Rambus Inc Stock Fair Value Calculator – Epoch Investment Partners Reduces Shareholding in Rambus Inc

June 11, 2023

🌥️Trending News

Epoch Investment Partners Inc. recently announced that they have reduced their shareholding in Rambus Inc ($NASDAQ:RMBS), symbolizing an important move in the technology sector. Rambus Inc is a company specializing in the development and licensing of high-speed memory and semiconductor technologies. They focus on the design and development of custom and standard interface technologies that reduce power consumption, increase system performance and enable fast access to and efficient management of data and information. These technologies are used by some of the most recognized names in the industry including Samsung, NVIDIA, Qualcomm, and Intel. The exact size of the reduction has not been disclosed, but it could have a significant impact on the company’s stock price.

This news has sparked speculation about the future of Rambus Inc, as investors try to determine what effect this move could have on the company’s performance. Regardless of the reasons behind this decision, it is clear that Epoch Investment Partners Inc has reduced its shareholding in Rambus Inc. This could be a sign of uncertain times ahead for the company, or it could be a strategic move on Epoch’s part. It remains to be seen what effect this will have on the company’s future.

Share Price

On Friday, Rambus Inc’s stock opened at $65.1 and closed at $63.7, down by 1.2% from its last closing price of 64.4. The amount of shares held by Epoch Investment Partners Inc. is not yet known. Analysts attribute the decrease in share price to the uncertainty surrounding the impact of Epoch Investment Partners Inc.’s decision on the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rambus Inc. More…

| Total Revenues | Net Income | Net Margin |

| 469.5 | 55.19 | 16.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rambus Inc. More…

| Operations | Investing | Financing |

| 230.39 | 151.98 | -362.94 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rambus Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 962.63 | 200.9 | 7.16 |

Key Ratios Snapshot

Some of the financial key ratios for Rambus Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.1% | -8.3% | 13.4% |

| FCF Margin | ROE | ROA |

| 44.7% | 5.1% | 4.1% |

Analysis – Rambus Inc Stock Fair Value Calculator

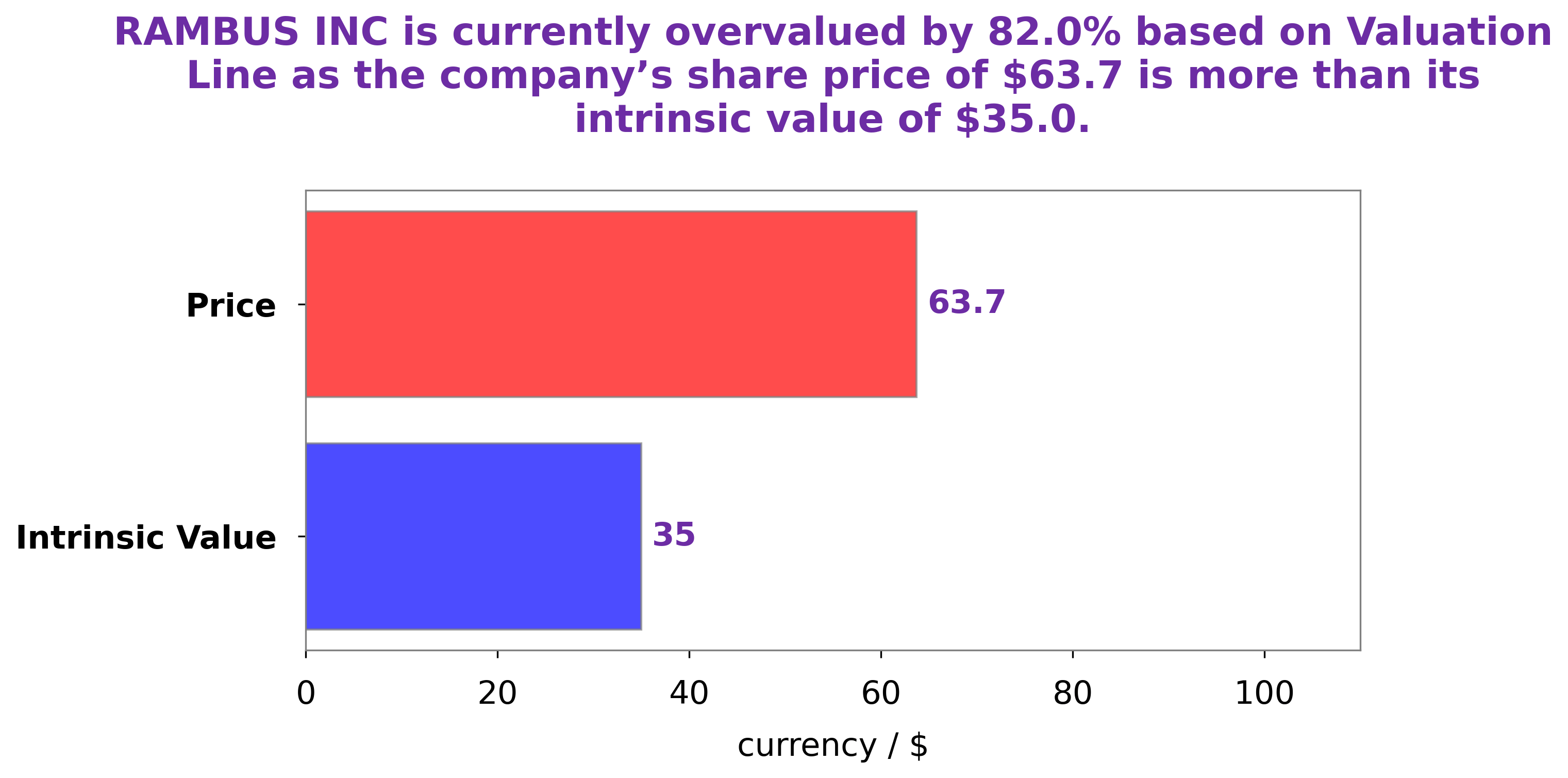

At GoodWhale, we have conducted an analysis of RAMBUS INC‘s fundamentals and can now provide an assessment of the company’s intrinsic value. Our proprietary Valuation Line has calculated that the intrinsic value of RAMBUS INC’s share is around $35.0. Currently, RAMBUS INC’s stock is trading at $63.7, which means it is overvalued by 82.0%. More…

Peers

Rambus Inc. is a leading developer of high-speed memory chips and interfaces. Its products are used in a variety of applications, including personal computers, servers, and mobile devices. The company competes with Goke Microelectronics Co Ltd, 3Peak Incorporated, and Suzhou Novosense Microelectronics Co Ltd in the development of high-speed memory chips and interfaces.

– Goke Microelectronics Co Ltd ($SZSE:300672)

Goke Microelectronics Co Ltd is a leading provider of semiconductor and display technologies. The company has a market cap of 11.04B as of 2022 and a return on equity of 12.85%. Goke Microelectronics Co Ltd is a leading provider of semiconductor and display technologies. The company develops and manufactures innovative semiconductor and display products for a wide range of applications. Goke Microelectronics Co Ltd’s products are used in a variety of electronic devices, including mobile phones, computers, TVs, and more.

– 3Peak Incorporated ($SHSE:688536)

Peak Incorporated is a leading provider of analytical instruments, software, and services for the global life sciences market. The company has a market cap of 30.14B and a ROE of 9.56%. Peak Incorporated provides a wide range of products and services to help scientists and researchers advance their scientific knowledge and improve human health. The company’s products are used in a variety of applications, including drug discovery, basic research, and clinical research.

– Suzhou Novosense Microelectronics Co Ltd ($SHSE:688052)

Suzhou Novosense Microelectronics Co Ltd is a Chinese company that designs, develops, manufactures, and sells microelectronic products and services. The company has a market cap of 30.12B as of 2022 and a return on equity of 6.73%. The company’s products include integrated circuits, sensors, and other electronic components. It also provides services such as design, development, and testing of microelectronic products.

Summary

Investors have been closely watching Rambus Inc. (RMBS) as Epoch Investment Partners Inc. recently revealed in its filings that they had decreased their position in the company’s shares. Analysts are closely examining the company’s financials, performance, and future prospects to gain insight into its potential as an investment. Recent speculation has been centered around the company’s increased profitability, strong balance sheet, and its commitment to innovation and research and development.

Investors are also taking into account the company’s return on equity, which is higher than the industry average. Despite short-term market fluctuations, analysts believe that Rambus Inc. is well-positioned for long-term success. They are optimistic that the company’s strategic plans will continue to yield strong returns and provide investors with profitable investments in the future.

Recent Posts