Pilgrim’s Pride Intrinsic Value – Pilgrim’s Pride: Too Risky for Long-Term Investment

June 2, 2023

☀️Trending News

Pilgrim’s Pride ($NASDAQ:PPC) is a poultry producer and processor based in the United States that has been subject to a great deal of volatility in recent years. As such, it may not be the best choice for long-term investors who are looking to benefit from a steady stream of income. Despite the attractive dividends that the company offers, its stock price has been highly volatile. This makes it an unreliable option for those who are seeking to build long-term wealth. This rollercoaster pattern of price movements has caused great uncertainty and made it difficult for investors to accurately assess the company’s value.

Additionally, the highly competitive nature of the poultry market has put Pilgrim’s Pride at a disadvantage. As a result, their profit margins have been slim and their overall financial performance has been sub-par. For these reasons, Pilgrim’s Pride may not be the most attractive option for those looking to invest for the long-term. The company’s stock is prone to sudden swings that can quickly erode its value and make it a risky bet. Investors should be aware of the risks associated with investing in Pilgrim’s Pride and should conduct their own due diligence before making any decisions.

Stock Price

Pilgrim’s Pride (PPC) has been on a downward spiral lately, with Thursday’s closing price of $22.0 representing a 0.8% drop from its previous close of $22.2. This demonstrates that at the moment, PPC is not a safe long-term investment option. With its stock price continuing to trend downwards, it is highly likely that the return on investment will be poor in the long run.

Furthermore, with stock prices continuing to decrease on a daily basis, it is unlikely that PPC will show a substantial upside in the near future. Overall, it is prudent to steer clear of investing in Pilgrim’s Pride for the time being. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pilgrim’s Pride. More…

| Total Revenues | Net Income | Net Margin |

| 17.39k | 470.68 | 3.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pilgrim’s Pride. More…

| Operations | Investing | Financing |

| 281.16 | -477.15 | -371.46 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pilgrim’s Pride. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.23k | 6.32k | 12.22 |

Key Ratios Snapshot

Some of the financial key ratios for Pilgrim’s Pride are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.9% | 9.8% | 4.7% |

| FCF Margin | ROE | ROA |

| -1.5% | 18.0% | 5.6% |

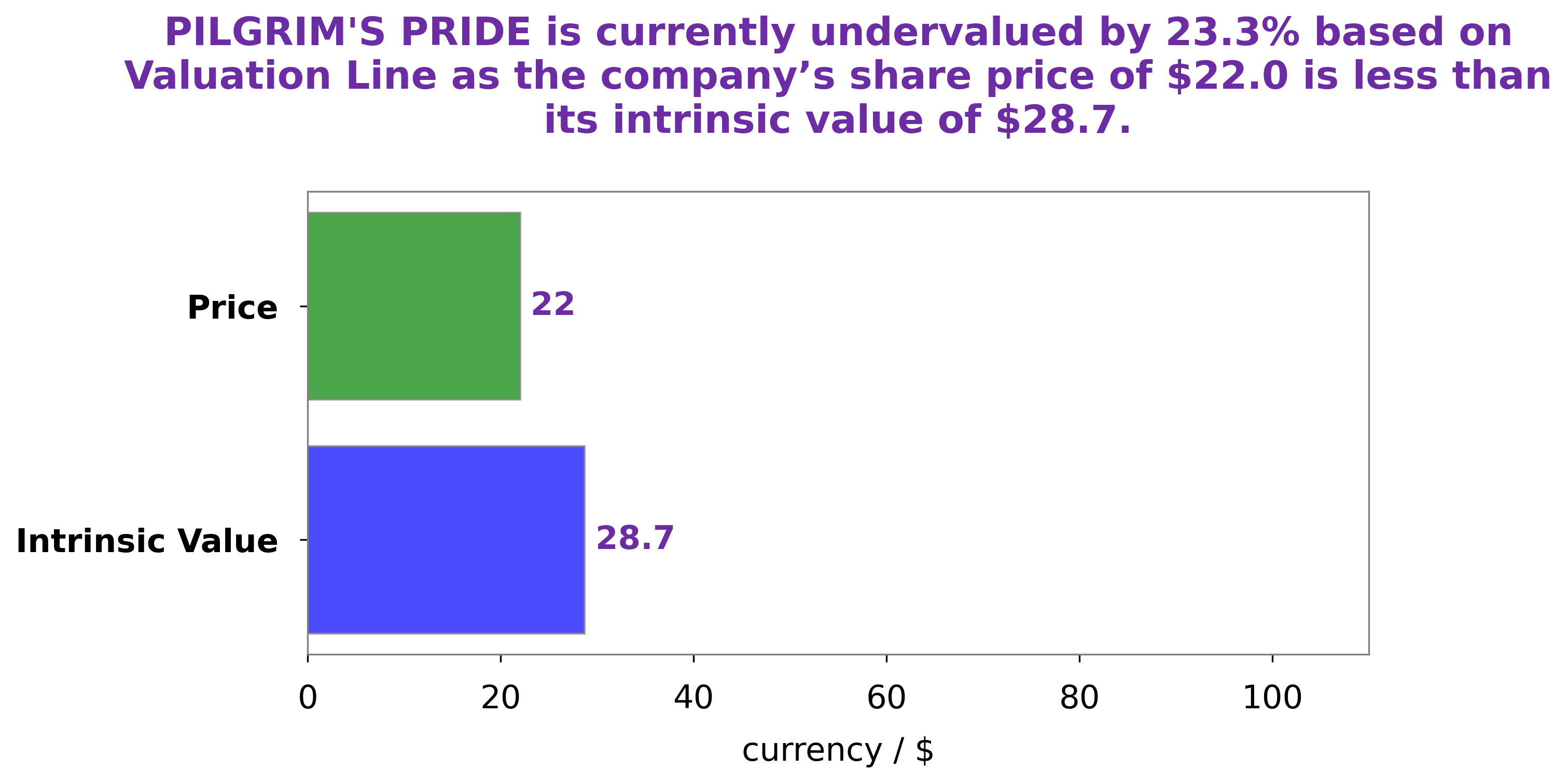

Analysis – Pilgrim’s Pride Intrinsic Value

At GoodWhale, we have analyzed PILGRIM’S PRIDE‘s fundamentals and found that its fair value is around $28.7. This calculation has been done using our proprietary Valuation Line which takes into account the company’s financials, economic environment, and risk profile. At the moment, PILGRIM’S PRIDE shares are trading at $22.0, which is 23.4% below its fair value. This presents an opportunity for investors to buy in at a discounted price relative to its true worth. More…

Peers

The company has been in business for over 70 years and has a long history of success.

– Beyond Meat Inc ($NASDAQ:BYND)

As of 2022, Beyond Meat Inc has a market capitalization of 857.33 million and a return on equity of 238.68%. The company produces plant-based meat substitutes. Its products are designed to have the same taste and texture as animal-based meat products, but are made from plant-based ingredients. The company’s products are sold in major grocery stores and restaurants in the United States and Canada.

– JM Smucker Co ($NYSE:SJM)

The J. M. Smucker Company has a market capitalization of $15.57 billion as of March 2022 and a return on equity of 7.19%. The company manufactures and markets food and beverage products, including coffee, peanut butter, shortening and oils, jams, jellies, and fruit spreads, pancake mixes, syrups, frozen sandwiches, frozen biscuits and pies, cereal and snack bars, and pet food and pet snacks.

– Conagra Brands Inc ($NYSE:CAG)

Conagra Brands Inc is a food company with a focus on packaged food. The company has a market cap of 17.23B as of 2022 and a return on equity of 7.38%. Conagra Brands Inc is a food company that manufactures and markets packaged food products. The company operates in two segments, Consumer Foods and Commercial Foods.

Summary

Pilgrim’s Pride Corporation is a poultry producing company based in the United States. According to an investment analysis, the company’s stock is still not trading at a price that would justify long-term investing. It is currently trading at a high level of price-to-earnings and price-to-book valuations relative to its peers, and its return on equity is relatively low.

In addition, the company’s debt levels are higher than what is seen in other poultry producers, leading to a worrisome level of financial leverage. This increases the risk associated with investing in Pilgrim’s Pride for the long-term.

Recent Posts