Service Corporation Stock Intrinsic Value – Recent Quarter Sees Ascent Wealth Partners LLC Invest in Service Co. International

April 21, 2023

Trending News ☀️

Service ($NYSE:SCI) Co. International is a publicly-traded diversified services company that operates in the United States and Canada. The company provides services ranging from funeral, cremation, and cemetery services to pet, home, and health services. It is headquartered in Houston, Texas and is one of the largest providers of these types of services in the world. Ascent Wealth Partners LLC recently acquired an interest in Service Co. International, as reported in its fourth quarter financial statement.

This investment marked a significant move for the firm, as it is now likely to benefit from the company’s positive growth in revenues and profits. With their acquisition of the company’s stocks, they are now positioned to benefit from Service Co. International’s continued growth in the coming quarters.

Stock Price

This news came as the stock opened at $70.9, and ultimately closed at $70.6, a 0.2% decrease from its most recent closing price of $70.8. The investment in SERVICE CORPORATION is seen as a positive sign by industry analysts, demonstrating that there is still confidence in the company’s market position and prospects for future growth. Analysts have pointed to the company’s strong financial performance in recent quarters as a sign of its potential in the current market. With this recent investment from Ascent Wealth Partners LLC, SERVICE CORPORATION has solidified its position as a leader in the industry, and is well-poised to make further gains in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Service Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 4.11k | 565.34 | 13.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Service Corporation. More…

| Operations | Investing | Financing |

| 825.73 | -447.88 | -448 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Service Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.07k | 13.39k | 10.87 |

Key Ratios Snapshot

Some of the financial key ratios for Service Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.3% | 13.1% | 22.6% |

| FCF Margin | ROE | ROA |

| 11.1% | 34.6% | 3.8% |

Analysis – Service Corporation Stock Intrinsic Value

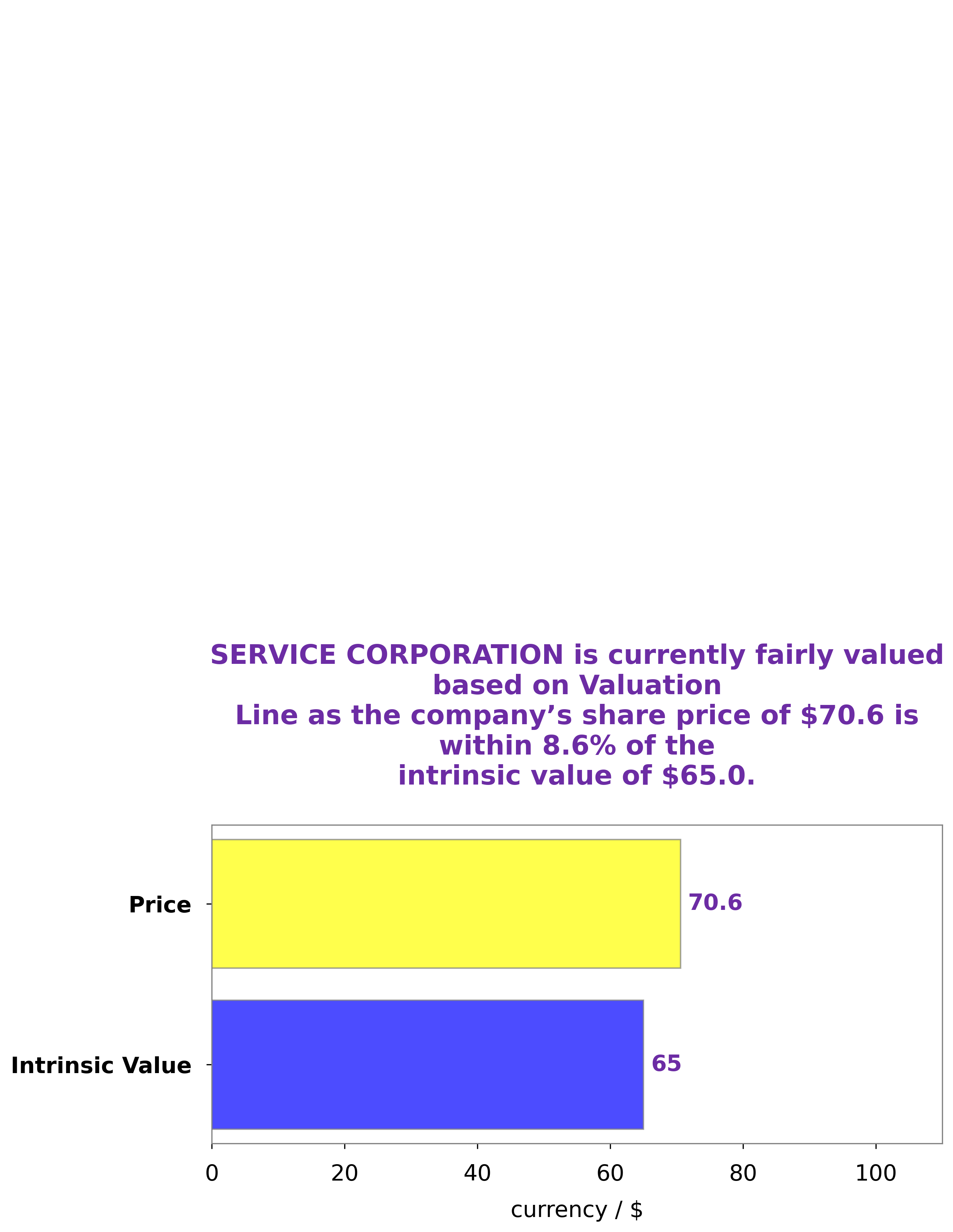

At GoodWhale, we recently conducted a thorough analysis of SERVICE CORPORATION‘s wellbeing, and have come to the conclusion that the fair value of SERVICE CORPORATION’s share is around $65.0. This value was calculated using our proprietary Valuation Line, which takes into account the company’s fundamentals, financials and overall outlook. Despite this, SERVICE CORPORATION’s stock is currently trading at $70.6 on the market, which is 8.6% higher than our fair value assessment. This suggests that SERVICE CORPORATION’s stock is currently overvalued, and investors should be aware of this when considering whether or not to invest in the company. More…

Peers

Service Corp International is the largest provider of death care services and products in North America. The company operates more than 2,000 funeral homes and crematories in the United States and Canada. LE Lavoir Ltd is a provider of funeral and cremation services in Japan. HEIAN CEREMONY SERVICE Co Ltd is a leading provider of funeral services in China.

– Park Lawn Corp ($TSX:PLC)

Park Lawn Corporation is a provider of death care products and services in North America. The Company owns and operates cemeteries, funeral homes, crematoria, burial vaults, urn gardens, memorialization products and services, and cemetery property. Park Lawn’s products and services include interment rights, such as graves, crypts or niches in cemeteries, and funeral and cremation services.

– LE Lavoir Ltd ($BSE:539814)

In 2022, the market capitalization of Lavoir Ltd was 108.86 million, with a return on equity of 1.66%. The company provides laundry and dry-cleaning services.

– HEIAN CEREMONY SERVICE Co Ltd ($TSE:2344)

The Heian Ceremony Service Co Ltd has a market capitalization of 9.16 billion as of 2022. The company has a return on equity of 4.27%. Heian Ceremony Service Co Ltd is a company that provides services for ceremonies.

Summary

Service Corporation International (SCI) is an American international corporation that provides death care services and products, such as cemetery and funeral services. Recently, Ascent Wealth Partners LLC purchased a new stake in SCI during the fourth quarter, indicating a renewed interest in the company’s prospects. To analyze this investment decision, it is important to consider the company’s current financial standing and industry trends.

Additionally, the industry trend of a shift to cremation services has been favorable for the company due to its cost-effective services. In conclusion, this investment decision appears to be based on sound analysis given the company’s solid financial performance and the favorable industry trend.

Recent Posts