Nine Dragons Paper Intrinsic Value Calculator – Nine Dragons Paper Limited’s Share Price Drops 3.3% on Friday, Trading as Low as $0.68

May 17, 2023

Trending News 🌥️

Nine Dragons Paper ($SEHK:02689) Limited is a Hong Kong-based corporation that manufactures and distributes packaging paper, paperboard and other products. The company is listed on the Hong Kong Stock Exchange and is one of the largest paper product manufacturers in Asia. On Friday, Nine Dragons Paper Limited’s share price dropped 3.3%, with the lowest value being $0.68 and the last trade occurring at $0.686. This drop in the stock’s value was unexpected, since many analysts had expected the stock to remain relatively stable or potentially even increase in value.

However, the downward trend in the stock’s value (which began a few weeks prior to this drop) indicates that there may be a larger underlying problem with the company. This could include financial difficulties, management issues, or other factors that have not yet been identified. Given this drop in the share price, investors may be weary of purchasing more stock in Nine Dragons Paper Limited until more information is revealed about the situation. It is important for investors to do their due diligence before investing in any company, and especially so in the case of stocks that have seen such a drastic drop in price in a very short period of time.

Analysis – Nine Dragons Paper Intrinsic Value Calculator

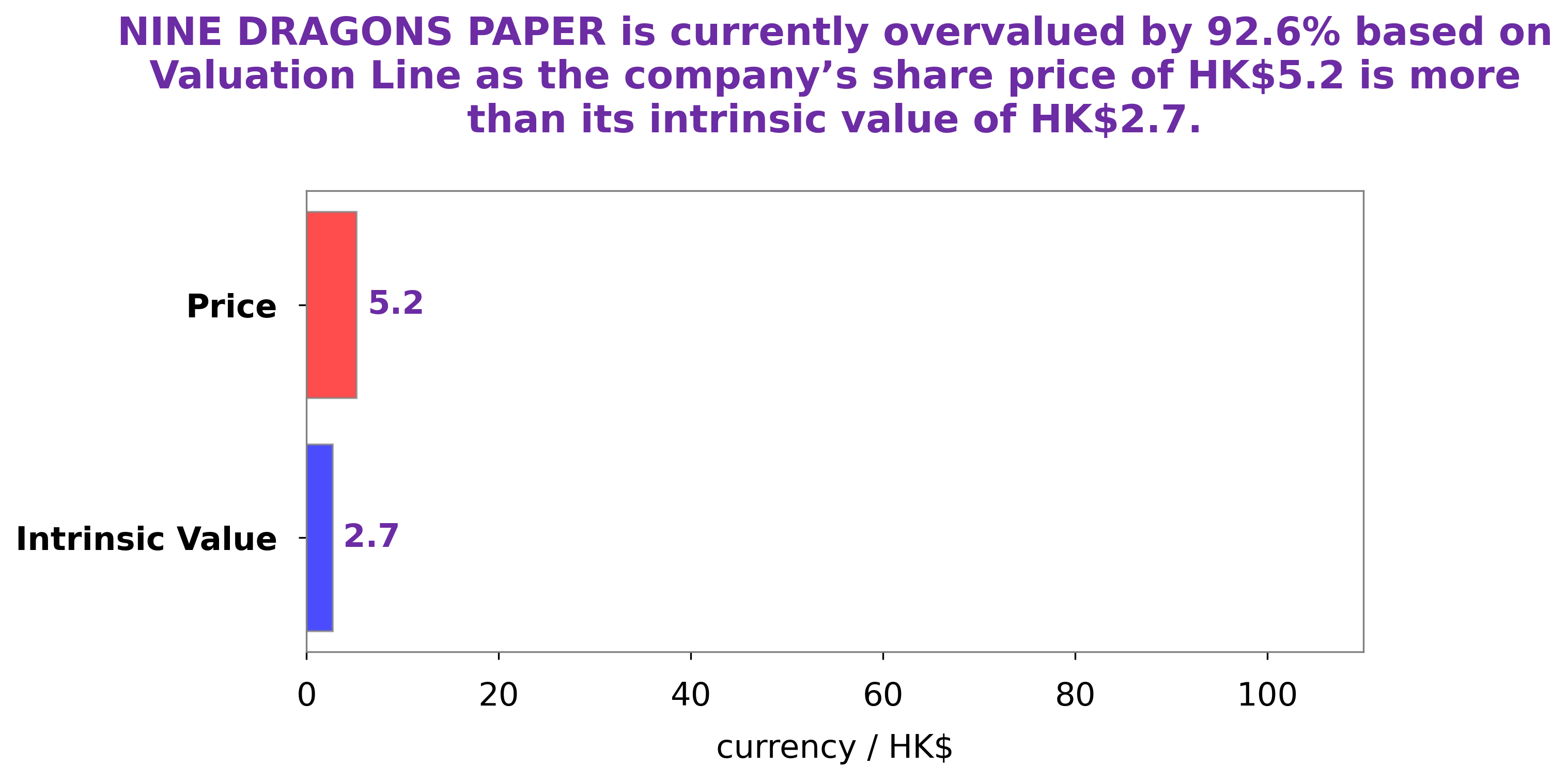

At GoodWhale, we have examined the financials of NINE DRAGONS PAPER and analyzed the data provided. Through our proprietary Valuation Line, we have determined that the fair value of NINE DRAGONS PAPER share is around HK$2.7. However, the current market price of NINE DRAGONS PAPER stock is HK$5.2 which is overvalued by 95.6%. Our analysis suggests that this could be an opportune time to buy into NINE DRAGONS PAPER. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nine Dragons Paper. More…

| Total Revenues | Net Income | Net Margin |

| 61.26k | -888.16 | -1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nine Dragons Paper. More…

| Operations | Investing | Financing |

| 2.56k | -17.2k | 14.81k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nine Dragons Paper. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 113.83k | 68.04k | 9.67 |

Key Ratios Snapshot

Some of the financial key ratios for Nine Dragons Paper are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.9% | -15.1% | 0.1% |

| FCF Margin | ROE | ROA |

| -24.4% | 0.0% | 0.0% |

Peers

Nine Dragons Paper (Holdings) Ltd is one of the world’s leading manufacturers of containerboard and paper products, operating in China and other parts of Asia. It is a public company listed on the Hong Kong Stock Exchange and is a major player in the global paper industry, competing with other international firms such as New Toyo International Holdings Ltd, Forest Packaging Group Co Ltd, and Kostenetz HHI. Through its commitment to innovation and customer service, Nine Dragons Paper (Holdings) Ltd has established itself as a powerhouse in the paper industry.

– New Toyo International Holdings Ltd ($SGX:N08)

Toyo International Holdings Ltd is an international company that specializes in the manufacturing, sales and distribution of auto parts, automotive components and related products. The company’s market cap as of 2022 stands at 94.48M USD. This indicates that the market values the company’s current and future performance highly. Toyo International Holdings Ltd also has a Return on Equity (ROE) of 6.11%, which is an indication of its strong financial performance. The ROE measures how efficiently the company can use its shareholders’ funds to generate profits. This indicates that Toyo International Holdings Ltd has been successful in utilizing its equity for generating profits.

– Forest Packaging Group Co Ltd ($SHSE:605500)

Forest Packaging Group Co Ltd is a leading packaging solutions provider in the Chinese market. With a market cap of 3.2B as of 2022, the company has been able to demonstrate a strong financial performance and a healthy return on equity of 5.02%. The company provides a wide range of products and services to meet the needs of customers, including paper and cardboard packaging solutions, corrugated boxes, plastic packaging, and other packaging materials. In addition, Forest Packaging Group also offers services such as design, printing, and packaging management. The company operates in many major cities in China, including Beijing, Shanghai, Guangzhou, and Shenzhen.

Summary

Nine Dragons Paper Limited saw a 3.3% dip in their share price on Friday. The stock traded as low as $0.68 and closed the day at that price. This could signal a bearish sentiment towards the company’s future prospects in the market. Investors should assess the company’s fundamentals such as financials, market share, operations, competitive landscape, and outlook before investing.

Analysts may also look into the company’s risk profile to gauge whether their investment is well-equipped to handle potential downside and volatility. Ultimately, investors should assess their risk tolerance and goals before making any decisions to buy, sell, or hold Nine Dragons Paper Limited shares.

Recent Posts