PK Intrinsic Value Calculator – Park Hotels & Resorts Delivers Significant Returns to Investors with Beta Value of 1.99 and Over 3.54 Million Shares Traded

April 21, 2023

Trending News ☀️

Park Hotels & Resorts ($NYSE:PK) Inc. is an established hospitality company operating in the U.S., Canada, and the Caribbean. Their portfolio consists of a wide variety of hotels and resorts that provide luxury experiences. The latest session saw 3.54 million shares traded, showing that the stock is in high demand and expected to rise in the near future. Furthermore, the high trading volume indicates that the stock is in great demand and could further increase in value.

Stock Price

The stock opened at $12.0, and despite closing the day at $11.8, it still represented a 3.0% decrease from the prior closing price of 12.2. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PK. More…

| Total Revenues | Net Income | Net Margin |

| 2.5k | 162 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PK. More…

| Operations | Investing | Financing |

| 409 | 87 | -320 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.73k | 5.44k | 19.37 |

Key Ratios Snapshot

Some of the financial key ratios for PK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 11.6% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – PK Intrinsic Value Calculator

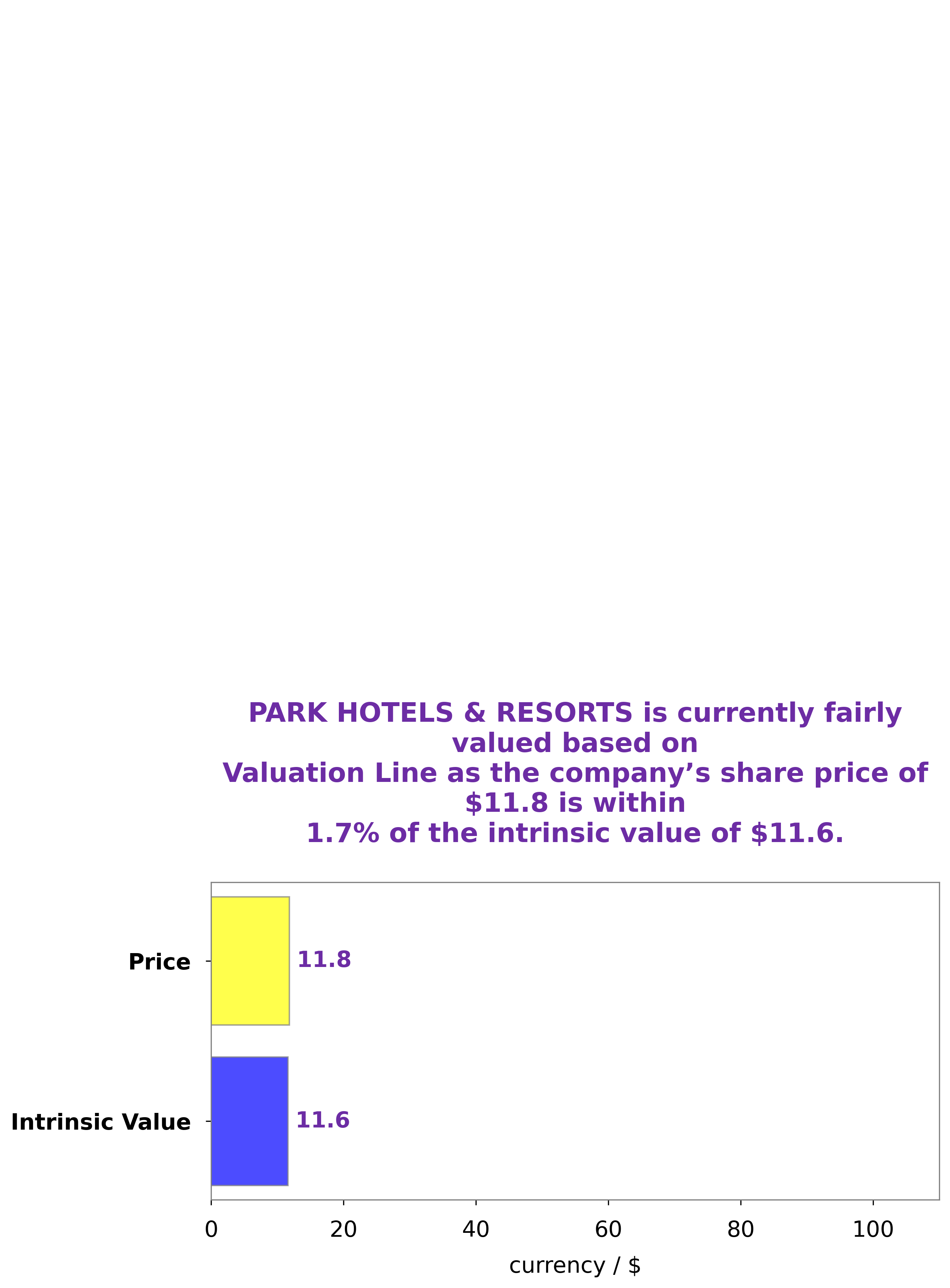

At GoodWhale, we have conducted an in-depth analysis of PARK HOTELS & RESORTS fundamentals and our proprietary Valuation Line has determined that the fair value of PARK HOTELS & RESORTS share is around $11.6. Currently, the stock is being traded at $11.8, which is a fair price that is slightly overvalued by 1.6%. More…

Peers

The company’s portfolio includes Marriott, Hilton, Hyatt, and Intercontinental hotels. Park Hotels & Resorts Inc’s competitors include Apple Hospitality REIT Inc, Ryman Hospitality Properties Inc, Pebblebrook Hotel Trust.

– Apple Hospitality REIT Inc ($NYSE:APLE)

Apple Hospitality REIT Inc. is a real estate investment trust (REIT) that owns and operates a portfolio of upscale, select-service hotels located in the United States. As of December 31, 2020, the Company’s portfolio consisted of 235 hotels with approximately 30,000 guest rooms.

– Ryman Hospitality Properties Inc ($NYSE:RHP)

Ryman Hospitality Properties Inc is a real estate investment trust that owns, operates, and develops hotels and resorts in the United States. The company has a market cap of 4.68B as of 2022. Ryman Hospitality Properties Inc was founded in 1994 and is headquartered in Nashville, Tennessee.

– Pebblebrook Hotel Trust ($NYSE:PEB)

Pebblebrook Hotel Trust is a real estate investment trust that owns and invests in hotels. The company has a market cap of 2.07B as of 2022. Pebblebrook Hotel Trust is headquartered in Bethesda, Maryland, and was founded in 2009. The company focuses on investing in hotel properties located in major urban markets in the United States.

Summary

Investors of Park Hotels & Resorts Inc. can expect to see a large return on their investments. Unfortunately, the stock price moved down the same day, so investors may want to consider researching further before investing to maximize their return. Park Hotels & Resorts Inc. does show potential as a profitable investment, but investors should make sure to consider all the factors before making their decisions.

Recent Posts