RRR Stock Fair Value – Las Vegas Red Rock Resorts Could Benefit from Oakland A’s Potential Move

April 22, 2023

Trending News ☀️

The potential relocation of the Oakland A’s baseball team to Las Vegas could be a lucrative move for certain stocks, including those of Red Rock Resorts ($NASDAQ:RRR). Red Rock Resorts is a gaming and entertainment company based in Las Vegas, Nevada. It owns and operates multiple properties, including a casino, resort, and entertainment venues. This potential move could bring an influx of tourists to the city of Las Vegas, which could in turn increase profits for Red Rock Resorts. The relocation of the Oakland A’s to Las Vegas would bring a major professional sports franchise to the city, as well as provide Las Vegas with an additional source of income. This could lead to increased tourism, as well as a boost in revenue for Red Rock Resorts. The additional tourists to Las Vegas will likely lead to an increase in demand for the services and amenities that the Red Rock Resorts offers. This in turn will likely result in an increase in profits for the company. The influx of tourists, combined with the added attraction of a professional sports team, could result in increased profits for the company.

Additionally, the increased exposure for the city of Las Vegas could lead to more business opportunities for the company in the future.

Price History

On Friday, shares of Las Vegas Red Rock Resorts opened at $46.9 and closed at $47.3, up by 1.0% from the previous closing price of 46.8. If the A’s move to Las Vegas, they would become the first Major League Baseball (MLB) team to reside in the city, expanding the arenas accessible to Red Rock Resorts. This could lead to larger numbers in customer patronage visiting their hotels and gaming establishments, potentially boosting revenues for the company.

The move to Las Vegas could also increase tourism in the city, boosting the overall economy of the area, and therefore, benefiting Red Rock Resorts. With the news of the potential move, investors are watching closely to see if it will affect Red Rock stock prices. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RRR. More…

| Total Revenues | Net Income | Net Margin |

| 1.66k | 205.46 | 14.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RRR. More…

| Operations | Investing | Financing |

| 542.22 | -442.14 | -290.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RRR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.35k | 3.31k | 0.75 |

Key Ratios Snapshot

Some of the financial key ratios for RRR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.6% | 30.3% | 33.9% |

| FCF Margin | ROE | ROA |

| -1.1% | 926.4% | 10.6% |

Analysis – RRR Stock Fair Value

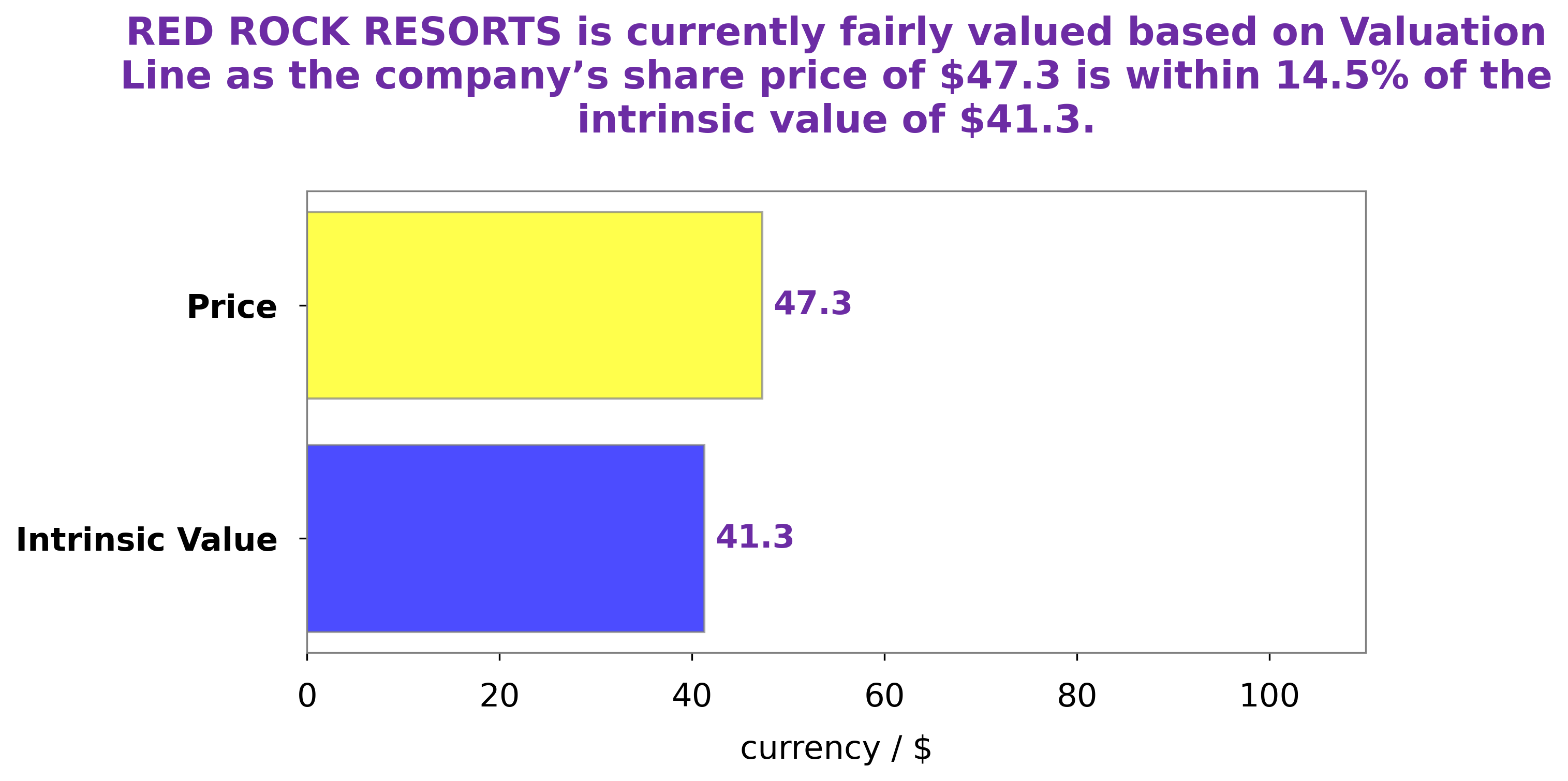

At GoodWhale, we have conducted a thorough analysis of RED ROCK RESORTS and their wellbeing. Our proprietary Valuation Line has calculated the intrinsic value of RED ROCK RESORTS shares at around $41.3. Currently, the stock is traded at $47.3, which is fair price and indicates an overvaluation of 14.4%. All in all, this suggests that while RED ROCK RESORTS is performing well, it may be overvalued at present. More…

Peers

The company’s main competitors are Boyd Gaming Corp, Golden Entertainment Inc, and Bloomberry Resorts Corp.

– Boyd Gaming Corp ($NYSE:BYD)

Boyd Gaming Corporation is a leading diversified owner and operator of 22 gaming entertainment properties located in Nevada, Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi and Ohio. Boyd Gaming press releases are available at boydgaming.com. Additional information about Boyd Gaming can be found at https://www.boydgaming.com/.

The company has a market cap of 5.86B as of 2022 and a ROE of 36.77%. The company operates gaming entertainment properties located in various states in the US.

– Golden Entertainment Inc ($NASDAQ:GDEN)

As of 2022, Golden Entertainment, Inc. had a market capitalization of 1.19 billion and a return on equity of 28.98%. The company is a gaming and hospitality company that owns and operates casinos, taverns, and gaming machines in the United States.

– Bloomberry Resorts Corp ($PSE:BLOOM)

The company’s market cap stands at 77.45B as of 2022 and its ROE is 11.83%. The company is engaged in the business of developing, owning and operating resorts.

Summary

Red Rock Resorts Inc. (NASDAQ: RRR) is a stock that could benefit from the potential move of the Oakland Athletics to Las Vegas. It is the largest gaming operator in the state of Nevada, primarily running multiple properties under the Station Casinos brand. It has solid operating cash flow and large liquidity.

Recent Posts