Oge Energy Intrinsic Value – B.O.S.S. Retirement Advisors LLC Invests in OGE Energy Corp

May 5, 2023

Trending News ☀️

B.O.S.S. Retirement Advisors LLC has recently made a major investment in OGE ($NYSE:OGE) Energy Corp’s shares. This investment is seen as a significant addition to their portfolio, as OGE Energy Corp is one of the leading providers of electricity and natural gas in the United States. They have operations in Oklahoma and Arkansas, and are part of the larger OGE Energy Corp family that also operates in Texas and New Mexico. Through their subsidiaries, OGE Energy Corp generates, transmits, distributes, and sells electricity and natural gas to over 8 million customers across the four states.

Their commitment to sustainability and renewable energy solutions has established them as a leader in the energy sector. B.O.S.S. Retirement Advisors LLC’s investment in their shares is both a testament to their success and a major endorsement of their future prospects. With this new investment, OGE Energy Corp is well-positioned for continued growth and success.

Price History

OGE Energy Corp stock opened at $37.4 and closed at the same price, down by 0.3% from the prior closing price of $37.5. This slight decrease in stock price was not enough to deter B.O.S.S. Retirement Advisors LLC from making their investment, likely due to its long-term potential. OGE Energy Corp primarily engages in the generating, purchasing, transporting, and distributing of electricity in Arkansas, Oklahoma, and Texas. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Oge Energy. More…

| Total Revenues | Net Income | Net Margin |

| 3.38k | 665.7 | 19.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Oge Energy. More…

| Operations | Investing | Financing |

| 843.1 | 12.9 | -767.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Oge Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.54k | 8.13k | 22.18 |

Key Ratios Snapshot

Some of the financial key ratios for Oge Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.8% | 8.8% | 28.3% |

| FCF Margin | ROE | ROA |

| -6.2% | 13.5% | 4.8% |

Analysis – Oge Energy Intrinsic Value

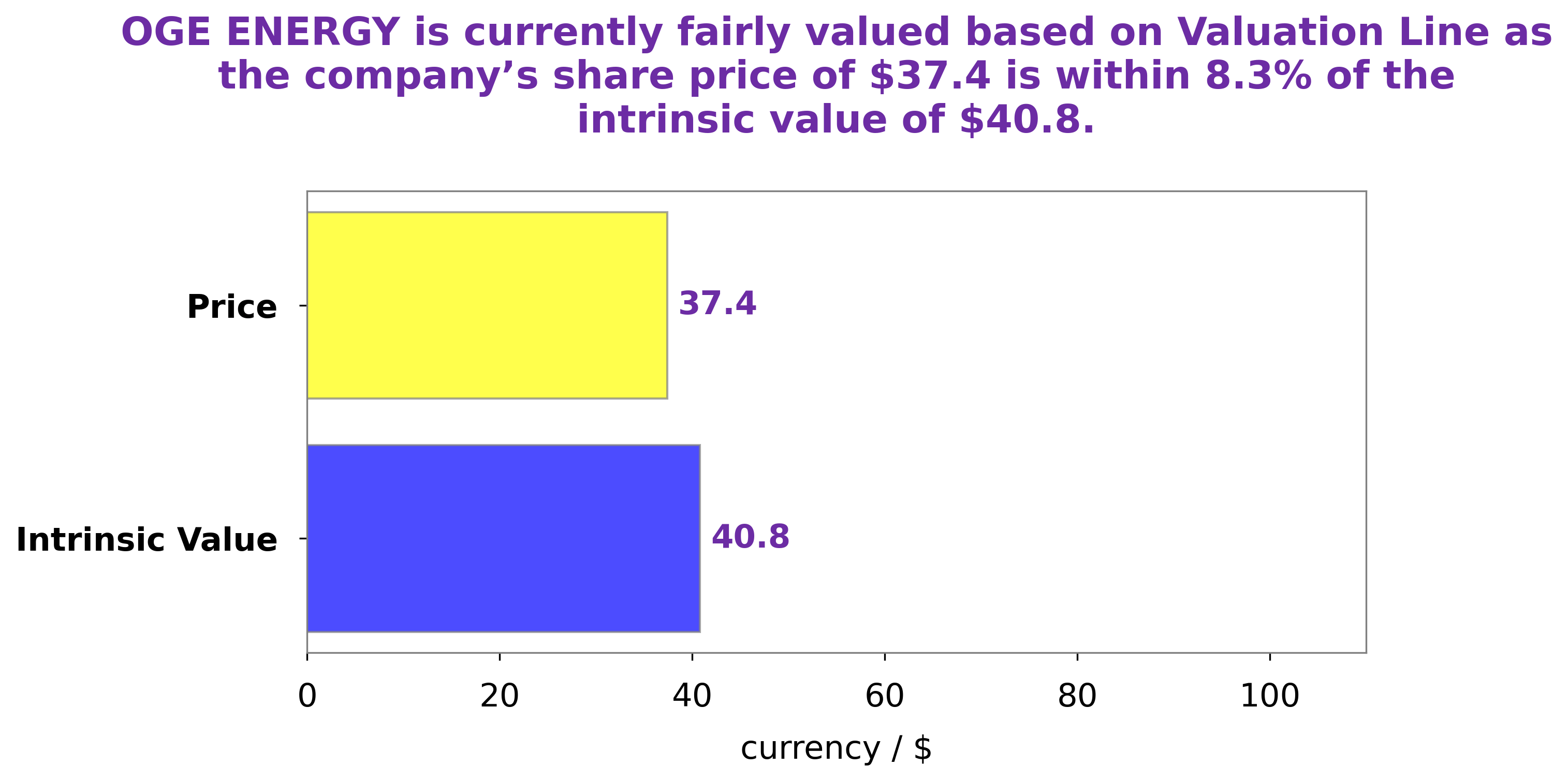

At GoodWhale, we have conducted an in-depth analysis of OGE ENERGY‘s fundamentals. Our proprietary Valuation Line has calculated the fair value of the OGE ENERGY share to be around $40.8. Currently, the OGE ENERGY stock is trading at $37.4, which is a fair price but is undervalued by 8.2%. This provides an opportunity to invest in the stock at an attractive rate. However, as with any investment, we urge investors to conduct thorough research before investing in the stock. More…

Peers

In the electric and natural gas utility industry in the United States, there are four companies that stand out as the largest competitors. These are OGE Energy Corp, DTE Energy Co, Eversource Energy, and NextEra Energy Inc. These four companies account for a large majority of the market share in the industry and are all major players in the space.

– DTE Energy Co ($NYSE:DTE)

DTE Energy Co is a holding company that engages in the utility operations through its subsidiaries. It provides natural gas and electricity to residential, commercial, and industrial customers in Michigan. The company’s segments include Electric, Gas, Gas Storage and Pipelines, Power and Industrial Projects, and Corporate and Other.

– Eversource Energy ($NYSE:ES)

Eversource Energy is an American utility company that serves electric and natural gas customers in Connecticut, Massachusetts, and New Hampshire. The company has a market cap of 26.86B as of 2022 and a return on equity of 10.13%. Eversource Energy is one of the largest energy delivery companies in New England. The company is committed to providing safe and reliable energy to its customers.

– NextEra Energy Inc ($NYSE:NEE)

NextEra Energy Inc is a clean energy company with a focus on renewable energy. The company has a market cap of 153.59B as of 2022 and a return on equity of 6.09%. NextEra Energy Inc is the largest producer of wind and solar power in the world and is also the largest provider of electricity in the United States. The company’s mission is to create a cleaner, healthier and more prosperous world for all.

Summary

OGE Energy Corp is an attractive investment opportunity for investors looking for a solid return over the long-term. The company has a strong track record of providing reliable and consistent dividends, as well as a proven history of delivering healthy returns on invested capital. They have a well-diversified portfolio of businesses, including electric and natural gas utilities, energy infrastructure, and corporate and other services.

The company is also highly efficient and has low debt, making it an attractive investment choice. B.O.S.S. Retirement Advisors LLC recently acquired shares of OGE Energy Corp, indicating their confidence in the company’s ability to provide a solid return over the long-term.

Recent Posts