Mueller Industries Stock Intrinsic Value – Mueller Industries’ Share Price Surpasses 200-Day Moving Average of $39.83

December 19, 2023

☀️Trending News

Mueller Industries ($NYSE:MLI), Inc. is a leading global manufacturer of copper, brass, plastic, and aluminum products for a wide variety of industrial applications. Their stock recently surged above the 200-day moving average of $39.83, indicating a major shift in investor sentiment towards the company. This is a major milestone for the company, since breakouts above long-term moving averages are often seen as a sign of strength and an increase in share price over time. The strong performance of Mueller Industries’ stock is likely due to the company’s success in expanding its product lines and further diversifying its customer base.

In addition, the company’s recent strategic acquisitions have enabled it to broaden its portfolio of products and services, allowing it to tap into a larger customer base. Investors are also likely encouraged by the company’s solid financial performance in recent quarters, with revenue growth and improved margins driving a steady rise in profitability. Overall, Mueller Industries’ share price surpassing its 200-day moving average signals a strong outlook for the company and its prospects for further growth. With a range of well-positioned products, strategic acquisitions, and solid financial results, Mueller Industries appears to be well-positioned to capitalize on the opportunities ahead.

Price History

Mueller Industries‘ stock price surpassed a 200-day moving average of $39.83 on Wednesday when the company opened at $41.1 and closed at $40.8, up by 0.6% from the prior closing price of 40.6. The 200-day moving average is considered to be an important benchmark in measuring stock performance and investor sentiment in the market. The surge in Mueller Industries’ share price is a positive sign that investor sentiment is recovering and that the company is in a good position to capitalize on future growth opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mueller Industries. More…

| Total Revenues | Net Income | Net Margin |

| 3.57k | 622.57 | 16.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mueller Industries. More…

| Operations | Investing | Financing |

| 705.52 | -131.62 | -100.36 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mueller Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.66k | 412.51 | 19.57 |

Key Ratios Snapshot

Some of the financial key ratios for Mueller Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.3% | 57.2% | 24.0% |

| FCF Margin | ROE | ROA |

| 18.5% | 24.6% | 20.0% |

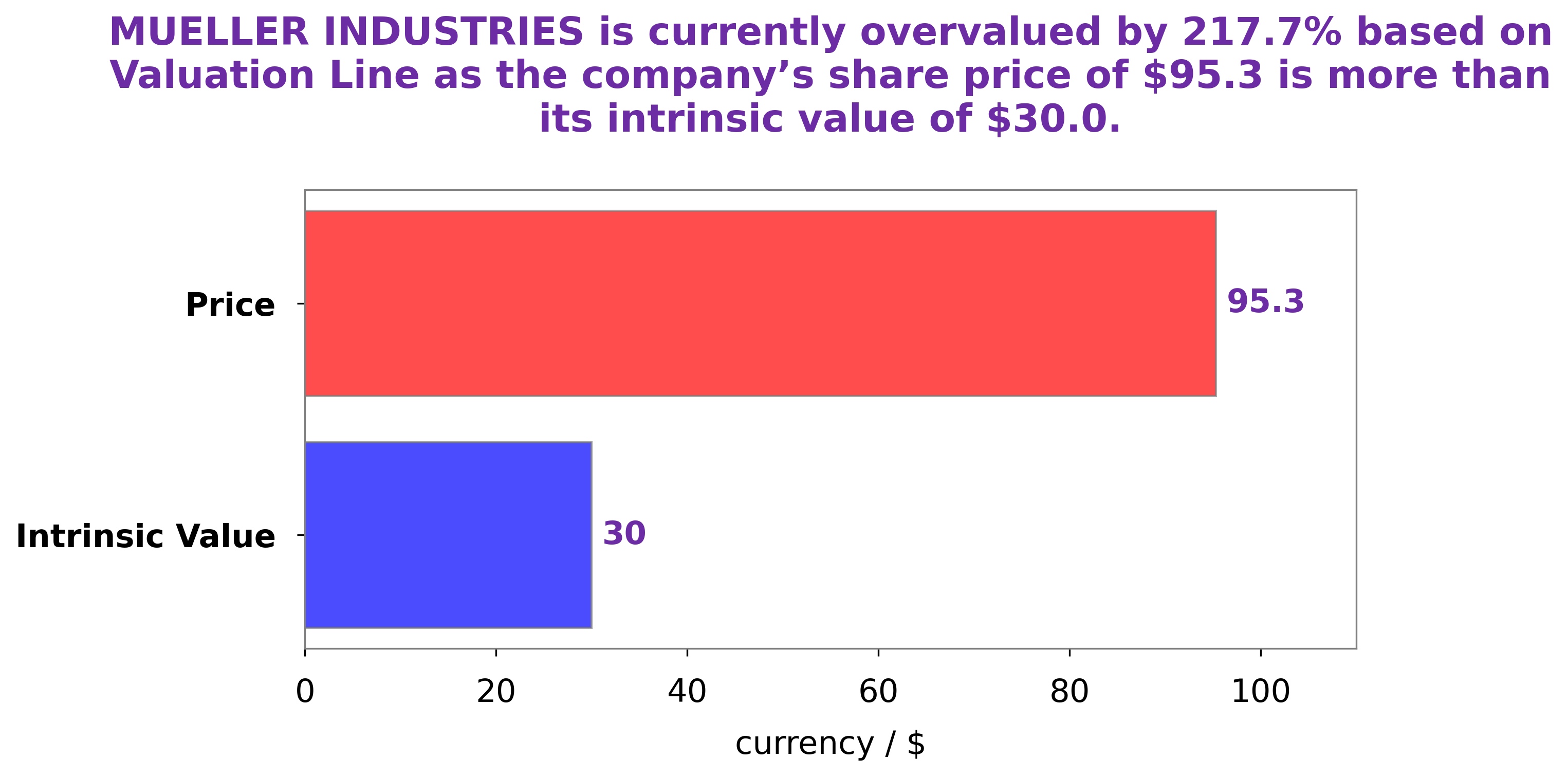

Analysis – Mueller Industries Stock Intrinsic Value

At GoodWhale, we have taken a look at the fundamentals of MUELLER INDUSTRIES and have conducted a comprehensive analysis. After taking into account various factors such as the company’s financials, competitive landscape, and potential growth opportunities, we have come to the conclusion that the fair value of the company’s stock is around $29.0. This value was calculated using our proprietary Valuation Line that takes into account all the relevant factors to arrive at a fair value. However, the current market price of MUELLER INDUSTRIES stock is $40.8, which is overvalued by 40.5%. As such, we recommend that investors should be cautious about investing in this stock. It is possible that the stock is being overvalued due to market sentiment and hype. Therefore, investors should do their own due diligence before investing in this stock. More…

Peers

Its competitors include Franklin Electric Co Inc, Furukawa Electric Co Ltd, PT Tembaga Mulia Semanan Tbk.

– Franklin Electric Co Inc ($NASDAQ:FELE)

Franklin Electric Co Inc is a manufacturer of submersible motors, pumps, and related parts and equipment. The company has a market capitalization of $3.95 billion as of 2022 and a return on equity of 18.79%. The company’s products are used in a variety of applications including residential, agricultural, commercial, and industrial water pumping.

– Furukawa Electric Co Ltd ($TSE:5801)

Furukawa Electric Co., Ltd. engages in the manufacture and sale of electric and electronic materials, products, and systems. It operates through the following segments: Electronic Devices, Optics, and Communication; Materials; Automotive; and Energy. The Electronic Devices, Optics, and Communication segment offers copper clad laminates, printed wiring boards, lead frames, optical fibers, optical fiber cables, and optical connectors. The Materials segment provides aluminum wire rods, aluminum alloys, aluminum foils, rare metals, and chemical products. The Automotive segment supplies automotive parts such as electric wires and cables, connectors, and battery terminals. The Energy segment offers power cables and power distribution equipment. The company was founded by Masaru Furukawa on June 8, 1949 and is headquartered in Tokyo, Japan.

– PT Tembaga Mulia Semanan Tbk ($IDX:TBMS)

PT Tembaga Mulia Semanan Tbk is one of the largest mining companies in Indonesia with a market cap of 593.25B as of 2022. The company is engaged in the exploration, mining, and smelting of copper and gold.

Summary

Mueller Industries (NYSE: MLI) has recently seen its share price move above the 200-day moving average of $39.83, an important technical indicator. This could be an indication of a potential upside in the stock, as the 200-day moving average is a widely-followed metric for analyzing long-term trends. Analysts generally view a share price move above the 200-day moving average as a sign of positive momentum, and some investors may view it as a buying opportunity.

Furthermore, Mueller Industries has a strong balance sheet and is well positioned to take advantage of growth opportunities. As a result, investors may want to consider adding the stock to their portfolios.

Recent Posts