Remitly Global Intrinsic Stock Value – Remitly Global Reaches New Heights in 2023 Technical Analysis.

March 30, 2023

Trending News ☀️

Remitly Global ($NASDAQ:RELY) Inc. has demonstrated remarkable growth in 2023, and its technical analysis has illustrated its continued success in the global market. Through careful examination of its business operations and current performance, Remitly Global Inc. has managed to reach unprecedented heights. The technical analysis of Remitly Global Inc. has shown that their business model and investments have been successful in providing returns to shareholders and customers. This is evidenced by the company’s growth in profits, capital, and market share. The company has made strategic investments in emerging markets, allowing it to expand its reach and increase revenues.

Additionally, the company has adopted innovative technology and services, such as artificial intelligence and machine learning, to further streamline operations and increase customer satisfaction. In addition to these technological advancements, Remitly Global Inc. has also implemented an effective marketing strategy which has allowed them to increase their market share and customer base. Their marketing campaigns have focused on educating customers about the product and how it can be beneficial to them. Remitly Global Inc. has also leveraged digital platforms to build a strong online presence and reach new markets. Overall, Remitly Global Inc. has managed to reach new heights in 2023 due to its commitment to innovation and customer satisfaction. The company’s technical analysis illustrates their success in the global market and highlights their potential as a leader in the industry. With their current strategies in place, it is likely that Remitly Global Inc. will continue to experience strong growth and success in the years to come.

Price History

On Tuesday, REMITLY GLOBAL Inc. (REMITLY) reached a new milestone in its technical analysis, with its stock opening the trading day at $16.4 and closing at the same price after the market closed. This represents a slight decrease of 0.4% from its prior closing price of $16.4.

Additionally, REMITLY has seen a steady increase in its value over the past year, with its stock now trading at more than double its value from a year ago. These results point to the company’s continued success in the industry, as well as its strong presence in the global market. With REMITLY’s focus on providing easy and affordable access to international money transfers, its consistent growth can be attributed to its commitment to providing quality services to its customers. As REMITLY continues to expand its services and reach more customers worldwide, it is likely to experience even more success in the coming years. With this in mind, investors are likely to continue to monitor the company’s progress and consider investing in it for long-term gains. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Remitly Global. More…

| Total Revenues | Net Income | Net Margin |

| 653.56 | -114.02 | -17.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Remitly Global. More…

| Operations | Investing | Financing |

| -105.14 | -7.31 | 11.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Remitly Global. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 695.95 | 215.87 | 2.77 |

Key Ratios Snapshot

Some of the financial key ratios for Remitly Global are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 72.8% | – | -17.1% |

| FCF Margin | ROE | ROA |

| -17.2% | -14.7% | -10.0% |

Analysis – Remitly Global Intrinsic Stock Value

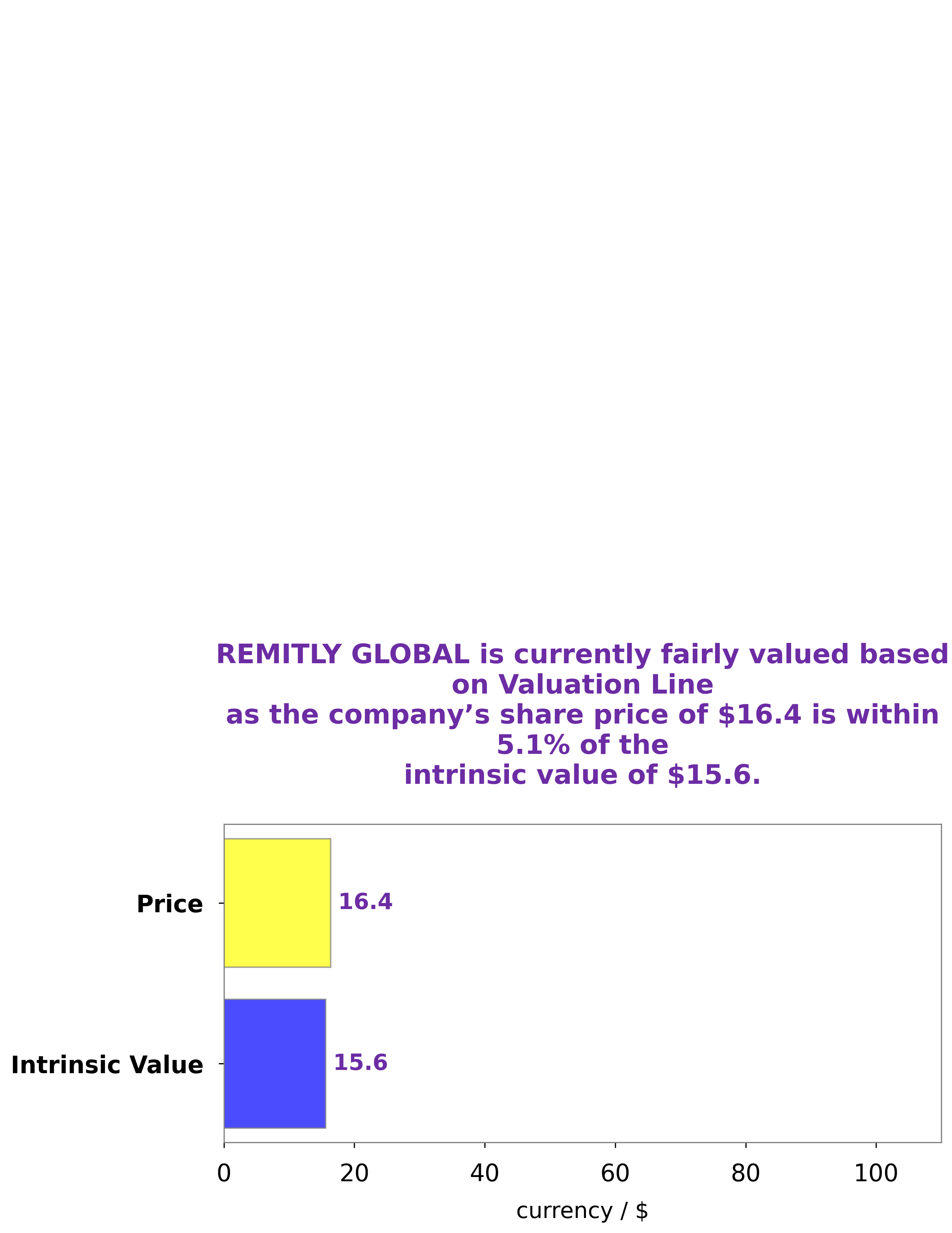

At GoodWhale, we conducted an analysis of REMITLY GLOBAL‘s wellbeing to provide an assessment of the company. After considering various metrics, our proprietary Valuation Line shows that the fair value of REMITLY GLOBAL’s share is around $15.6. However, at the moment the stock is being traded at $16.4, which is a fair price but still slightly overvalued by 5.2%. More…

Peers

The company was founded in 2011 and is headquartered in Seattle, Washington. Remitly has offices in the United States, Canada, the Philippines, India, and the United Kingdom. The company offers money transfer services to more than 50 countries. Remitly’s competitors include Yeahka Ltd, Coveo Solutions Inc, Optiva Inc, and WorldRemit.

– Yeahka Ltd ($SEHK:09923)

The company’s market cap is 9.29B as of 2022. The company’s ROE is 3.37%. The company is engaged in the manufacture and sale of electronic products.

– Coveo Solutions Inc ($TSX:CVO)

Coveo Solutions Inc has a market cap of 561.87M as of 2022, a Return on Equity of 59.41%. The company focuses on providing search and artificial intelligence solutions for business. Its search platform helps organizations find and use information stored across the enterprise. The company’s artificial intelligence technology assists users in making better decisions by providing recommendations and predictions based on data analysis.

– Optiva Inc ($TSX:OPT)

Optiva Inc is a Canadian company that provides software solutions for the telecommunications industry. Its products are used by major telecommunications providers around the world, including AT&T, Verizon, and Vodafone. The company has a market capitalization of 108.11 million as of 2022 and a return on equity of -52.55%.

Summary

Investors interested in Remitly Global Inc. have cause to be optimistic in 2023. A technical analysis of the company’s stock performance shows a steady increase in its price since the start of the year, and the company’s fundamentals indicate a strong market position. The stock has seen a high level of volatility, with short-term dips and peaks, but overall it has been trending up. Remitly has reported impressive earnings growth and is expanding into new markets.

The company’s balance sheet is healthy, and its growth potential is promising. Overall, investors looking for a successful stock to invest in should consider Remitly Global Inc. as a viable option.

Recent Posts