Noodles Stock Fair Value Calculation – Noodles & Company’s Poor Margins & Slowing Growth Worry Investors

June 9, 2023

🌧️Trending News

Noodles ($NASDAQ:NDLS) & Company, a fast-casual restaurant chain, is worrying investors with its poor profit margins and slow growth. The company has been facing difficulties in recent years due to stiff competition from other restaurant chains in the fast-casual segment, as well as rising labor costs, which has led to a decrease in the company’s profit margins.

Additionally, the company’s expansion efforts have been largely unsuccessful, with only a few new locations being opened over the past few years. The company’s stock price has been steadily declining, which reflects the poor performance and lack of confidence in its future prospects. With such low profit margins and slow growth, investors are becoming increasingly concerned about the future of Noodles & Company.

Share Price

On Thursday, investors expressed concerns over Noodles & Company’s poor margins and slowing growth, resulting in the stock opening at $3.6 and closing at $3.4, a 5.6% drop from its last closing price of $3.6. This represents a significant decrease in investor confidence and has highlighted the lack of profitability that the company is experiencing. The company’s slowing growth and poor margin growth are alarming for investors, indicating a potential decline in the near future. Noodles & Company is operating in a highly competitive market with many competitors, and this could be a major factor in its slow rate of growth and lack of profitability.

This could account for the dip in confidence displayed by investors on Thursday. Despite this worrying news, the company is still committed to improving its margins and growing its business. With the right strategy in place, Noodles & Company could turn its fortunes around and once again become an attractive investment option for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Noodles. More…

| Total Revenues | Net Income | Net Margin |

| 523 | 0 | 0.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Noodles. More…

| Operations | Investing | Financing |

| 22.84 | -35.91 | 13.53 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Noodles. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 349.04 | 313.11 | 0.78 |

Key Ratios Snapshot

Some of the financial key ratios for Noodles are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.9% | -2.4% | 0.6% |

| FCF Margin | ROE | ROA |

| -2.5% | 5.1% | 0.5% |

Analysis – Noodles Stock Fair Value Calculation

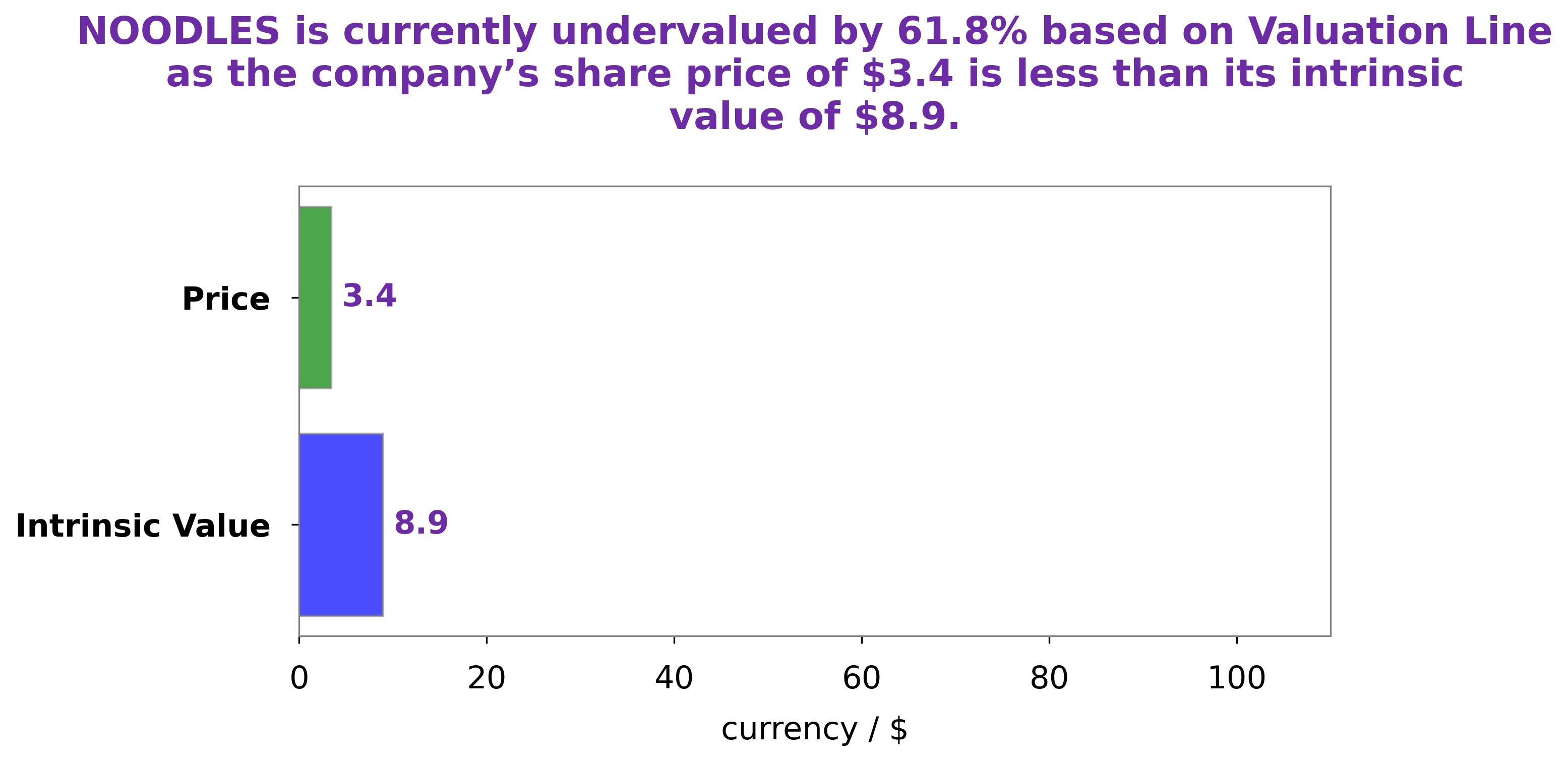

At GoodWhale, we have analyzed the wellbeing of NOODLES and have calculated the fair value of its share to be around $8.9. This calculation is based on our proprietary Valuation Line, which takes into account a variety of factors such as the company’s financials, market conditions, and industry trends. Currently, NOODLES stock is trading at $3.4, meaning that it is undervalued by 61.6%. This provides an excellent opportunity for investors who are looking for undervalued stocks with strong potential for growth. We recommend that investors take advantage of this opportunity and consider investing in NOODLES. Noodles__Companys_Poor_Margins__Slowing_Growth_Worry_Investors”>More…

Peers

The company was founded in 1995 and is headquartered in Broomfield, Colorado. Noodles & Co has over 500 locations in the United States and Canada. The company offers a variety of noodle and pasta dishes, as well as salads and sandwiches. Noodles & Co competes with Cordia Corp, PT Indo Boga Sukses Tbk, and Williston Holding Co.

– Cordia Corp ($OTCPK:CORG)

Cordia Corporation is a publicly traded company with a market capitalization of $725.5 million as of 2022. The company’s return on equity, a measure of profitability, was 66.16% for the same period. Cordia Corporation is engaged in the development and commercialization of pharmaceutical products. The company’s products include treatments for cardiovascular and central nervous system diseases, as well as cancer.

– PT Indo Boga Sukses Tbk ($IDX:IBOS)

Williston Holding Co is a publicly traded company with a market capitalization of 401.76 thousand dollars as of 2022. The company has a return on equity of 7.94%. Williston Holding Company is engaged in the business of oil and gas exploration, production, and development. The company was founded in 1954 and is headquartered in Williston, North Dakota.

Summary

The company’s gross margins have decreased significantly from the previous year, causing investors concern. Revenues have also slowed compared to the same quarter last year, with same store sales declining by 3.6%. While Noodles & Company is still in the early stages of its transformation plan, investors are becoming increasingly worried about the lack of growth and poor margins.

Despite its potential, it appears that Noodles & Company is not yet in a position to capitalize on its investments. With all of these factors in mind, this could be a risky investment for those looking to add to their portfolios.

Recent Posts