge in demand for e-commerce solutions. Its platform is more important than ever and its re-prioritization of main objectives will only increase its already impressive success rate. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Shopify Inc. More…

| Total Revenues | Net Income | Net Margin |

| 5.9k | -1.92k | -21.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Shopify Inc. More…

| Operations | Investing | Financing |

| -11.45 | -705.57 | 17.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Shopify Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.96k | 2.51k | 6.46 |

Key Ratios Snapshot

Some of the financial key ratios for Shopify Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 50.6% | – | -63.0% |

| FCF Margin | ROE | ROA |

| -1.0% | -27.8% | -21.2% |

Analysis – Shopify Inc Stock Fair Value

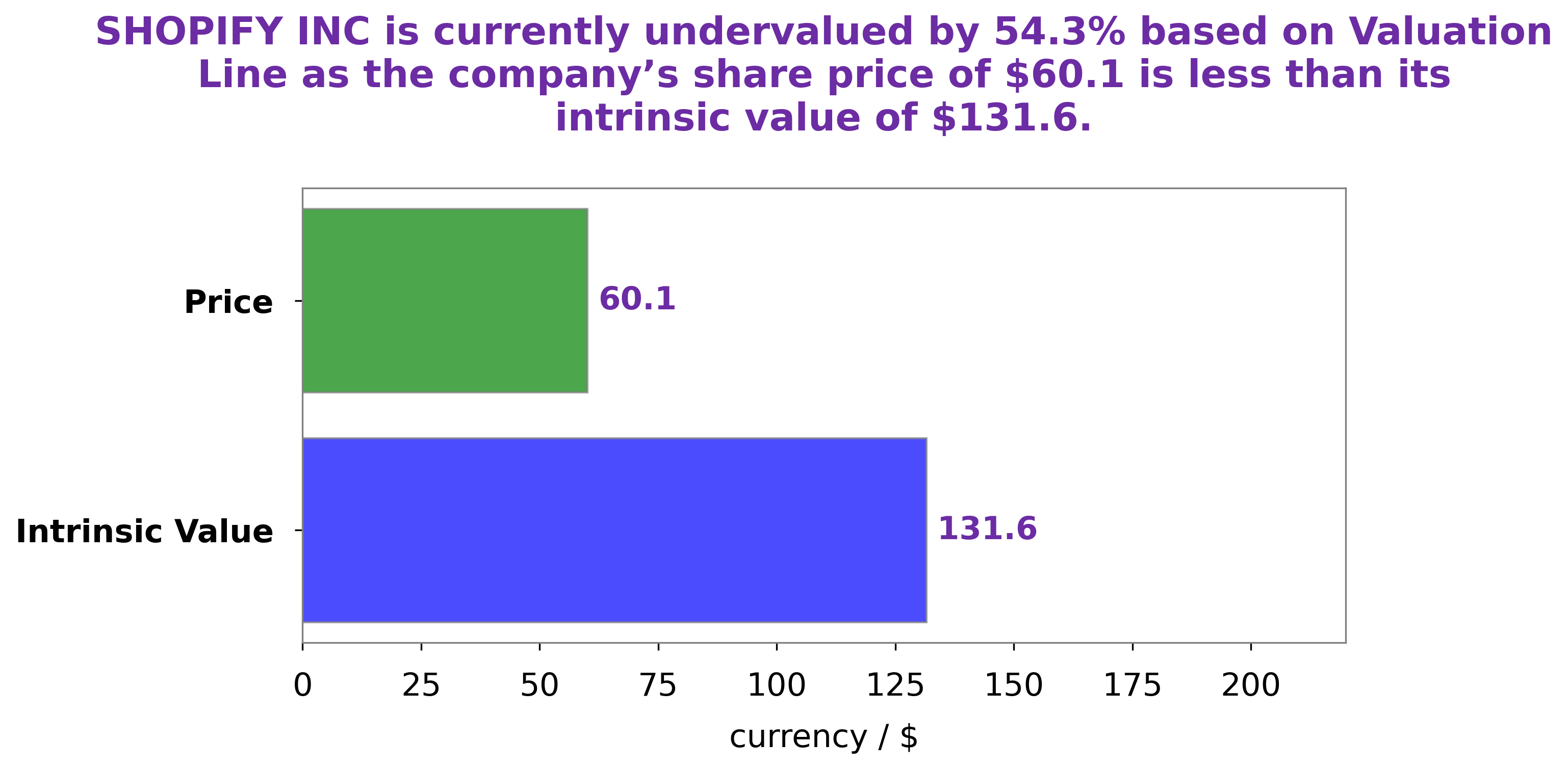

We at GoodWhale have conducted an analysis of the well-being of SHOPIFY INC. After careful consideration and analysis, we have determined the fair value of SHOPIFY INC’s share to be around $131.6 using our proprietary Valuation Line. As of today, SHOPIFY INC is being traded at $60.1, a significant 54.3% below its fair value. This provides a great entry opportunity for investors. We recommend taking advantage of this and investing in SHOPIFY INC’s stock to gain returns in the long-term. More…

Peers

It is also the name of its proprietary e-commerce platform for online stores and retail point-of-sale systems. Shopify offers online retailers a suite of services “including payments, marketing, shipping and customer engagement tools to simplify the process of running an online store for small merchants. Shopify was founded in 2004 by Tobias Lütke, Daniel Weinand, and Scott Lake after attempting to open Snowdevil, an online store for snowboarding equipment. Shopify was initially written in Ruby on Rails by Lütke.

– BigCommerce Holdings Inc ($NASDAQ:BIGC)

BigCommerce Holdings Inc is a publicly traded company with a market capitalization of 695.55 million as of 2022. The company has a return on equity of -116.92%. BigCommerce Holdings Inc is a provider of eCommerce software-as-a-service solutions. The company offers a platform that enables businesses to create online stores and sell products and services.

– Riskified Ltd ($NYSE:RSKD)

Riskified Ltd is a technology company that uses data and machine learning to help businesses approve more orders and prevent fraud. The company has a market cap of 897.11M as of 2022 and a Return on Equity of -14.29%. Riskified was founded in 2013 and is headquartered in Tel Aviv, Israel.

– Vtex ($NYSE:VTEX)

Vtex has a market cap of 751.26M as of 2022, a Return on Equity of -11.41%. The company provides an e-commerce platform that helps businesses with their online stores.

Summary

Shopify Inc. (SHOP) is a leading e-commerce platform that enables businesses of all sizes to create, launch and manage stores in one place. The company’s strategic move is expected to help improve revenue and profitability in the long run. Investors should consider buying shares in Shopify given its potential to generate strong returns in the future. Analysts suggest that the company is well positioned to benefit from the continued growth in the e-commerce sector, while also offering a solid portfolio of products for online retailers.

Additionally, the company has recently entered into strategic partnerships with leading companies such as Amazon and Walmart, which could help drive further growth and expansion. Going forward, investors should keep an eye on Shopify’s progress in rolling out its new strategies and initiatives.

Recent Posts