Nickel Industries Stock Fair Value Calculation – Private Companies Take the Heat as Nickel Industries Limited’s Market Cap Drops AU$197m Last Week

May 30, 2023

🌥️Trending News

Last week, the market cap of Nickel Industries ($ASX:NIC) Limited (NIL) dropped by a staggering AU$197m, resulting in a significant burden to be shouldered by private companies. This decrease in market capitalization serves to highlight the extent of control wielded by private entities over NIL, compared to the general public. It was founded with the goal of becoming a long-term, low-cost producer of high-grade nickel, with operations extending from Australia to North America and Africa. NIL has since grown to become one of the world’s largest nickel producers. It has a diversified portfolio of projects in Australia, North America and Africa and is listed on the Australian Securities Exchange (ASX). The company has achieved a significant level of success in recent years, with its share price increasing steadily over the past few years, even despite last week’s drop in its market cap.

NIL is committed to delivering superior shareholder returns through investing in high-grade nickel projects, and prides itself on its robust governance processes and operational risk management framework. It is also dedicated to engaging with local communities and Indigenous people in the areas where it operates, and works hard to ensure its activities are carried out responsibly. The recent decrease in the company’s market cap is a setback for NIL, but is also a stark reminder that private companies can have a major influence on market trends, especially when it comes to stock prices. Going forward, it will be important for NIL to maintain its strong commitment to responsible business practices and operational excellence in order to continue to deliver value for its shareholders.

Share Price

On Friday, Nickel Industries Limited’s market cap dropped AU$197m, resulting in private companies taking the heat. The stock opened at AU$0.8 and closed at the same price, up by 2.4% from its prior closing price. This drop in market cap has been attributed to a number of factors, such as increased competition and a decrease in demand for nickel-based products. Despite the drop in market cap, investors remain optimistic about Nickel Industries’ future, as the company continues to make strides in research and development, as well as exploring new pathways for growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nickel Industries. More…

| Total Revenues | Net Income | Net Margin |

| 1.22k | 158.98 | 13.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nickel Industries. More…

| Operations | Investing | Financing |

| 63.04 | -430.01 | 373.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nickel Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.67k | 857.98 | 0.48 |

Key Ratios Snapshot

Some of the financial key ratios for Nickel Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 165.6% | 186.5% | 20.6% |

| FCF Margin | ROE | ROA |

| 4.4% | 11.7% | 5.9% |

Analysis – Nickel Industries Stock Fair Value Calculation

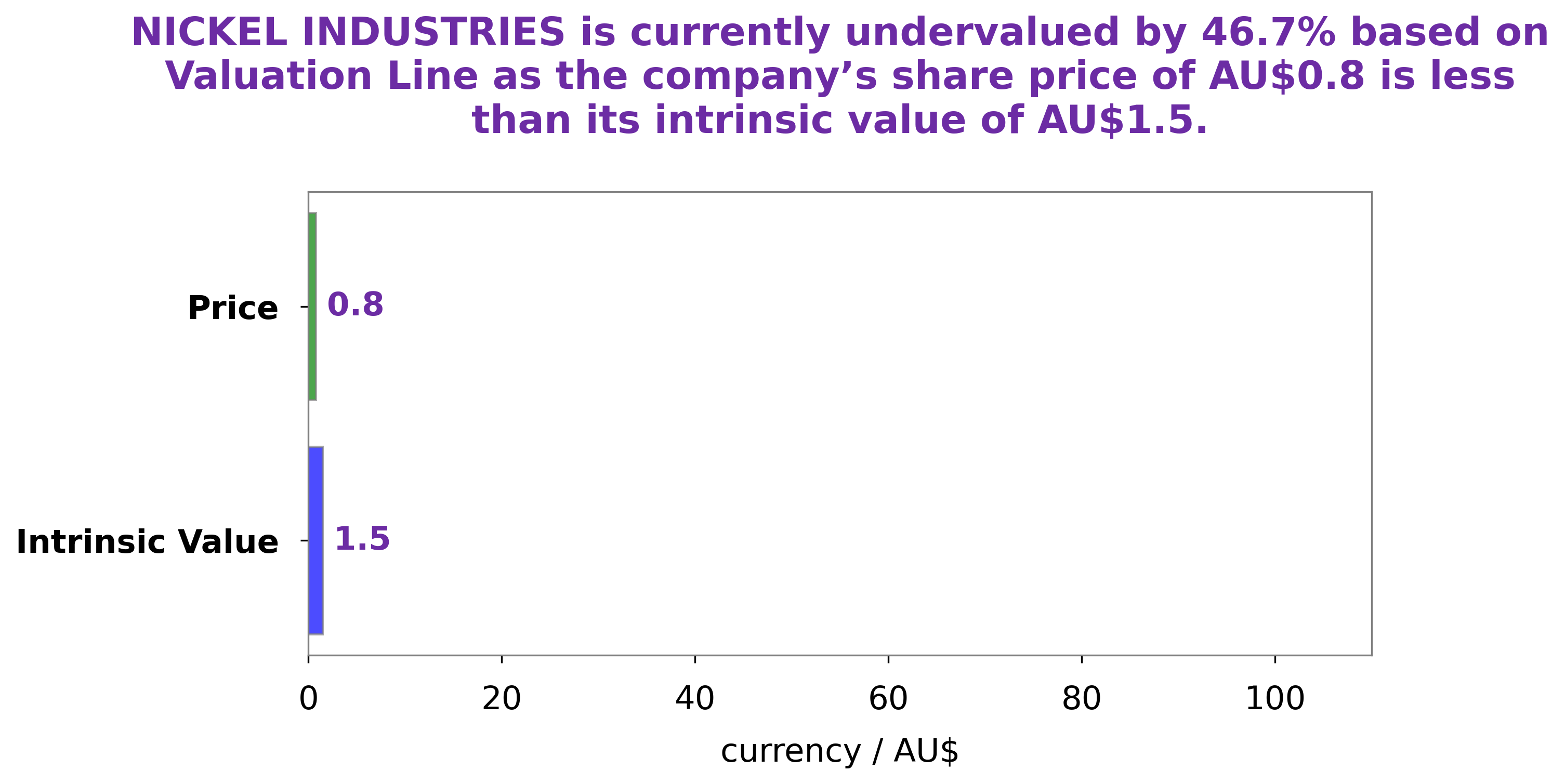

We at GoodWhale have recently conducted an analysis of NICKEL INDUSTRIES, focused on understanding the intrinsic value of the company’s wellbeing. Through our proprietary Valuation Line, we have estimated the intrinsic value of a NICKEL INDUSTRIES share to be around AU$1.5. At the time of writing, NICKEL INDUSTRIES stock is traded at AU$0.8, which is significantly lower than the AU$1.5 estimated intrinsic value. This implies that the stock is currently undervalued by 46.8%. We believe that this presents a great opportunity for investors to capitalise on the current market conditions and get in on a good deal. More…

Peers

The company’s main competitors are Elmore Ltd, Jupiter Mines Ltd, and Pantera Minerals Ltd.

– Elmore Ltd ($ASX:ELE)

Elmore Ltd is a company that focuses on providing services to the oil and gas industry. The company has a market capitalization of 25.5 million as of 2022 and a return on equity of -69.31%. The company has been facing some financial difficulties recently, which has led to its market capitalization and return on equity decreasing.

– Jupiter Mines Ltd ($ASX:JMS)

Jupiter Mines Ltd is a resource company that is engaged in the exploration, development and mining of mineral properties. The company has a market cap of 362.41M as of 2022 and a return on equity of 8.45%. The company’s main products are copper, nickel and gold. Jupiter Mines Ltd is headquartered in Perth, Australia.

Summary

Last week, Nickel Industries Limited’s market cap dropped by approximately AU$197m, with private companies suffering the most from the losses. This suggests that private companies have a considerable amount of control over the company, meaning the general public has limited influence on its performance. Investors should consider the implications of such a large drop in market capitalization when researching this company.

They should also be aware that private companies may be able to sway the company’s stock prices more easily due to their influence over Nickel Industries. It is important to evaluate all available data carefully before investing in Nickel Industries.

Recent Posts