NNN Stock Fair Value – Secure a Generous 5.2% Yield with National Retail Properties Investment

March 31, 2023

Trending News ☀️

Investors looking for a generous yield and a stable income stream should consider National Retail Properties ($NYSE:NNN) as an investment. With a 5.2% yield and stock prices that have been on a steady rise, National Retail Properties is an ideal choice for those looking for a reliable, long-term investment. National Retail Properties, Inc. (NNN) is a publicly-traded real estate investment trust that owns and operates single-tenant retail properties throughout the United States. The company focuses on acquiring, owning and operating retail properties leased to national and regional tenants in the retail industry. As an investor in National Retail Properties, you are investing in the company’s portfolio of leased real estate assets. The company’s tenants have strong credit ratings and long-term leases that provide predictable and reliable cash flow. The company is also well diversified geographically and by tenant type, reducing the risks associated with a single tenant or location.

Additionally, National Retail Properties maintains a conservative balance sheet and has a strong track record of both generating and distributing cash to its shareholders. It is an investment that can provide a steady income stream with minimal volatility. Therefore, investors looking for an attractive yield and reliable returns would do well to consider National Retail Properties as part of their portfolio.

Market Price

On Thursday, the stock opened at $43.3 and closed at the same price, representing a 1.0% increase from last closing price of $42.9. This suggests that investors are bullish on National Retail Properties and are confident in its potential to generate consistent and reliable returns. Moreover, National Retail Properties currently offers an attractive dividend yield of 5.2%, which is one of the highest yields in the real estate sector.

This indicates that the company is committed to providing its shareholders with rewarding dividends and that it has confidence in its ability to sustain its generous dividend policy over the long-term. Given the attractive yield and increasing investor interest, National Retail Properties is an attractive investment opportunity for investors seeking a reliable source of dividend income. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NNN. More…

| Total Revenues | Net Income | Net Margin |

| 773.05 | 334.11 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NNN. More…

| Operations | Investing | Financing |

| 578.36 | -777.63 | 34.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NNN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.15k | 4.02k | 22.72 |

Key Ratios Snapshot

Some of the financial key ratios for NNN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 61.2% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – NNN Stock Fair Value

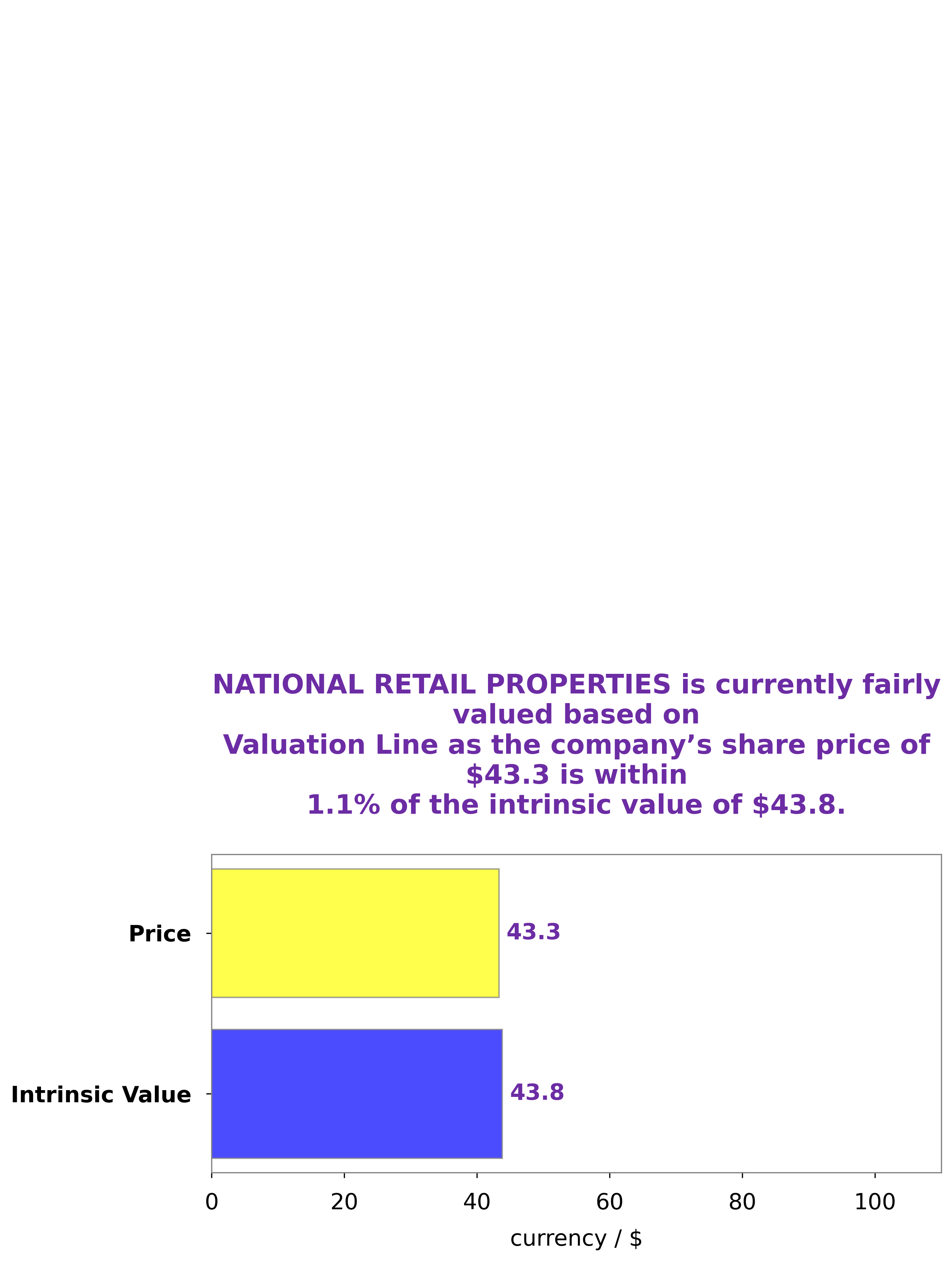

At GoodWhale, we recently performed an analysis of the wellbeing of NATIONAL RETAIL PROPERTIES. After careful assessment, our proprietary Valuation Line determined the intrinsic value of NATIONAL RETAIL PROPERTIES share to be around $43.8. We have found that currently, NATIONAL RETAIL PROPERTIES stock is being traded at a fair price of $43.3, which is slightly undervalued by 1.2%. This means that now is a good time to invest in this company, as long as you are confident with the performance of the stock in the future. More…

Peers

The company’s portfolio consists of freestanding retail properties, strip centers, neighborhood centers, and malls. National Retail Properties Inc. has a market capitalization of $8.6 billion and its stock is traded on the New York Stock Exchange. The company’s competitors include STORE Capital Corp, Realty Income Corp, and W.P. Carey Inc.

– STORE Capital Corp ($NYSE:STOR)

As of 2022, STORE Capital Corp has a market cap of 8.92B. The company is a leading provider of capital to the US middle market, with a focus on durable, service-based businesses. STORE Capital has a diversified portfolio of over 1,800 investments in 47 states, across more than 340 different industries.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation is a real estate investment trust which focuses on the ownership of commercial real estate in the United States. Its portfolio includes office buildings, retail properties, warehouses, and distribution centers. The company has a market capitalization of $35.49 billion as of 2022.

– W.P. Carey Inc ($NYSE:WPC)

W.P. Carey Inc is a publicly traded real estate investment trust (REIT) that provides financing solutions for commercial real estate owners and operators. The company has a market cap of 14.58B as of 2022. The company operates through two segments: Real Estate Ownership and Real Estate Investment Management. The Real Estate Ownership segment acquires, owns, leases, and operates commercial real estate properties. The Real Estate Investment Management segment provides investment management services to institutional and private investors.

Summary

National Retail Properties is a publicly-traded real estate investment trust that specializes in the acquisition and ownership of single-tenant retail properties throughout the United States. The company currently offers a 5.2% yield and is an attractive investment for those looking for a quality yield with an established real estate investment trust. The company has a solid history of dividend distribution and its portfolio has a high occupancy rate, leading to steady cash flows.

Furthermore, the company’s portfolio is comprised of properties in strong markets and it has an impressive balance sheet, with low debt and a strong commitment to growing its dividend over time. These factors make National Retail Properties an appealing option for investors seeking a reliable source of income and steady capital appreciation.

Recent Posts