Sba Communications Stock Fair Value – Ieq Capital LLC Reduces Stake in SBA Communications Co. by 29.2% in 4th Quarter

May 7, 2023

Trending News 🌥️

SBA ($NASDAQ:SBAC) Communications Co. is a leading independent owner and operator of wireless communications infrastructure across the United States and Latin America. Recently, the company saw its holdings decrease by 29.2% during the fourth quarter, according to a Form 13F filing with the Securities and Exchange Commission (SEC) by Ieq Capital LLC. This makes it one of the largest holders of the company’s stock, with BlackRock Inc. currently holding the most at 29.2%.

Analysis – Sba Communications Stock Fair Value

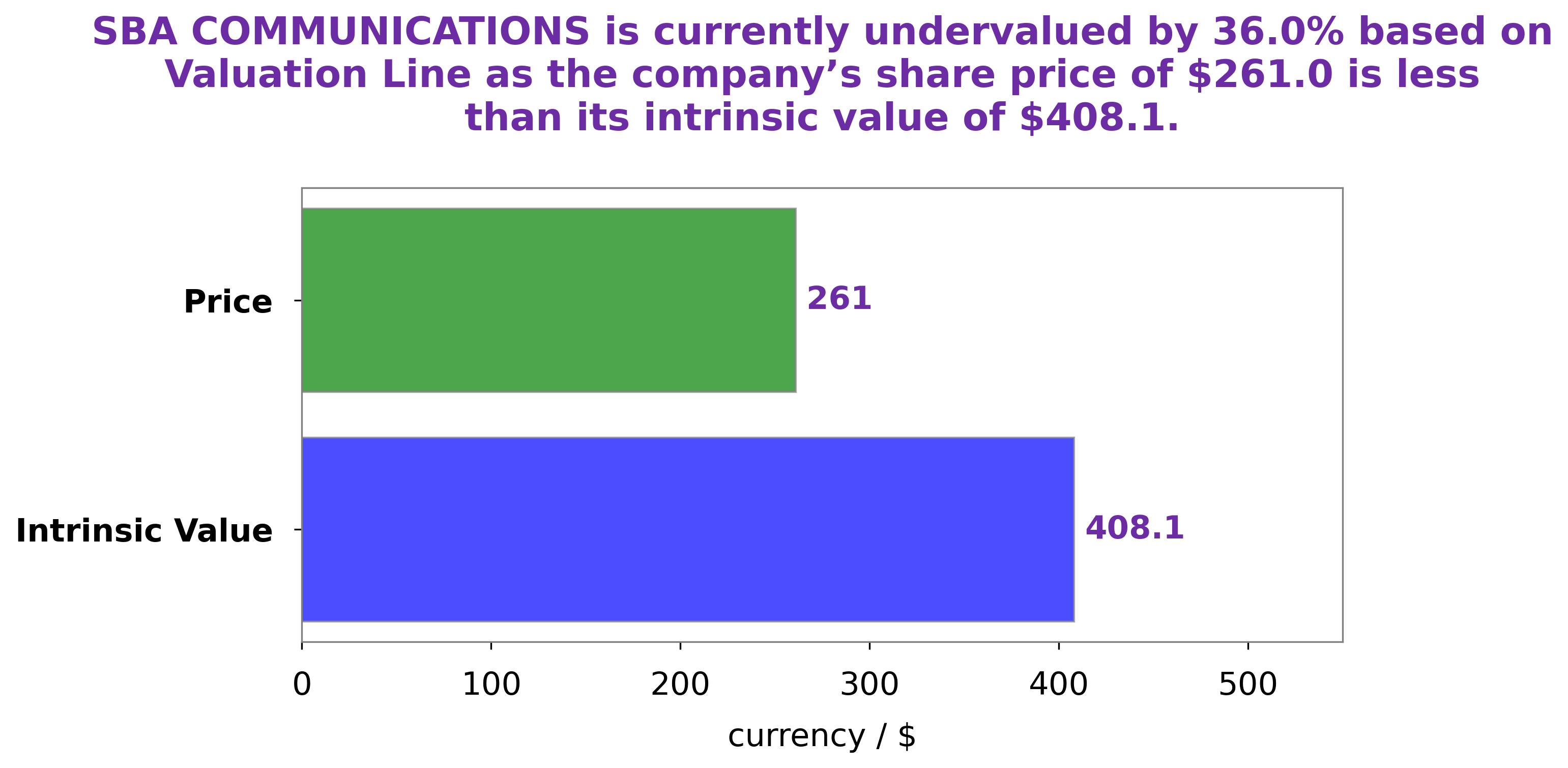

At GoodWhale, we have conducted a thorough analysis of SBA COMMUNICATIONS‘ fundamentals in order to provide our clients with the most accurate insight into the company. Our proprietary Valuation Line indicates that the fair value of SBA COMMUNICATIONS’ stock is around $408.1. However, the current trading price of the company’s shares is $261.0, which represents a 36.0% undervaluation of the stock. This makes it an attractive opportunity for investors looking to capitalize on the current market situation. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sba Communications. More…

| Total Revenues | Net Income | Net Margin |

| 2.69k | 374.02 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sba Communications. More…

| Operations | Investing | Financing |

| 1.3k | -1.28k | -144.45 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sba Communications. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.54k | – | -48.64 |

Key Ratios Snapshot

Some of the financial key ratios for Sba Communications are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 38.0% |

| FCF Margin | ROE | ROA |

| – | – | – |

Peers

The U.S. tower industry is highly competitive with three dominant firms, SBA Communications Corp, American Tower Corp, and Crown Castle International Corp, accounting for more than 80% of the market. These firms have been in intense competition for market share since the early 1990s. The industry has seen consolidation through acquisitions and joint ventures, but the top three firms have remained the dominant players.

Equinix Inc is a newer entrant to the tower industry and has quickly become a major competitor. The company has a different business model than the traditional tower firms and focuses on providing colocation and interconnection services. Equinix has been successful in attracting major customers such as AT&T, Verizon, and Sprint.

– American Tower Corp ($NYSE:AMT)

American Tower is a leading independent owner, operator and developer of wireless and broadcast communications real estate. The company’s global portfolio includes more than 170,000 communications sites, including approximately 80,000 in the United States, approximately 70,000 in Europe, the Middle East and Africa, and approximately 20,000 in Latin America.

– Crown Castle International Corp ($NYSE:CCI)

Crown Castle International Corp is a publicly traded real estate investment trust (REIT) that owns, operates, and leases communications towers and other infrastructure in the United States. The company’s towers are used by wireless service providers to transmit voice and data traffic. Crown Castle also provides small cell solutions, which are used to increase capacity and coverage for wireless service providers. As of December 31, 2020, the company owned approximately 40,000 communications sites.

– Equinix Inc ($NASDAQ:EQIX)

Equinix, Inc. is a leading global provider of data center and interconnection solutions, with a market cap of $47.86B as of 2022. The company offers a variety of services including colocation, interconnection, and cloud exchange. Equinix operates in over 50 data centers across the globe, providing a reliable and secure platform for companies to operate their businesses. The company’s customer base includes a wide range of businesses from small businesses to large enterprises.

Summary

Ieq Capital LLC, a major investor, decreased its holdings in SBA Communications Co. by 29.2%. This signals a negative sentiment towards the company’s performance, as investors are pulling their money out. This could be a sign that investors anticipate a downturn in the company’s profitability and prospects.

Recent Posts