Pearson Plc Stock Fair Value – UBS Group AG Increases Holdings in Shares of Pearson plc by 0.4% in 4th Quarter

June 4, 2023

☀️Trending News

Pearson ($LSE:PSON) plc is a British multinational publishing and education company based in London. UBS Group AG recently increased its ownership of Pearson plc shares by 0.4% during the fourth quarter, as indicated in the 13F filing submitted to the Securities & Exchange Commission. It is likely that UBS Group AG will continue to increase their holdings in Pearson going forward, especially given the company’s strong performance this past quarter. At present, Pearson plc appears to have a promising future ahead, with its stock price continuing to rise and its services being utilized by a growing number of customers.

This trend is likely to continue, especially as the company continues to expand its portfolio of services and products. As such, UBS Group AG’s increase in ownership of Pearson plc is likely to be a profitable endeavor for them going forward.

Analysis – Pearson Plc Stock Fair Value

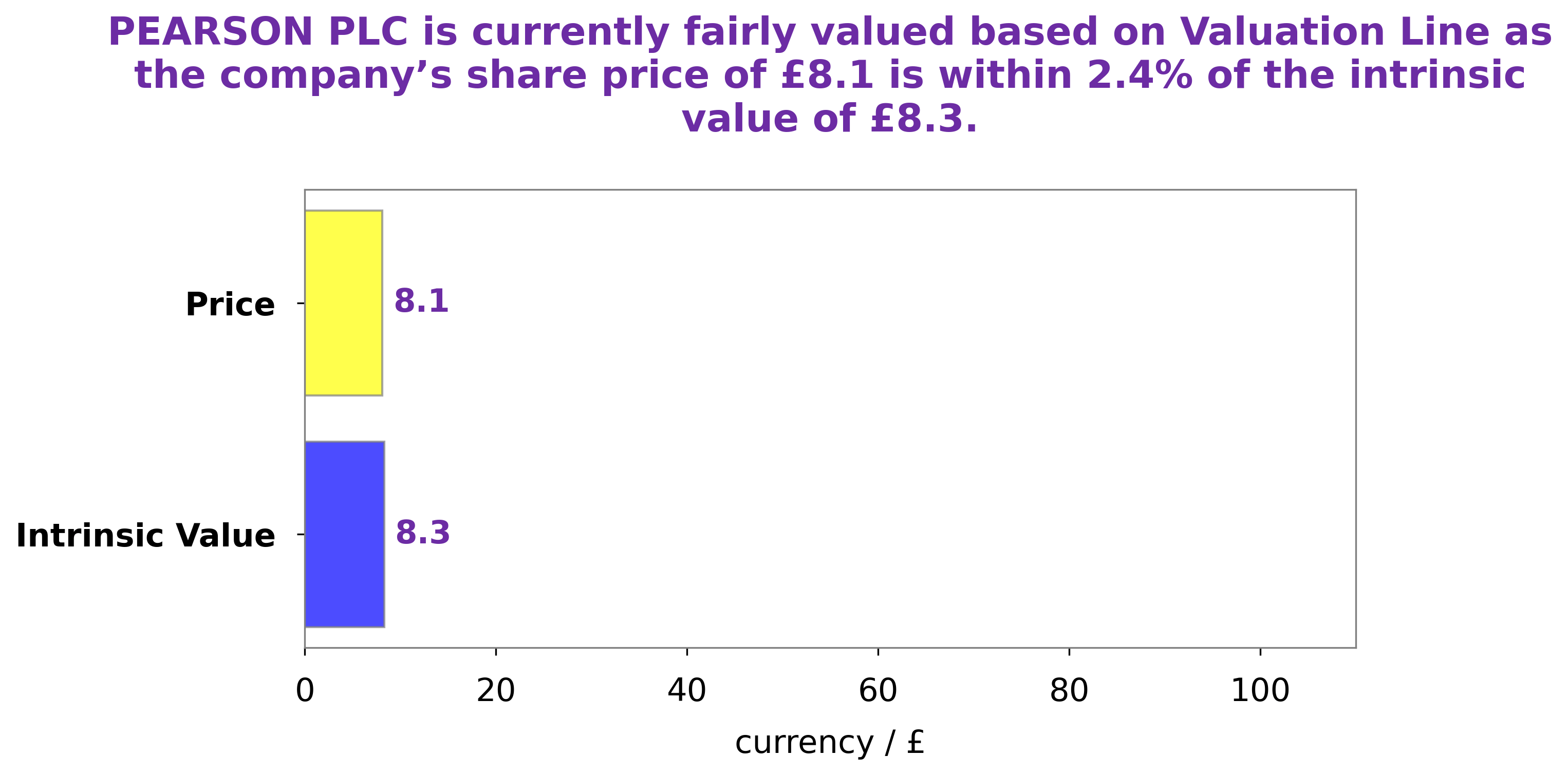

At GoodWhale, we have conducted a detailed analysis of PEARSON PLC‘s financials. According to our proprietary Valuation Line, the fair value of PEARSON PLC share is around £8.3. However, the stock is currently traded at £8.1, which implies that it is undervalued by 2.1%. Therefore, this presents an attractive opportunity for investors. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pearson Plc. More…

| Total Revenues | Net Income | Net Margin |

| 3.84k | 242 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pearson Plc. More…

| Operations | Investing | Financing |

| 361 | 13 | -804 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pearson Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.31k | 2.89k | 6.15 |

Key Ratios Snapshot

Some of the financial key ratios for Pearson Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.2% | -12.1% | 10.2% |

| FCF Margin | ROE | ROA |

| 5.6% | 5.5% | 3.4% |

Peers

It is the largest education company in the world and was founded in 1844. The company is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. Its competitors include John Wiley & Sons Inc, Visang Education Inc, Sasbadi Holdings Bhd.

– John Wiley & Sons Inc ($NYSE:WLY)

Wiley is a global provider of knowledge and knowledge-enabled services that improve outcomes in areas of research, professional practice, and education. Through the Research segment, the company provides digital and print scientific, technical, medical, and scholarly journals, reference works, books, database services, and advertising. The Professional Development segment offers digital and print books, online assessment and training services, and education solutions in areas including accounting, finance, architecture, engineering, computing, nursing, and education. Wiley also serves the needs of individuals and institutions through the Education segment, which provides online program management services for higher education institutions and courses, as well as print and digital content and learning solutions for students and educators worldwide.

– Visang Education Inc ($KOSE:100220)

Visang Education Inc has a market cap of 72.28B as of 2022, a Return on Equity of 22.75%. The company is a provider of online education services in China. It offers a range of services, including online tutoring, test preparation, and consulting services. The company was founded in 2003 and is headquartered in Beijing, China.

– Sasbadi Holdings Bhd ($KLSE:5252)

Sasbadi Holdings Bhd is a Malaysia-based company engaged in the business of investment holding and the provision of management services. The Company’s segments include Publishing, which is engaged in the publication of educational books and marketing of learning aids; Property, which is engaged in property development and investment, and Others, which includes provision of ICT products and services, and manufacturing and trading of stationery.

Summary

Investors have been looking closely at Pearson PLC, with UBS Group AG increasing its holdings by 0.4% during the fourth quarter. Analysts have noted that the company has had a strong financial performance over the last few quarters, with its revenue increasing year-over-year. While there are risks associated with investing in Pearson, analysts believe that it is a worthwhile opportunity for investors who are looking for a reliable and stable company with strong fundamentals.

Recent Posts