Public Storage Stock Fair Value Calculator – Comparing Public Storage and Big Yellow Group: Which REIT Is Best For 2023?

May 20, 2023

Trending News ☀️

When it comes to choosing a real estate investment trust (REIT) for 2023, investors may be wondering which one offers the most value: Public Storage ($NYSE:PSA) or Big Yellow Group? To make an informed decision, it is important to understand the differences between the two companies and their respective offerings. The company is the world’s largest owner, operator, and developer of self-storage facilities. Public Storage also offers storage solutions to both residential and commercial customers. Its services include portable storage, vehicle storage, business storage, and more. Furthermore, the company prides itself on its customer service and offers a wide variety of amenities to its customers. In comparison, Big Yellow Group is a British REIT focusing on self-storage services in the UK.

Its services are similar to those offered by Public Storage, with storage solutions for both residential and commercial customers. In addition to self-storage services, Big Yellow Group also provides customers with document management, secure shredding, and archive services. Ultimately, investors looking for a REIT in 2023 must consider the merits of both Public Storage and Big Yellow Group before making their decision. Public Storage is the larger of the two companies and has a greater presence in the United States and Europe. On the other hand, Big Yellow Group focuses on self-storage services within the UK and provides additional services such as document management and shredding. Investors should weigh their options carefully before deciding which REIT is best suited for their investment portfolio in 2023.

Market Price

Public Storage is a real estate investment trust (REIT) that specializes in self storage. On Friday, Public Storage stock opened at $287.1 and closed at $284.9. Public Storage is also more diversified, with properties in the United States, Europe, Mexico, and Brazil. In comparison, Big Yellow Group’s properties are only in the UK and Ireland.

Therefore, when deciding which REIT is best for 2023, Public Storage appears to be the better choice. Its larger market capitalization and focus on multiple markets make it a higher performing stock, and its higher dividend yield makes it a more attractive option for investors interested in yielding returns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Public Storage. More…

| Total Revenues | Net Income | Net Margin |

| 4.3k | 4.15k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Public Storage. More…

| Operations | Investing | Financing |

| 3.16k | 1.2k | -4.6k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Public Storage. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.51k | 7.37k | 32.46 |

Key Ratios Snapshot

Some of the financial key ratios for Public Storage are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 51.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – Public Storage Stock Fair Value Calculator

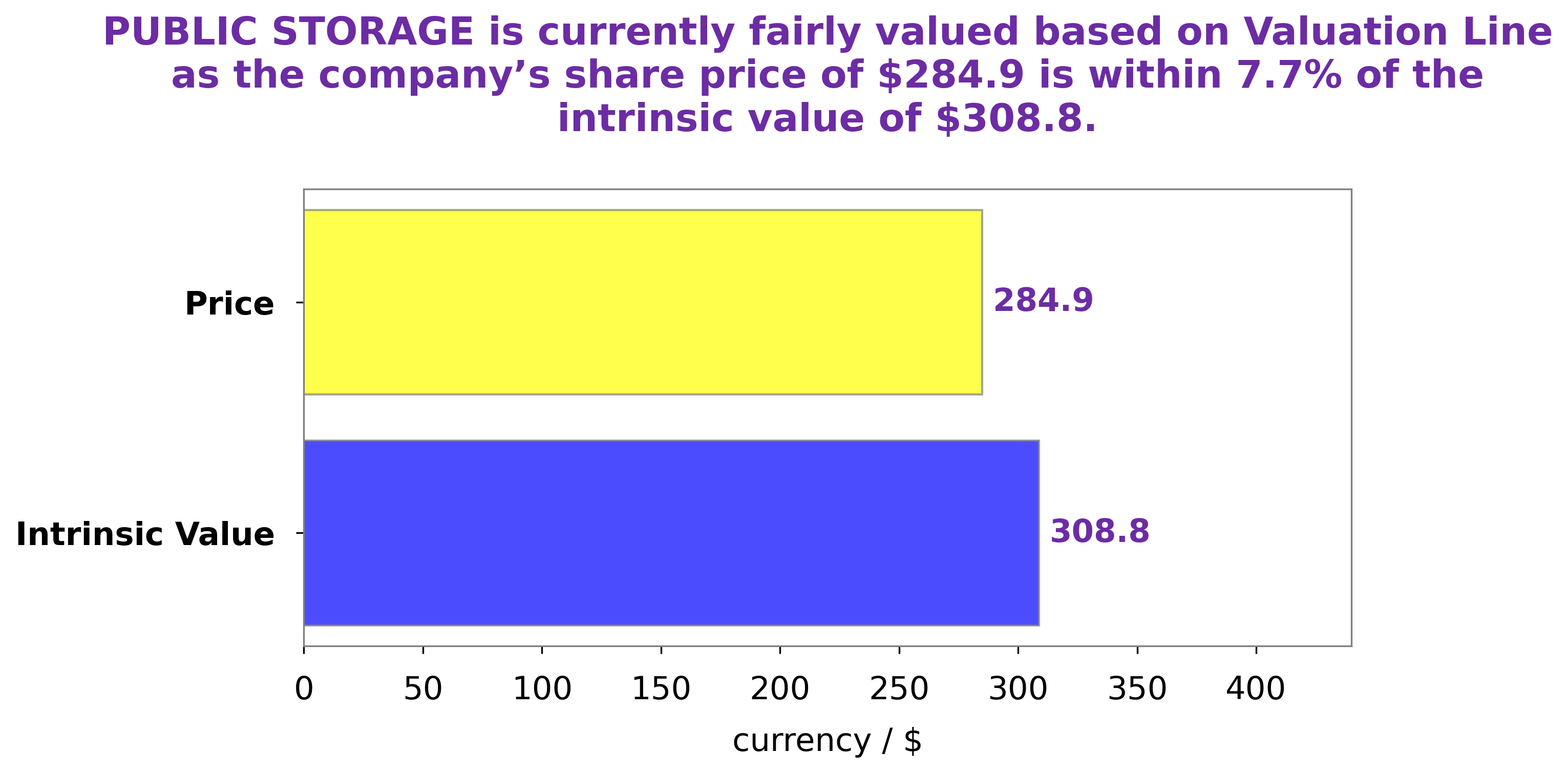

At GoodWhale, we conducted an analysis of PUBLIC STORAGE‘s wellbeing. Our proprietary Valuation Line calculation resulted in a fair value of $308.8 per share of PUBLIC STORAGE. Comparatively, PUBLIC STORAGE stocks are currently trading at $284.9, indicating the stock is undervalued by 7.7%. More…

Peers

Public Storage is a real estate investment trust that invests in self-storage facilities. The company was founded in 1972 and is headquartered in Glendale, California. Public Storage has over 2,200 locations in the United States and Europe. The company’s competitors include Life Storage Inc, Extra Space Storage Inc, and National Storage Affiliates Trust.

– Life Storage Inc ($NYSE:LSI)

Life Storage Inc is a US based self storage company. As of December 31, 2020, it operated 969 self storage facilities across the United States. The company has a market capitalization of $8.69 billion as of February 2021.

– Extra Space Storage Inc ($NYSE:EXR)

Extra Space Storage is a real estate investment trust that owns and operates self-storage properties across the United States. As of December 31, 2020, the company had 1,871 self-storage properties located in 40 states, Washington, D.C., and Puerto Rico. Extra Space Storage is the second largest self-storage company in the United States with a market cap of $22.22 billion as of February 2021.

– National Storage Affiliates Trust ($NYSE:NSA)

National Storage Affiliates Trust is a publicly traded real estate investment trust focused on the ownership, operation and acquisition of self storage properties located within the United States. As of December 31, 2020, the Company owned and operated 783 self storage properties located in 38 states with approximately 54.3 million rentable square feet.

Summary

Public Storage is an American REIT specializing in self-storage facilities. Its portfolio of properties has also seen consistent growth in occupancy rates and rent increases over the past few years, making it a strong player in the REIT market. Furthermore, Public Storage has diversified its portfolio through acquisitions and joint ventures, giving it a competitive edge.

Recent Posts