Pultegroup Stock Fair Value Calculator – Van ECK Associates Corp Trims Its Holdings in PulteGroup, by 9.2%

May 16, 2023

Trending News 🌥️

PULTEGROUP ($NYSE:PHM): It is America’s largest homebuilder in terms of revenue and one of the nation’s most-respected and well-known brands in the homebuilding industry. According to its most recent filing, Van ECK Associates Corp reduced its stake in PulteGroup, Inc. by 9.2% during the fourth quarter. This follows a trend of the company making strategic investments and adjustments to its portfolio in order to ensure the best returns for its investors.

The reduction in shares held by Van ECK Associates Corp will likely have a short-term negative impact on the stock price of PulteGroup. In the long run, however, investors should expect the stock to rebound as PulteGroup continues to make progress in its operations and develop new projects.

Analysis – Pultegroup Stock Fair Value Calculator

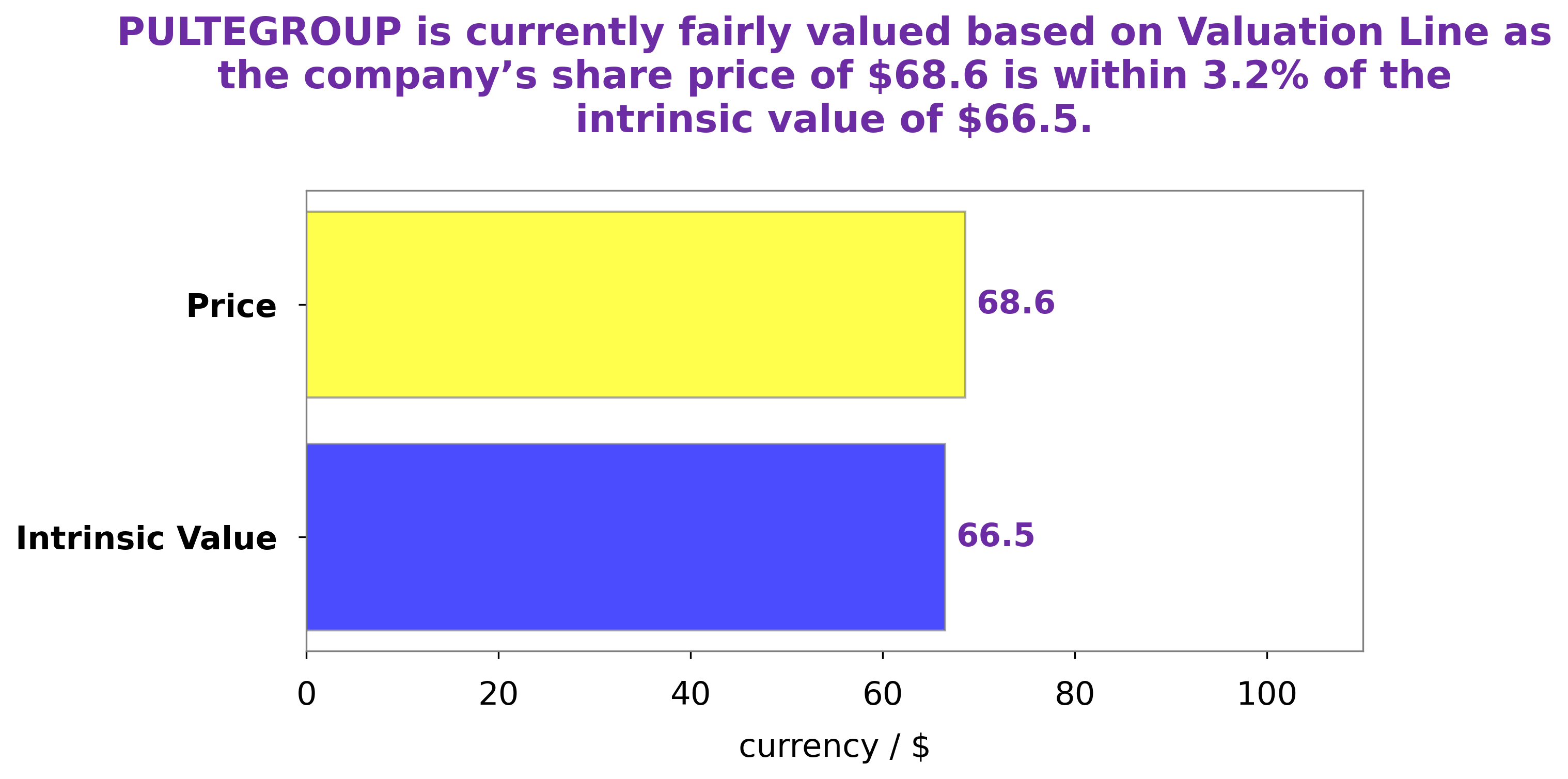

At GoodWhale, we have conducted research on the fundamentals of PULTEGROUP. Through our proprietary Valuation Line, we have determined that the intrinsic value of one PULTEGROUP share is roughly $66.5. Meanwhile, PULTEGROUP stock is currently being traded at $68.6, a price that is overvalued by 3.1% but is still considered fair. We believe that this stock is a good investment for long-term investors and those looking for a reliable dividend income. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pultegroup. PulteGroup_by_9.2″>More…

| Total Revenues | Net Income | Net Margin |

| 16.66k | 2.68k | 16.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pultegroup. PulteGroup_by_9.2″>More…

| Operations | Investing | Financing |

| 1.17k | -147.99 | -909.19 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pultegroup. PulteGroup_by_9.2″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.83k | 5.57k | 41.3 |

Key Ratios Snapshot

Some of the financial key ratios for Pultegroup are shown below. PulteGroup_by_9.2″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.6% | 36.0% | 21.3% |

| FCF Margin | ROE | ROA |

| 6.4% | 24.4% | 14.9% |

Peers

PulteGroup Inc is one of the largest homebuilders in the United States. The company’s competitors include D.R. Horton Inc, Lennar Corp, and Beazer Homes USA Inc.

– D.R. Horton Inc ($NYSE:DHI)

D.R. Horton Inc is a homebuilding company that operates in 84 markets across 26 states in the United States. The company is engaged in the construction and sale of single-family detached homes, townhomes, and condominiums. It also provides mortgage financing and title services for homebuyers through its subsidiaries. As of March 31, 2021, the company had a market capitalization of $26.2 billion and a return on equity of 25.97%.

D.R. Horton was founded in 1978 and is headquartered in Fort Worth, Texas. The company operates through its Homebuilding and Financial Services segments. The Homebuilding segment acquires and develops land, and constructs and sells homes in 27 states across the United States. The Financial Services segment provides mortgage financing, title insurance, and closing services for homebuyers in its homebuilding markets.

– Lennar Corp ($NYSE:LEN)

Lennar Corp is a leading homebuilder in the United States. The company has a market capitalization of $22.33 billion as of 2022 and a return on equity of 18.78%. Lennar Corp is engaged in the business of homebuilding, land development, and related activities through its subsidiaries. The company builds and sells a variety of homes, including single-family detached homes, townhomes, and condominiums. It also provides a range of homebuilding-related financial services, such as mortgage financing, title insurance, and home warranty services.

– Beazer Homes USA Inc ($NYSE:BZH)

Beazer Homes USA Inc is a homebuilding company that operates in the United States. The company is engaged in the design, construction, and sale of single-family homes. As of 2022, Beazer Homes USA Inc had a market capitalization of $345.59 million and a return on equity of 15.8%. The company’s primary business is the construction and sale of single-family homes. Beazer Homes USA Inc also engages in the construction of multi-family homes and the development of land for homebuilding.

Summary

Investors in PulteGroup, Inc. had a tumultuous fourth quarter, as Van ECK Associates Corp trimmed its holdings by 9.2% according to its latest filing. This continues a trend of careful stock analysis among investors, with many re-evaluating their holdings in the company. PulteGroup’s stock price has been on a roller coaster as analysts balance the potential of the company with uncertainties surrounding the possible downturn in housing market. Despite the overall volatility, analysts see promise in the company, and continue to watch PulteGroup’s stock closely.

Recent Posts