Progress Software Intrinsic Stock Value – StockNews.com Downgrades Progress Software from ‘Strong-Buy’ to ‘Buy’ Rating

June 10, 2023

☀️Trending News

On Friday, StockNews.com’s investment analysts downgraded Progress Software ($NASDAQ:PRGS)’s rating from a “strong-buy” to a “buy.” This decision came after an in-depth analysis of the company’s financial performance. Progress Software is a leading provider of application development and digital experience technologies. The company is dedicated to helping organizations create successful outcomes for their customers and citizens by delivering digital services faster, more effectively, and with less cost. Progress Software offers a wide range of software and services that enable customers to quickly and easily build modern, data-driven applications.

Progress Software’s stock had been performing well over the past few months, but the analysts at StockNews.com decided that the company’s financial performance did not meet their expectations. As a result, they downgraded the rating from “strong-buy” to “buy.” Although the stock was previously considered to be a good investment, investors should now approach it with caution. Nevertheless, Progress Software remains a strong contender in the application development and digital experience technology space, and its stock could still be a valuable addition to any investor’s portfolio.

Share Price

On Friday, stock market research firm StockNews.com downgraded Progress Software from a ‘Strong-Buy’ to a ‘Buy’ rating. This came as a surprise to investors, as Progress Software had recently been performing quite well. The downgrade had an immediate effect on the price of Progress Software’s stock, with the stock opening at $60.0 and closing at $59.9, down by 0.2% from its previous closing price of $60.0. This marks a slight drop in the stock’s price, but investors remain optimistic about the company’s future prospects.

The downgrade from StockNews.com is a signal to investors that the stock may not be as strong an investment as they had initially thought. It remains to be seen whether this downgrade will have a lasting impact on Progress Software’s stock and its overall performance in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Progress Software. More…

| Total Revenues | Net Income | Net Margin |

| 621.32 | 98.29 | 15.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Progress Software. More…

| Operations | Investing | Financing |

| 194.83 | -333.68 | 102.69 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Progress Software. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.64k | 1.23k | 9.21 |

Key Ratios Snapshot

Some of the financial key ratios for Progress Software are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.8% | 15.1% | 22.9% |

| FCF Margin | ROE | ROA |

| 30.4% | 21.9% | 5.4% |

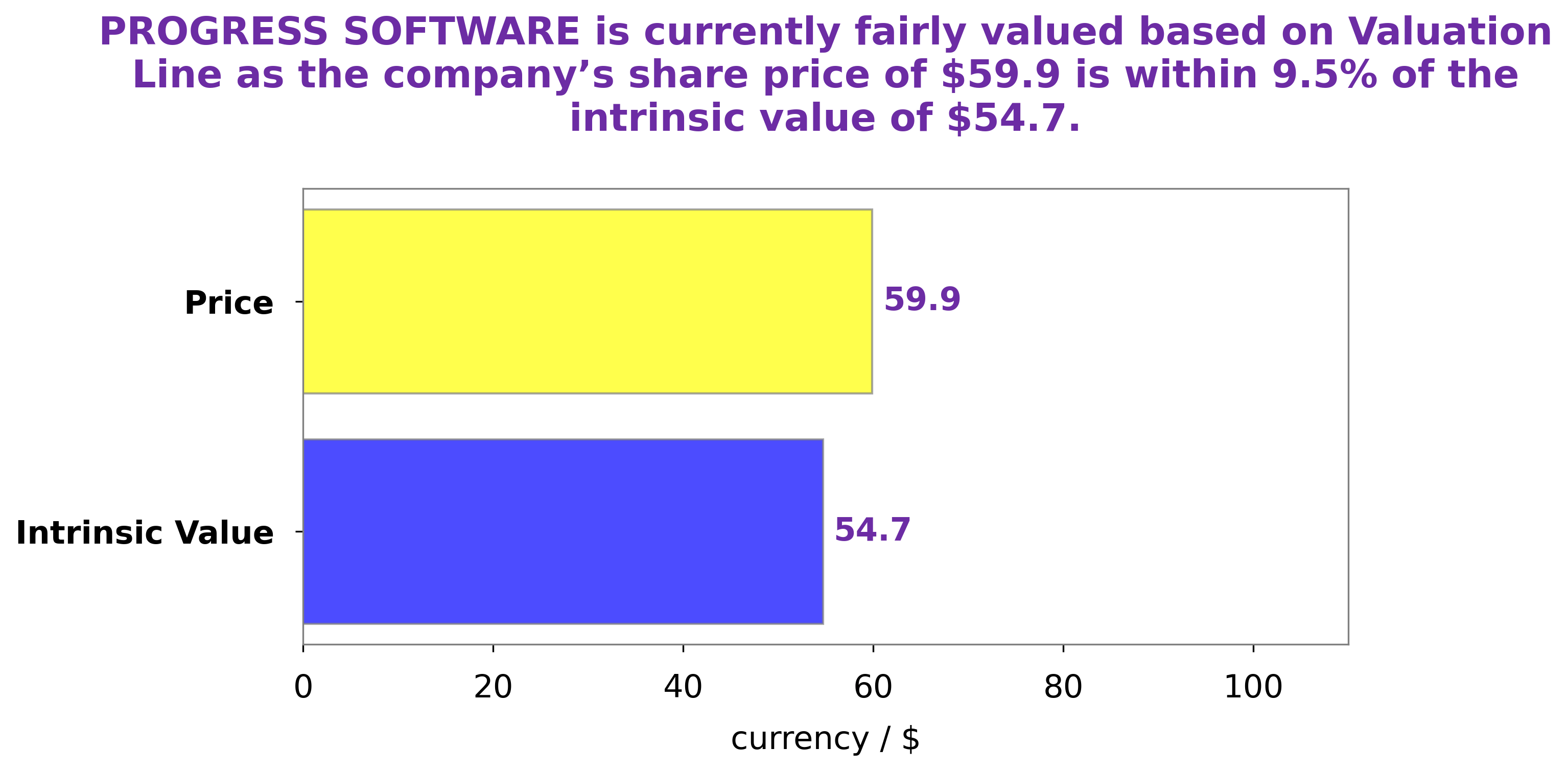

Analysis – Progress Software Intrinsic Stock Value

GoodWhale recently conducted financial analyses of PROGRESS SOFTWARE and found an intrinsic value of around $54.7 per share through our proprietary Valuation Line. Right now, PROGRESS SOFTWARE’s stock is trading at $59.9 – a fair price, but one that is overvalued by 9.5%. Overall, we recommend taking a closer look at the stock’s performance before deciding whether or not to invest in PROGRESS SOFTWARE. We suggest looking at the company’s financials, as well as other factors such as management’s strategies for growth and expansion, and the industry trends, to gain a better understanding of their financial health. Additionally, paying attention to other macroeconomic trends in the market is also essential. At GoodWhale, we understand that every investor is different and has their own unique goals when it comes to investing. Our team is here to provide guidance and support as you make decisions about PROGRESS SOFTWARE and any other investments you may be considering. More…

Peers

Progress Software Corporation is an American publicly traded company headquartered in Bedford, Massachusetts. The company develops software products and services for businesses. Progress Software’s main competitors are DocuSign Inc, Pros Holdings Inc, and Sprout Social Inc.

– DocuSign Inc ($NASDAQ:DOCU)

DocuSign Inc is a US provider of electronic signature technology and digital transaction management services, founded in 2003. The company’s software allows users to electronically sign, send, and manage documents. As of 2022, DocuSign has a market cap of 8.52B and a ROE of -15.28%.

– Pros Holdings Inc ($NYSE:PRO)

A market cap of 1.17B means that the company is worth 1.17 billion dollars. The company’s ROE is 195.47%, which means that the company has made 195.47% profit on every dollar that it has invested. The company does business in the healthcare industry.

– Sprout Social Inc ($NASDAQ:SPT)

Sprout Social is a social media management platform that helps brands grow their social media presence. The company has a market cap of $2.61B and a ROE of -17.92%. Sprout Social’s platform helps brands with tasks such as scheduling and publishing content, analyzing social media analytics, andEngaging with their audience.

Summary

Progress Software recently received a downgrade from StockNews.com from a “Strong-Buy” to a “Buy” rating, causing investors to re-evaluate their portfolios. Upon analysis of the company’s financial performance, it appears that Progress Software has experienced a decline in profitability over the past several quarters. Revenue and earnings growth have been negative in the past year, and their gross margin has decreased substantially.

On the other hand, the company has also seen an increase in cash flow from operations and has decreased debt over the past several quarters. Despite the downgrade, investors should continue to monitor Progress Software’s financial performance closely.

Recent Posts