Ree Automotive Intrinsic Value Calculation – REE Automotive Ltd. Receives ‘Moderate Buy’ Recommendation from Five Brokerages

May 12, 2023

Trending News 🌥️

REE ($NASDAQ:REE) Automotive Ltd. recently received a “Moderate Buy” recommendation from five brokerages. REE Automotive Ltd. is a global automotive company that focuses on developing modular electric vehicle platforms and products for the commercial, passenger, and off-road vehicle markets. The average recommendation by the five brokerages currently covering REE Automotive Ltd. is “Moderate Buy”, citing strong performance in the development of its products and services, as well as positive market trends in the electric vehicle industry. The analysts covering REE Automotive Ltd. cite the company’s high-tech capabilities, deep experience in the automotive industry, and forward-thinking management team as reasons for their positive outlook. The five brokerages also cited the increasing demand for electric vehicles as a strong driver of growth for REE Automotive Ltd.

The demand for electric vehicles worldwide is expected to grow significantly over the next few years due to increasing environmental awareness, consumer preference for clean energy, and more stringent emissions regulations imposed by governments around the world. Overall, the five brokerages that currently cover REE Automotive Ltd. have issued a “Moderate Buy” rating to the company, citing its strong product development capabilities, experienced team, and favorable market conditions.

Price History

On Friday, REE AUTOMOTIVE Ltd. experienced a moderate boost in its stock price, opening at $0.3 and closing at $0.3, up 0.8% from the previous closing price of 0.3. This increase in stock value comes after five brokerages recommended the stock with a ‘Moderate Buy’ rating. The ratings are based on an analysis of REE Automotive’s company performance, financials and outlook for future growth.

With the Moderate Buy recommendation from these brokerages, REE Automotive is poised to gain further traction in the automotive industry. Investors are likely to take note of the positive outlook that the brokerages have given the company and may decide to invest in the stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ree Automotive. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -107.42 | -8563641.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ree Automotive. More…

| Operations | Investing | Financing |

| -112.58 | -106.83 | 2.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ree Automotive. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 215.01 | 39.6 | 0.82 |

Key Ratios Snapshot

Some of the financial key ratios for Ree Automotive are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -8591600.0% |

| FCF Margin | ROE | ROA |

| -1025900.0% | -43.0% | -37.2% |

Analysis – Ree Automotive Intrinsic Value Calculation

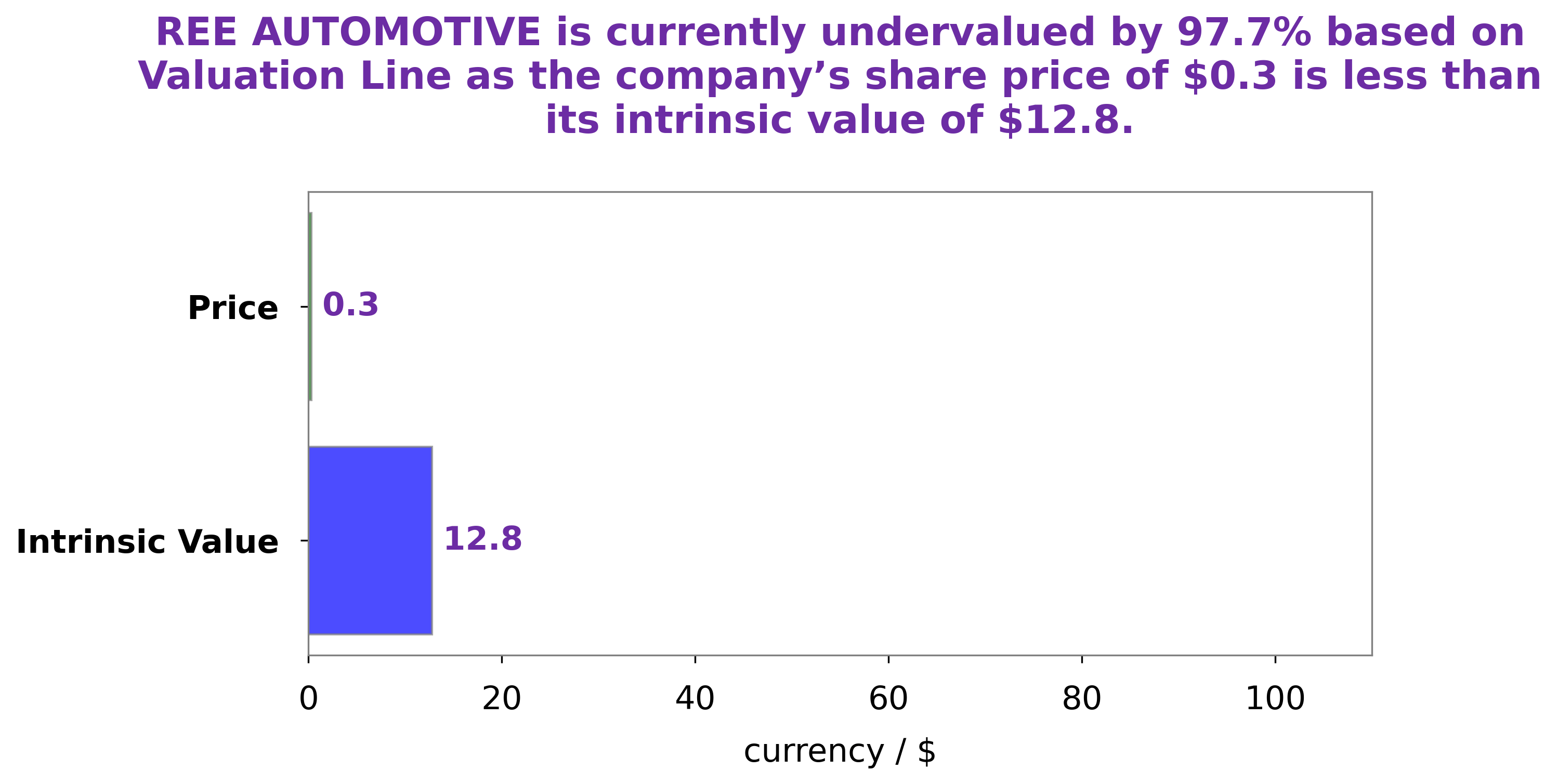

GoodWhale has conducted an analysis of REE AUTOMOTIVE‘s fundamentals and found an intrinsic value of its share to be around $12.8, as calculated by our proprietary Valuation Line. This value is significantly higher than the trading price of REE AUTOMOTIVE stock at the moment. At $0.3, the stock is currently undervalued by 97.7%. We believe that this represents a great buying opportunity for investors who are able to research and evaluate the intrinsic value of a company’s shares. More…

Peers

REE Automotive Ltd is an electric vehicle company based in China. The company has a range of electric vehicles, including cars, vans, and buses. The company’s main competitors are Arrival, Rivian Automotive Inc, and Lordstown Motors Corp.

– Arrival ($NASDAQ:ARVL)

Arrival is a UK-based technology company that designs, manufactures, and operates electric vehicles. The company has a market cap of 485.12M as of 2022 and a Return on Equity of -6.58%. Arrival’s products include electric buses, vans, and cars. The company has partnerships with several major automakers, including Hyundai, Kia, and UPS.

– Rivian Automotive Inc ($NASDAQ:RIVN)

Rivian Automotive Inc is a company that manufactures and sells electric vehicles. As of 2022, the company has a market capitalization of 31.59 billion dollars and a return on equity of -24.65%. The company’s products include electric cars, trucks, and SUVs.

– Lordstown Motors Corp ($NASDAQ:RIDE)

Return on equity is a measure of a company’s profitability that takes into account the company’s overall equity. negative 39.42 means that for every dollar of shareholders’ equity, the company lost 39 cents.

Market cap is short for market capitalization. It is the total value of a company’s shares of stock. 372.07 million is the value of all of the shares of common stock outstanding.

Summary

REE Automotive Ltd. has recently been given an investment analysis recommendation of “Moderate Buy” from five brokerages. Investors are advised to buy the stock with caution, as the rating indicates a moderate degree of risk. The company’s current financials show positive performance, and there is potential for growth over the long-term.

However, investors should carefully consider the company’s fundamentals and future prospects before making their decision to invest. Furthermore, market trends and external influences can also affect the performance of the stock. Therefore, investors should carry out thorough due diligence and research prior to investing in REE Automotive Ltd. and make sure they understand the associated risks.

Recent Posts