NOG Intrinsic Value Calculator – expenditures

April 20, 2023

Trending News ☀️

Northern ($NYSE:NOG) Oil and Gas (NOG) is a leading oil and gas exploration and production company focused on creating value for its shareholders. The company recently announced increased share buybacks, updated first quarter hedging and capital management activities, and increased its commitment to driving shareholder value. This program is intended to increase NOG’s liquidity and shareholder value. This strategic hedging provides NOG with certainty in the volatile market conditions. In addition to the share buyback and hedging activities, NOG has undertaken an aggressive capital management program in order to drive additional value for shareholders. This includes optimizing its capital structure and reducing its debt burden.

The company has also instituted a comprehensive budgeting process in order to prioritize resources and maximize cost efficiencies. These strategic moves by Northern Oil and Gas demonstrate the company’s commitment to driving shareholder value through various actions. The share buyback and hedging activities provide additional liquidity while the capital management activities reduce risk and optimize the company’s resources. By doing so, NOG is able to maximize its value in an increasingly volatile energy market.

Price History

Wednesday saw Northern Oil and Gas (NORTHERN OIL & GAS) stock open at $33.4 and close at $33.8, down 1.0% from the last closing price of 34.1. The company has recently taken action to increase shareholder value, through a buyback of notes and strategic hedging. By embarking on these activities, Northern Oil and Gas has hopes of minimizing exposure to volatility in the market while increasing its financial flexibility. The notes buyback is an effort by Northern Oil and Gas to reduce debt, which should improve cash flow and increase shareholder value. The company is using available funds to buy back notes at a discount, allowing them to improve their balance sheet by reducing their liabilities. Furthermore, Northern Oil and Gas is engaging in strategic hedging to provide greater protection against price movements in the commodities market. These activities should help Northern Oils and Gas to reduce risk and improve their financial performance in the long run.

In addition, Northern Oil and Gas has also made notable investments in its operations and infrastructure, which are expected to have a positive impact on the company’s financials in the future. By taking these steps to strengthen their balance sheet and reduce expenses, Northern Oil and Gas is sending a clear signal to investors that they are serious about increasing shareholder value. Overall, the recent moves by Northern Oil and Gas prove that they are committed to protecting investor interests while positioning themselves for future success. As they continue to make strategic investments and implement risk-reducing strategies, we can expect Northern Oil and Gas to remain a strong contender in the oil and gas market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NOG. More…

| Total Revenues | Net Income | Net Margin |

| 1.99k | 727.7 | 59.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NOG. More…

| Operations | Investing | Financing |

| 928.42 | -1.4k | 467.37 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NOG. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.88k | 2.13k | 8.75 |

Key Ratios Snapshot

Some of the financial key ratios for NOG are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 48.9% | 88.1% | 43.1% |

| FCF Margin | ROE | ROA |

| -21.7% | 73.6% | 18.6% |

Analysis – NOG Intrinsic Value Calculator

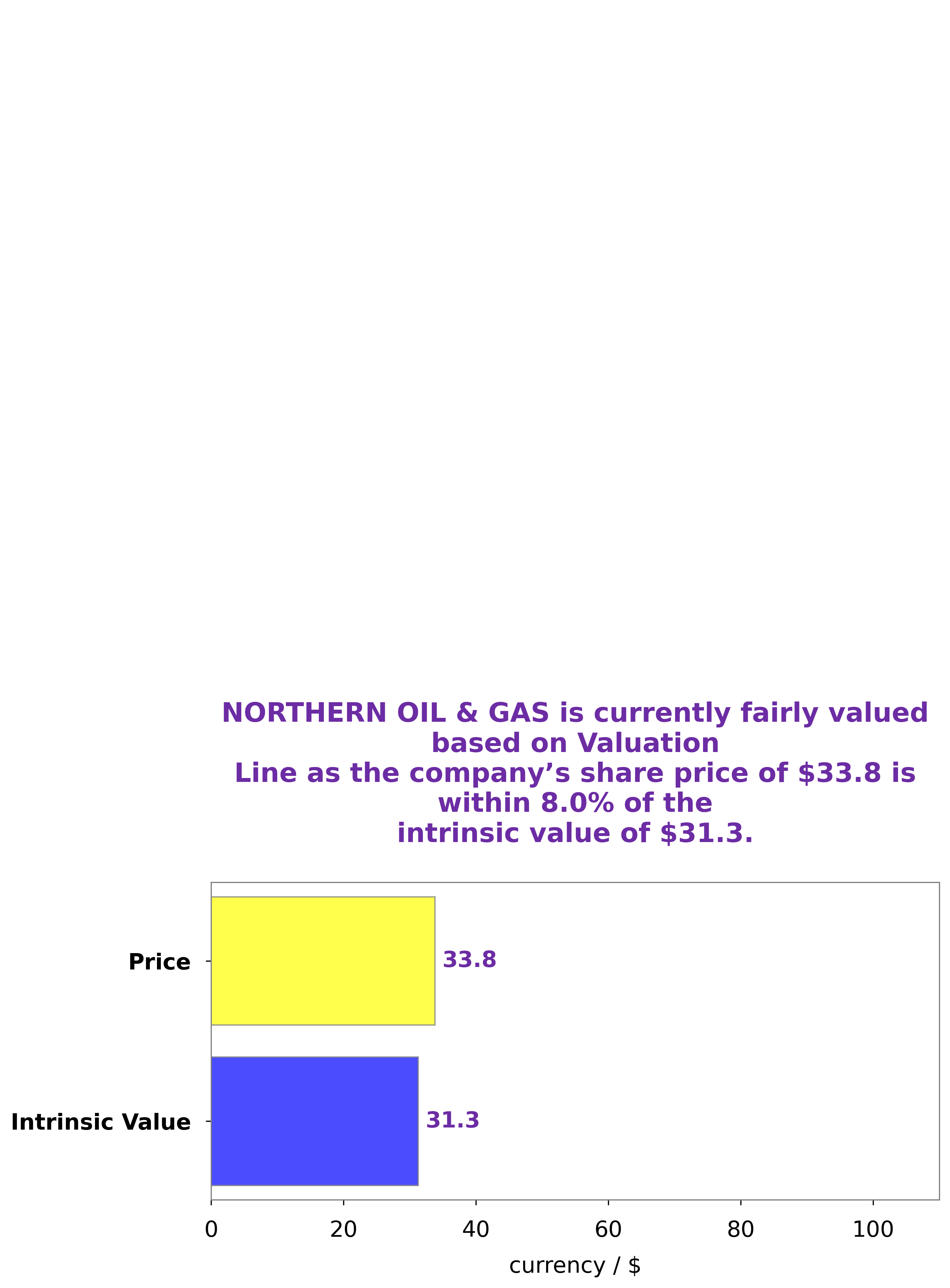

At GoodWhale, we’re committed to helping investors make informed decisions. We’ve taken a look at NORTHERN OIL & GAS’s fundamentals to provide you with a fair value of the company’s share. Our proprietary Valuation Line has determined that the fair price of NORTHERN OIL & GAS stock is around $31.3. However, the current share price is $33.8, which suggests that the stock is overvalued by 8.0%. At GoodWhale, we continue to monitor NORTHERN OIL & GAS’s financials and will update our Valuation Line as new information becomes available. More…

Peers

The company competes with Carbon Energy Corp, Earthstone Energy Inc, and Battalion Oil Corp in the highly competitive oil and gas industry.

– Carbon Energy Corp ($OTCPK:CRBO)

Carbon Energy Corp is a publicly-traded, integrated oil and gas exploration and production company headquartered in Denver, Colorado. They are focused on developing cleaner energy solutions from oil and gas resources located in the United States, Canada, and Argentina. The company has a market capitalization of 20.76k as of 2023, which represents a decrease from the previous year. Its Return on Equity (ROE) is also negative, coming in at -36.04%. This suggests that the company is not generating enough revenues to cover its costs and expenses. The company is working to improve its ROE performance by investing in more efficient and sustainable technologies and operations.

– Earthstone Energy Inc ($NYSE:ESTE)

Earthstone Energy Inc is an exploration and production company based in Texas that focuses on the development and exploitation of oil and natural gas reserves. With a market capitalisation of 1.24 billion USD as of 2023, the company has proven its resilience despite of the turbulence in the energy sector. The company has also achieved a very impressive Return on Equity of 33.04%, which is significantly higher than the industry average of 8.88%. This is a testament to the sound management employed by Earthstone Energy Inc, which has enabled it to outperform its competitors in terms of profitability.

– Battalion Oil Corp ($NYSEAM:BATL)

Battalion Oil Corp is an independent oil and natural gas company headquartered in Houston, Texas. It mainly focuses on developing and exploiting oil and natural gas properties in the Permian Basin, Mid-Continent, and Appalachian regions. Battalion Oil Corp has a market cap of 101.34M as of 2023, indicating that it is a highly valued company in the sector. Its Return on Equity (ROE) of 112.49% demonstrates that the firm is efficiently using its resources to generate profits and improve shareholder value, making it an attractive investment opportunity for investors seeking to capitalize on the favorable energy market conditions.

Summary

Northern Oil and Gas (NOG) recently announced an increase in their notes buybacks, as well as providing updates on their first quarter hedging and capital. NOG has continued to enhance their liquidity and presence in the energy market by aggressively increasing their share repurchases and making sure they are ready for any market downturns. They have also updated their hedging strategies to ensure they are well prepared for any potential volatility in the energy sector. NOG has also made strategic investments into their capital structure, positioning themselves for a strong future.

Their investments include strategic acquisitions, joint ventures, and new projects within the energy sector. As a result of these actions, NOG is well positioned to continue growing and meeting investor expectations.

Recent Posts