PK Stock Fair Value – Park Hotels & Resorts Halts Payments for $725M CMBS Loan, Reduces San Francisco Exposure

June 7, 2023

🌥️Trending News

Park Hotels & Resorts ($NYSE:PK), a publicly traded real estate investment trust (REIT) and the second largest lodging REIT in the United States, has announced that it will cease making payments on a $725 million commercial mortgage-backed security (CMBS) loan. This move is part of an effort to reduce its exposure to the San Francisco market. In addition to reducing its San Francisco exposure, Park Hotels & Resorts is making efforts to preserve liquidity by using existing cash and cash equivalents to pay down debt. This move is just one of many that Park Hotels & Resorts has taken to preserve liquidity and manage its exposure to the San Francisco market during the pandemic.

The company has also implemented cost saving measures and is seeking assistance from other sources such as government grants and asset-level financing. With these measures in place, Park Hotels & Resorts is confident that it can successfully manage its debt and position itself for a strong recovery once the pandemic subsides.

Market Price

On Monday, Park Hotels & Resorts, one of the world’s leading lodging real estate investment trusts, announced that it had halted payments for its $725 million CMBS loan and reduced its San Francisco exposure. This news had a positive effect on stock prices, as the stock opened at $14.0 and closed at $13.8 – a 0.4% increase from its last closing price of $13.7. As part of its debt reduction strategy, Park Hotels & Resorts has decided to reduce its San Francisco exposure by selling the property with the aim of repaying the loan.

This strategic move by Park Hotels & Resorts is seen as a sound financial decision which has been welcomed by investors, as reflected in the 0.4% increase on its stock price at the end of Monday trading. The company is confident of its ability to repay the loan and reduce its debt in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PK. More…

| Total Revenues | Net Income | Net Margin |

| 2.67k | 252 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PK. More…

| Operations | Investing | Financing |

| 469 | 157 | -468 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.55k | 5.37k | 19.65 |

Key Ratios Snapshot

Some of the financial key ratios for PK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 13.3% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – PK Stock Fair Value

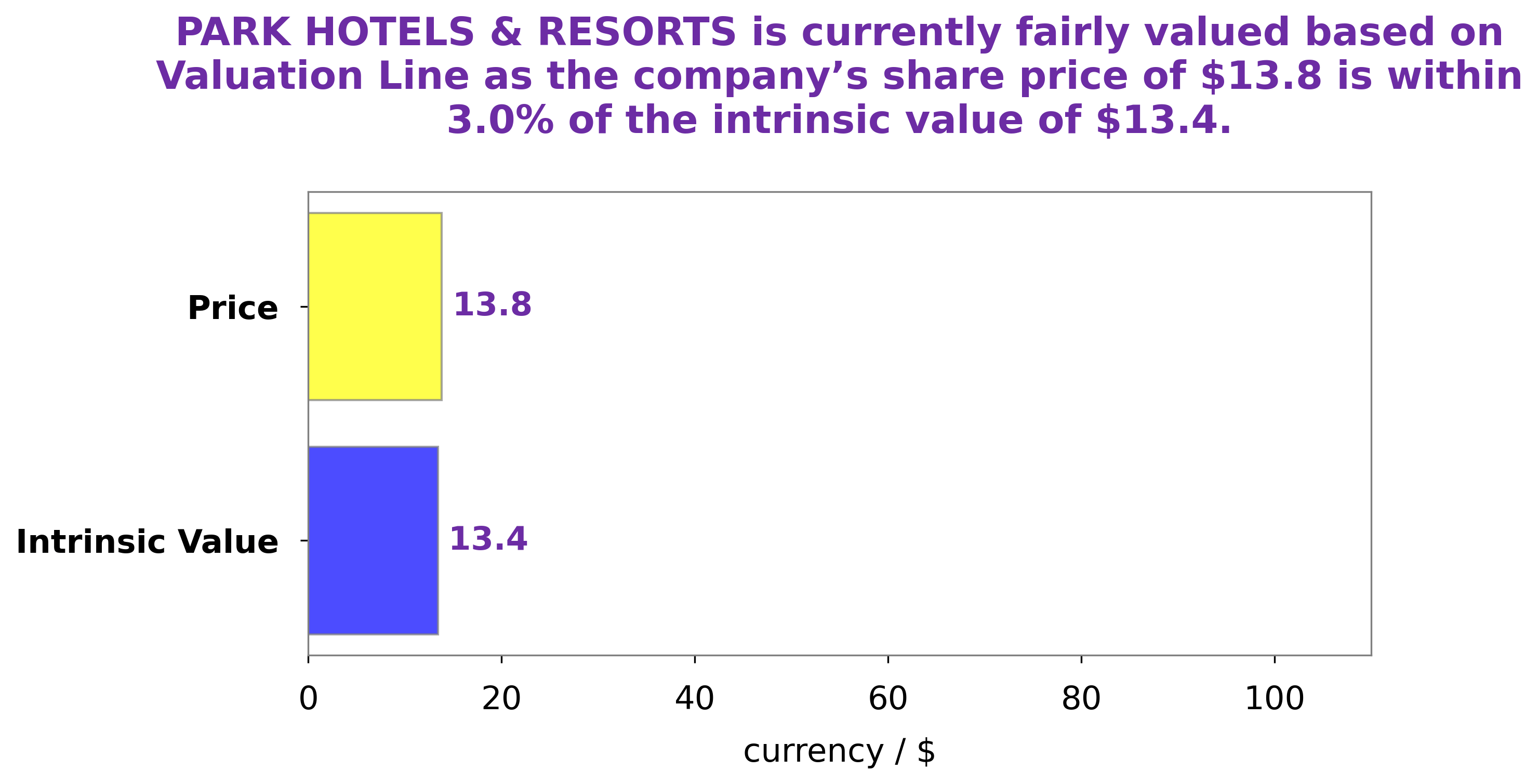

At GoodWhale, we conducted an analysis of PARK HOTELS & RESORTS’s wellbeing. After thoroughly examining the company’s financials, we calculated the intrinsic value of PARK HOTELS & RESORTS’s share at $13.4, using our proprietary Valuation Line. Currently, PARK HOTELS & RESORTS is trading at $13.8, a fair price that is slightly overvalued by 2.6%. More…

Peers

The company’s portfolio includes Marriott, Hilton, Hyatt, and Intercontinental hotels. Park Hotels & Resorts Inc’s competitors include Apple Hospitality REIT Inc, Ryman Hospitality Properties Inc, Pebblebrook Hotel Trust.

– Apple Hospitality REIT Inc ($NYSE:APLE)

Apple Hospitality REIT Inc. is a real estate investment trust (REIT) that owns and operates a portfolio of upscale, select-service hotels located in the United States. As of December 31, 2020, the Company’s portfolio consisted of 235 hotels with approximately 30,000 guest rooms.

– Ryman Hospitality Properties Inc ($NYSE:RHP)

Ryman Hospitality Properties Inc is a real estate investment trust that owns, operates, and develops hotels and resorts in the United States. The company has a market cap of 4.68B as of 2022. Ryman Hospitality Properties Inc was founded in 1994 and is headquartered in Nashville, Tennessee.

– Pebblebrook Hotel Trust ($NYSE:PEB)

Pebblebrook Hotel Trust is a real estate investment trust that owns and invests in hotels. The company has a market cap of 2.07B as of 2022. Pebblebrook Hotel Trust is headquartered in Bethesda, Maryland, and was founded in 2009. The company focuses on investing in hotel properties located in major urban markets in the United States.

Summary

PARK Hotels & Resorts recently announced that it has stopped payments on a $725 million CMBS loan and plans to reduce its exposure in the San Francisco market. This decision is likely a response to the impact of the current economic downturn on the hospitality industry. Investors should be mindful of the risks associated with investing in the company, as it faces increased competition and economic uncertainty due to the pandemic.

It is also important to consider the company’s overall financial health and future prospects for growth when evaluating the stock. Investors should carefully consider all of these factors before making an investment decision in PARK Hotels & Resorts.

Recent Posts