NRP Intrinsic Value Calculation – Natural Resource Partners LP Stock Performance in the Thermal Coal Market

April 9, 2023

Trending News ☀️

Natural Resource Partners ($NYSE:NRP) LP (NRP) is a publicly traded limited partnership headquartered in Houston, Texas. The company has a diversified portfolio of mineral and energy-related assets, including investments in thermal coal reserves, transportation and processing facilities.

In addition, NRP has a track record of making successful investments in the energy industry as well as actively managing its assets to maximize its returns. This has been driven by strong demand for thermal coal, due to its continued use in power generation and other industries. NRP has also benefitted from its investments in other energy-related businesses such as natural gas and oil production, resulting in further increases in its stock price.

Share Price

On Friday, NRP opened at $53.0 and closed at $52.2, down by 0.3% from the previous closing price of 52.3. The lack of profits and the bearishness of the thermal coal market have been two major factors contributing to NRP’s stock performance.

In addition, news of increased environmental concerns, particularly with respect to the use of coal for energy production, has led to a decreased demand for thermal coal. NRP is being forced to adapt to the changing market conditions in order to remain competitive in the thermal coal market. The company is exploring new ways to generate revenue, including the development of renewable energy projects. In addition, NRP is making efforts to reduce their environmental footprint with more sustainable practices. While these strategies may help NRP weather the changing market conditions, their long-term success is dependent upon the overall demand for thermal coal and the ability to remain competitive. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NRP. More…

| Total Revenues | Net Income | Net Margin |

| 328.08 | 233.72 | 84.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NRP. More…

| Operations | Investing | Financing |

| 266.84 | 2.69 | -365.95 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NRP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 877.13 | 235.09 | 51.34 |

Key Ratios Snapshot

Some of the financial key ratios for NRP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.0% | 19.5% | 89.8% |

| FCF Margin | ROE | ROA |

| 81.3% | 30.2% | 21.0% |

Analysis – NRP Intrinsic Value Calculation

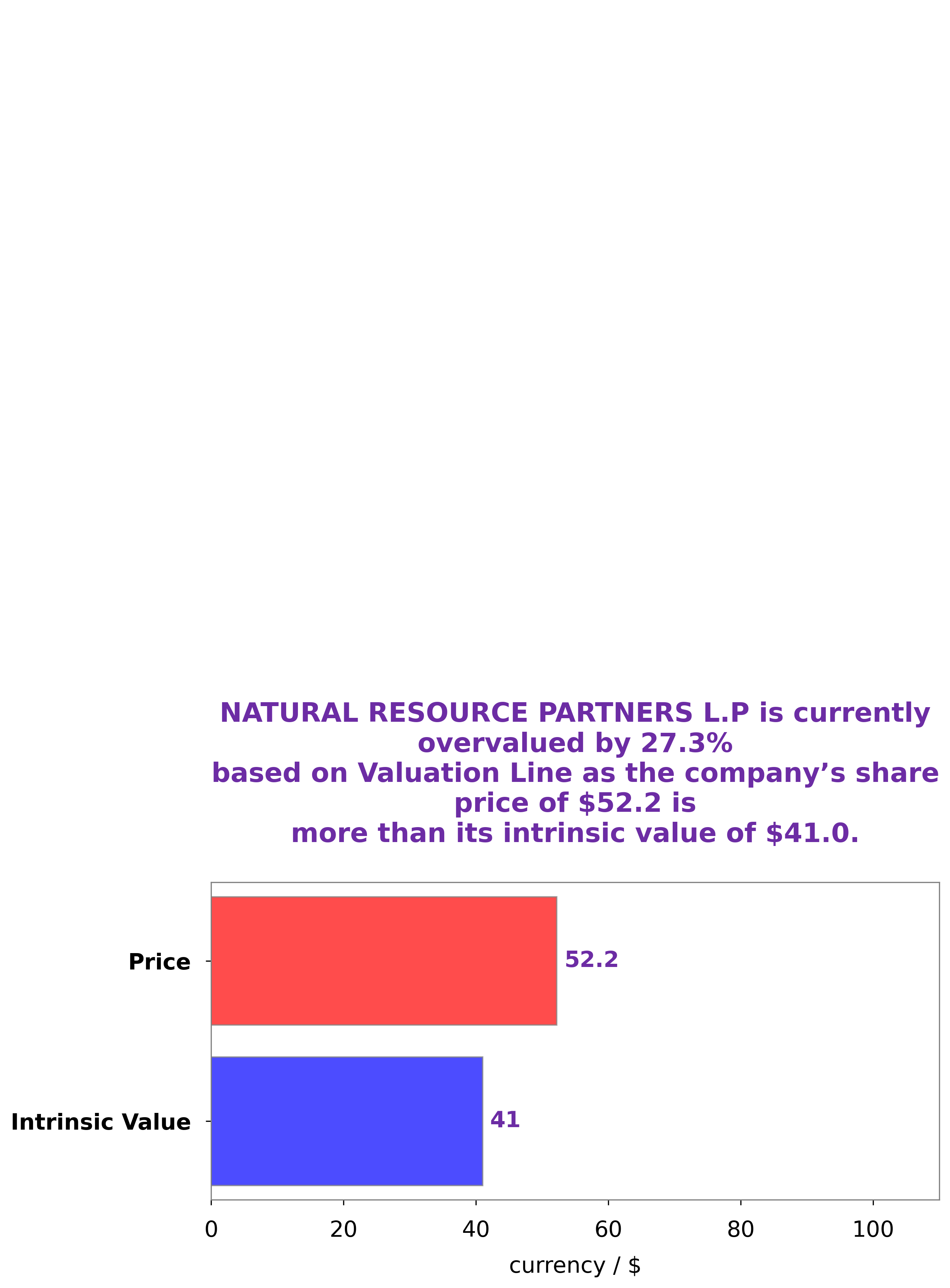

GoodWhale recently conducted an analysis of NATURAL RESOURCE PARTNERS L.P’s wellbeing and found that their intrinsic value was around $41.0. This value was calculated with our proprietary Valuation Line, which is composed of various fundamental metrics and quantitative analysis. Currently, NATURAL RESOURCE PARTNERS L.P shares are traded at $52.2, meaning that they are overvalued by 27.2%. More…

Peers

The competition between Natural Resources Partners LP and its competitors, BlackGold Natural Resources Ltd, PT Alfa Energi Investama Tbk, and Sharpe Resources Corp, is intense as they vie to become the leading natural resource partner in the global market. Each company brings its own unique set of strengths and expertise to the table, making the competition challenging and dynamic.

– BlackGold Natural Resources Ltd ($SGX:41H)

BlackGold Natural Resources Ltd is a Canadian energy company focused on developing and producing oil and gas assets in Alberta and Saskatchewan. The company has a current market cap of 6.45M as of 2023 and a Return on Equity of -4.73%. Market capitalization is a measure of the company’s overall size and is calculated by multiplying the current share price by the total number of outstanding shares. The ROE, on the other hand, measures how efficiently the company is using its shareholders’ equity to generate profits. A negative ROE indicates that the company is not generating profits, which may indicate poor management or weak market conditions.

– PT Alfa Energi Investama Tbk ($IDX:FIRE)

PT Alfa Energi Investama Tbk is an Indonesian power company that specializes in the generation, transmission, distribution, and trading of electricity. The company has a market capitalization of 172.18B as of 2023 and a Return on Equity of -18.75%. This indicates that the company’s shareholders are not seeing a return on their investments due to the company’s poor financial performance. Despite this, the company remains a major player in the Indonesian energy industry, with plans to expand its operations in the near future.

– Sharpe Resources Corp ($OTCPK:SHGP)

Sharp Resources Corp is an energy exploration and production company that operates in the US and Canada. The company has a market capitalization of $197.29k as of 2023, which is a reflection of its size and financial stability. It has a Return on Equity (ROE) of 4.55%, which shows that the company is able to efficiently use its investments to generate profits. Overall, Sharp Resources Corp is an attractive investment opportunity for investors looking for long-term growth potential.

Summary

Natural Resource Partners L.P. (NRP) is an equity-based limited partnership focused on investing in natural resources, primarily in the coal and aggregate industries. NRP has a strong balance sheet and cash flow, giving it the flexibility to make acquisitions that will further increase its presence in the thermal coal market. NRP’s investments also provide diversification as it continues to expand its portfolio of investments. The company has a solid track record of keeping costs low and returns high, making it a good option for investors looking for a sound long-term investment.

Recent Posts