Penn Entertainment Intrinsic Stock Value – PENN Entertainment Shares Dip 0.30% in Mixed Trading Session

June 12, 2023

☀️Trending News

PENN ($NASDAQ:PENN) Entertainment Inc.’s shares experienced a 0.30% decrease to $26.56 during Wednesday’s trading session. This was amid an overall mixed trading day for the stock market, which saw a mix of both positive and negative movements taking place. PENN Entertainment Inc. is a publicly traded media and entertainment company that produces film, television, recorded music, and digital content. It is dedicated to delivering entertaining experiences across a wide variety of platforms, including streaming services, theatrical releases, television networks, and various other platforms. The company has a portfolio of established and emerging brands that are committed to creating and delivering exceptional content to its fans and viewers worldwide.

Analysis – Penn Entertainment Intrinsic Stock Value

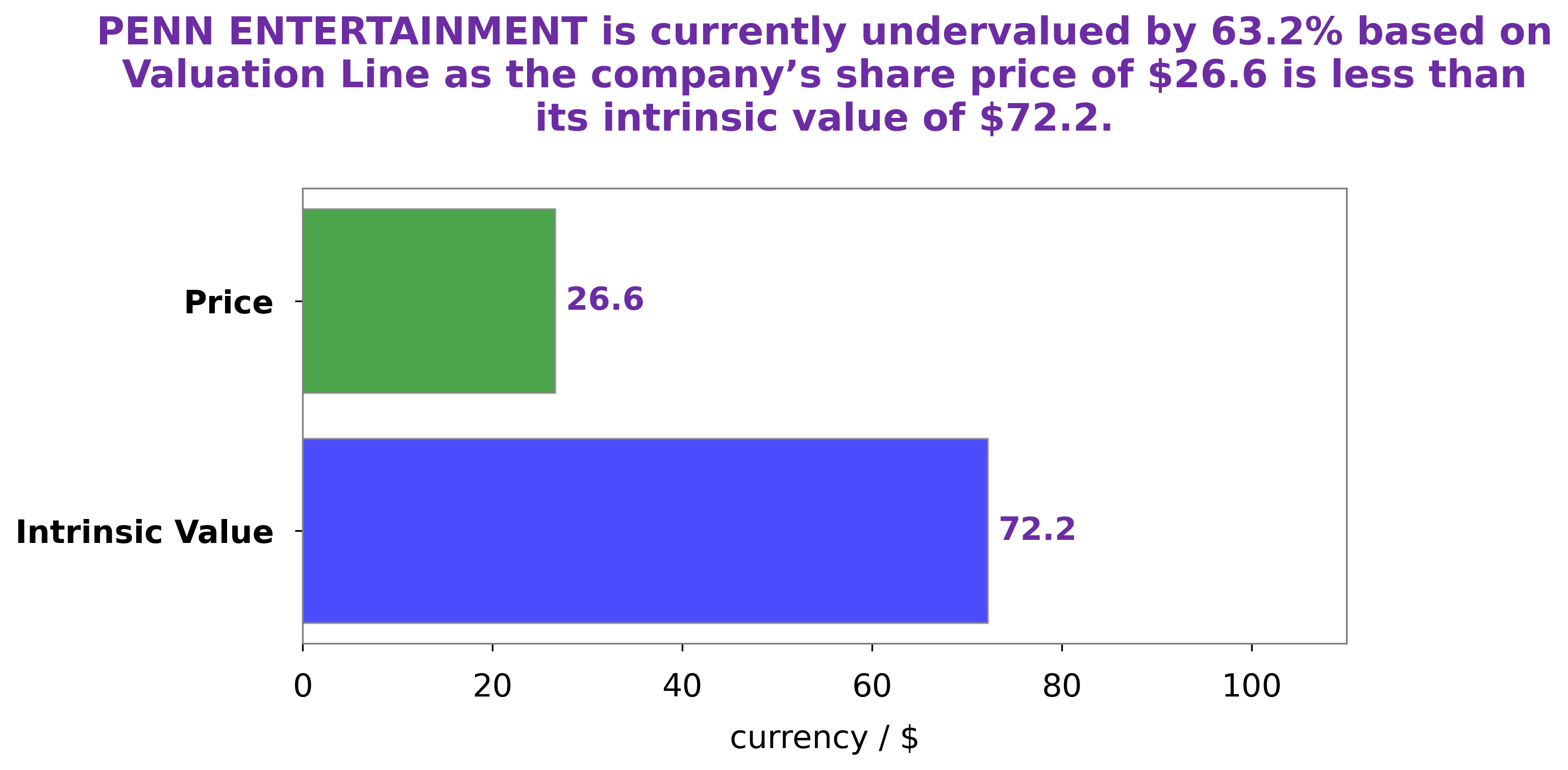

At GoodWhale, we have conducted an analysis of PENN ENTERTAINMENT‘s wellbeing. Based on our proprietary Valuation Line, our team has determined that the fair value of PENN ENTERTAINMENT share is around $72.2. However, PENN ENTERTAINMENT stock is currently being traded at $26.6, which is significantly lower than what we believe to be the fair value, making it over 63.2% undervalued. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Penn Entertainment. More…

| Total Revenues | Net Income | Net Margin |

| 6.51k | 684 | 4.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Penn Entertainment. More…

| Operations | Investing | Financing |

| 878.2 | -258.6 | -853 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Penn Entertainment. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.5k | 13.91k | 23.25 |

Key Ratios Snapshot

Some of the financial key ratios for Penn Entertainment are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.2% | 17.4% | 22.6% |

| FCF Margin | ROE | ROA |

| 9.3% | 25.5% | 5.2% |

Peers

The company has its headquarters in Wyomissing, Pennsylvania. Penn National Gaming Inc operates in the following segments: Gaming, Racing, and Hospitality. The company operates gaming facilities in Pennsylvania, Ohio, Louisiana, Illinois, Mississippi, and Maryland. The company was founded in 1969 and it employs around 26,000 people. Penn National Gaming Inc’s main competitors are DraftKings Inc, Caesars Entertainment Inc, and Boyd Gaming Corp. These companies are all gaming companies that operate in the United States.

– DraftKings Inc ($NASDAQ:DKNG)

DraftKings Inc is a digital sports entertainment and gaming company. It operates through two segments, Digital Sports and Gaming Platform, and Media Platform. The company was founded in 2012 and is headquartered in Boston, Massachusetts.

DraftKings Inc’s market cap is 5.93B as of 2022. The company has a Return on Equity of -105.71%.

DraftKings Inc operates a digital sports entertainment and gaming platform. The company offers daily fantasy sports, sports betting, and online gaming products. DraftKings Inc also operates a media platform that provides content and data products.

– Caesars Entertainment Inc ($NASDAQ:CZR)

Caesars Entertainment Inc is a gaming company that owns and operates casinos and resorts. As of 2022, the company has a market capitalization of 8.49 billion dollars and a return on equity of 19.66%. The company’s casinos are located in the United States, Canada, the United Kingdom, and Macau. The company’s resorts offer a variety of gaming, lodging, dining, entertainment, and retail options.

– Boyd Gaming Corp ($NYSE:BYD)

Boyd Gaming Corporation is an American gaming and hospitality company based in Las Vegas, Nevada. The company continues to be run by the Boyd family under the management of Sam Boyd, who founded the company in 1975. The company owns and operates 22 gaming properties in seven states. Boyd Gaming is the largest operator of casinos in Louisiana.

The company’s market cap is 5.71B as of 2022 and its ROE is 35.86%. The company operates 22 gaming properties in seven states and is the largest operator of casinos in Louisiana.

Summary

Investors in PENN Entertainment Inc. saw mixed results on Wednesday, as the stock price slipped 0.30% to $26.56. Despite the decline, the long-term outlook for the company remains positive. Analysts suggest that the company has ample prospects for growth, as there is currently strong demand for media and entertainment services. Investors should monitor the company closely for future developments and make informed decisions about when to buy or sell shares.

Recent Posts