Realty Inc Stock Fair Value Calculator – “Retirees: Is Realty Income a Better Choice than Fixed Income? Find Out Now!

June 7, 2023

☀️Trending News

Retirees are always looking for ways to earn income and make their retirement savings go further. Realty Inc ($NYSE:O)ome, often referred to as the ‘Monthly Dividend Company’, may be an attractive option for these individuals. REITs offer investors a combination of income, diversification, and growth potential. But how does Realty Income compare to traditional fixed income investments? When it comes to comparing Realty Income to fixed income, there are several factors to consider.

First, Realty Income offers an attractive dividend yield. This diversification reduces risk and provides stability.

Additionally, REITs are not subject to federal income tax, which can make them an attractive option for retirees looking for ways to reduce their taxable income. Finally, Realty Income has a long history of increasing its dividend payments and is well-positioned for future growth. In conclusion, Realty Income may be an attractive option for retirees looking for an alternative to traditional fixed income investments. It offers a high dividend yield, diversification, tax benefits, and potential for growth. Investors should consider all factors before making an investment decision.

Market Price

Retirees hoping to make a smarter investment choice than traditional fixed income investments should consider the stock of REALTY INC. On Tuesday, REALTY INC opened at $60.1 and closed at $60.0. While it is easy to think that this stock is not a good choice due to its lack of movement, it is important to look more closely at the stability that owning this stock offers. REALTY INC is a leader in the real estate industry and owns a portfolio of properties located in key markets all across the world.

This means that, regardless of market conditions, they are able to provide shareholders with a reliable source of income. The company also has a proven track record of success when it comes to increasing dividends for investors, providing them with a steady stream of additional income. Its strong portfolio and impressive dividend record make it a great option for those seeking a reliable and steady return on their investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Realty Inc. More…

| Total Revenues | Net Income | Net Margin |

| 3.48k | 895.05 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Realty Inc. More…

| Operations | Investing | Financing |

| 2.56k | -8.39k | 5.74k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Realty Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 51.1k | 21.71k | 44.3 |

Key Ratios Snapshot

Some of the financial key ratios for Realty Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 39.6% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – Realty Inc Stock Fair Value Calculator

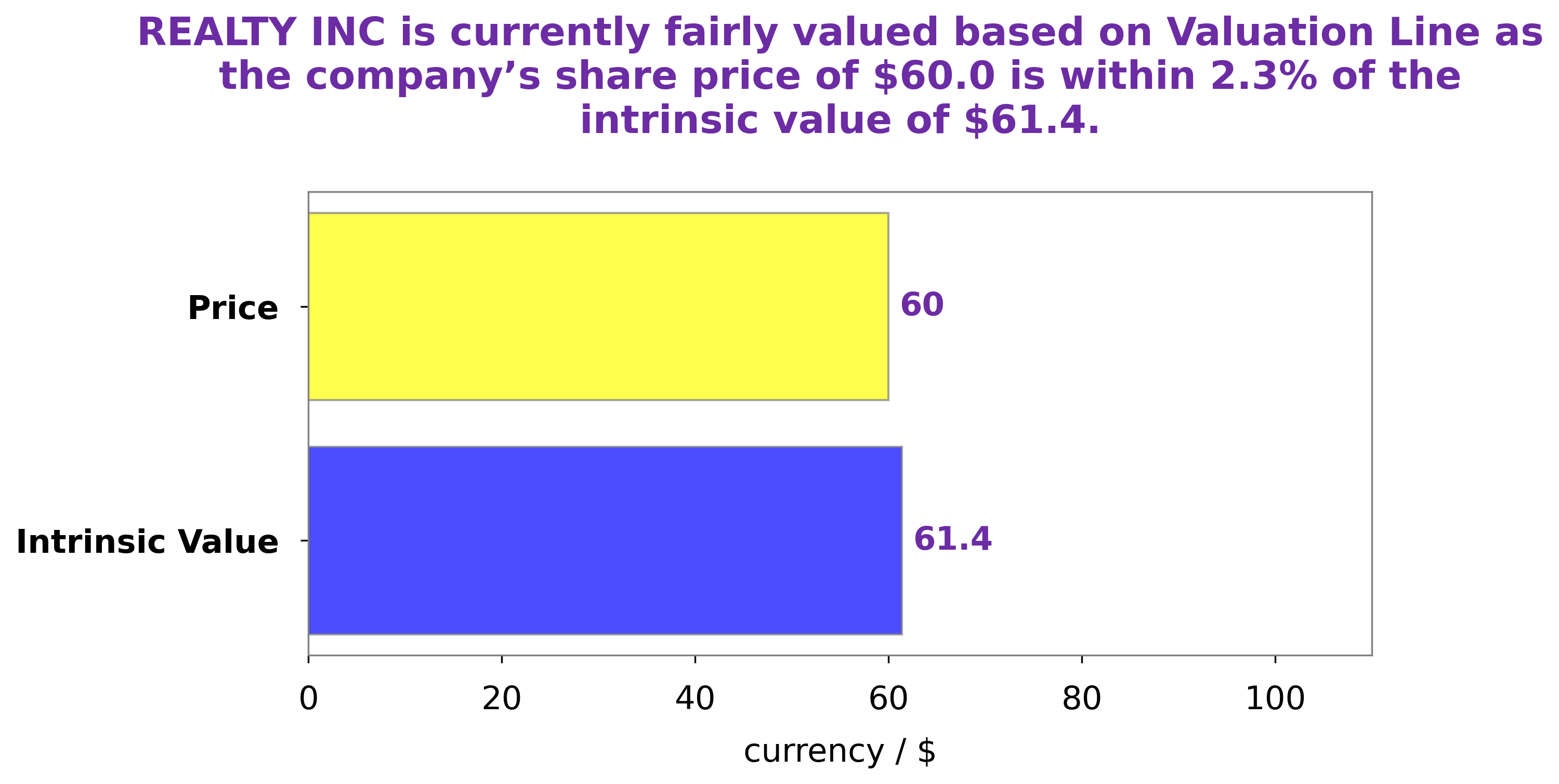

At GoodWhale, we have conducted a thorough analysis of REALTY INC‘s wellbeing and have arrived at an intrinsic value of their share of approximately $61.4, as calculated by our proprietary Valuation Line. Currently, REALTY INC’s stock is traded at $60.0, which is a fair price, though it does appear to be slightly undervalued by 2.3%. Overall, this presents an attractive buying opportunity for investors. More…

Peers

Realty Income Corp is in the business of owning and operating properties that are leased to retail tenants. Its competitors include National Retail Properties Inc, Agree Realty Corp, and The Necessity Retail REIT Inc.

– National Retail Properties Inc ($NYSE:NNN)

National Retail Properties, Inc. is a real estate investment trust, which owns, operates, and develops retail properties. As of December 31, 2020, the Company owned 2,637 properties in 48 states totaling approximately 278 million square feet. The Company’s properties are leased to national and regional retailers.

– Agree Realty Corp ($NYSE:ADC)

Agree Realty Corporation is a publicly traded real estate investment trust primarily engaged in the ownership and operation of open-air shopping centers and freestanding properties. The Company’s portfolio consists of approximately 400 properties located in 43 states, totaling approximately 50 million square feet of gross leasable area. The majority of Agree Realty’s portfolio is leased to national and regional tenants in the retail industry.

– The Necessity Retail REIT Inc ($NASDAQ:RTL)

Necessity Retail REIT Inc is a publicly traded company that owns and operates a portfolio of necessity retail properties across the United States. The company’s portfolio consists of convenience stores, grocery stores, drug stores, and other retail properties. Necessity Retail REIT Inc is headquartered in Atlanta, Georgia.

Summary

Realty Income is a real estate investment trust (REIT) that has long been a popular choice for retirees who are looking for reliable income and steady growth. Its portfolio of properties generates stable rental income and it has a long track record of dividend increases, making it an attractive long-term income investment. While investors should always do their own research before investing in any company, the combination of reliable rental income, dividend growth and a history of outperformance makes Realty Income an attractive option for retirees.

Recent Posts