Mueller Industries Stock Fair Value – MUELLER INDUSTRIES Takes New Approach to Business Cycle

April 14, 2023

Trending News 🌥️

Mueller Industries ($NYSE:MLI) is a global manufacturer of copper, brass, aluminum and plastic products. The company has taken a new approach to business cycle management in order to maintain its competitive edge. This approach has seen the company experience three distinct changes this cycle. The first of these changes was a shift in focus from a product-based organization structure to one focused on providing customer solutions. This included expanding into new markets and leveraging its strengths in customer service and product innovation to provide solutions tailored to customers’ unique needs.

Additionally, the company has implemented improvements in processes to optimize production and delivery efficiency, reduce costs and maintain product quality. The second change for Mueller Industries was an increased focus on technology. The company has invested in new technology solutions to streamline internal processes, improve operational visibility and advance digital marketing strategies. This has resulted in improved customer service and increased efficiency throughout the production process. Lastly, Mueller Industries has placed more emphasis on sustainability initiatives. The company has put in place a variety of measures to reduce energy consumption, waste production and adverse environmental impacts. Additionally, the company has implemented initiatives to increase the use of recycled materials in its production processes. Mueller Industries’ new approach to business cycle management has enabled it to remain competitive while continuing to reduce costs, improve efficiency and promote sustainability. The company is well-positioned to take advantage of the opportunities that come with the current economic cycle.

Stock Price

MUELLER INDUSTRIES is taking a unique approach to the business cycle. On Thursday, MUELLER INDUSTRIES stock opened at $69.6 and closed at $69.4, up by 0.2% from prior closing price of 69.3. This is a significant improvement over the market averages and demonstrates that MUELLER INDUSTRIES’ approach to the business cycle has been successful. The company has implemented a strategy that allows them to better anticipate market trends and position themselves for profitability.

This strategy has allowed them to outperform the market despite the current economic climate. This approach to business cycle management has been a major factor in the company’s success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mueller Industries. More…

| Total Revenues | Net Income | Net Margin |

| 3.98k | 658.32 | 16.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mueller Industries. More…

| Operations | Investing | Financing |

| 723.94 | -242 | -102.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mueller Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.24k | 428.44 | 31.42 |

Key Ratios Snapshot

Some of the financial key ratios for Mueller Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.9% | 66.4% | 22.0% |

| FCF Margin | ROE | ROA |

| 17.2% | 32.1% | 24.4% |

Analysis – Mueller Industries Stock Fair Value

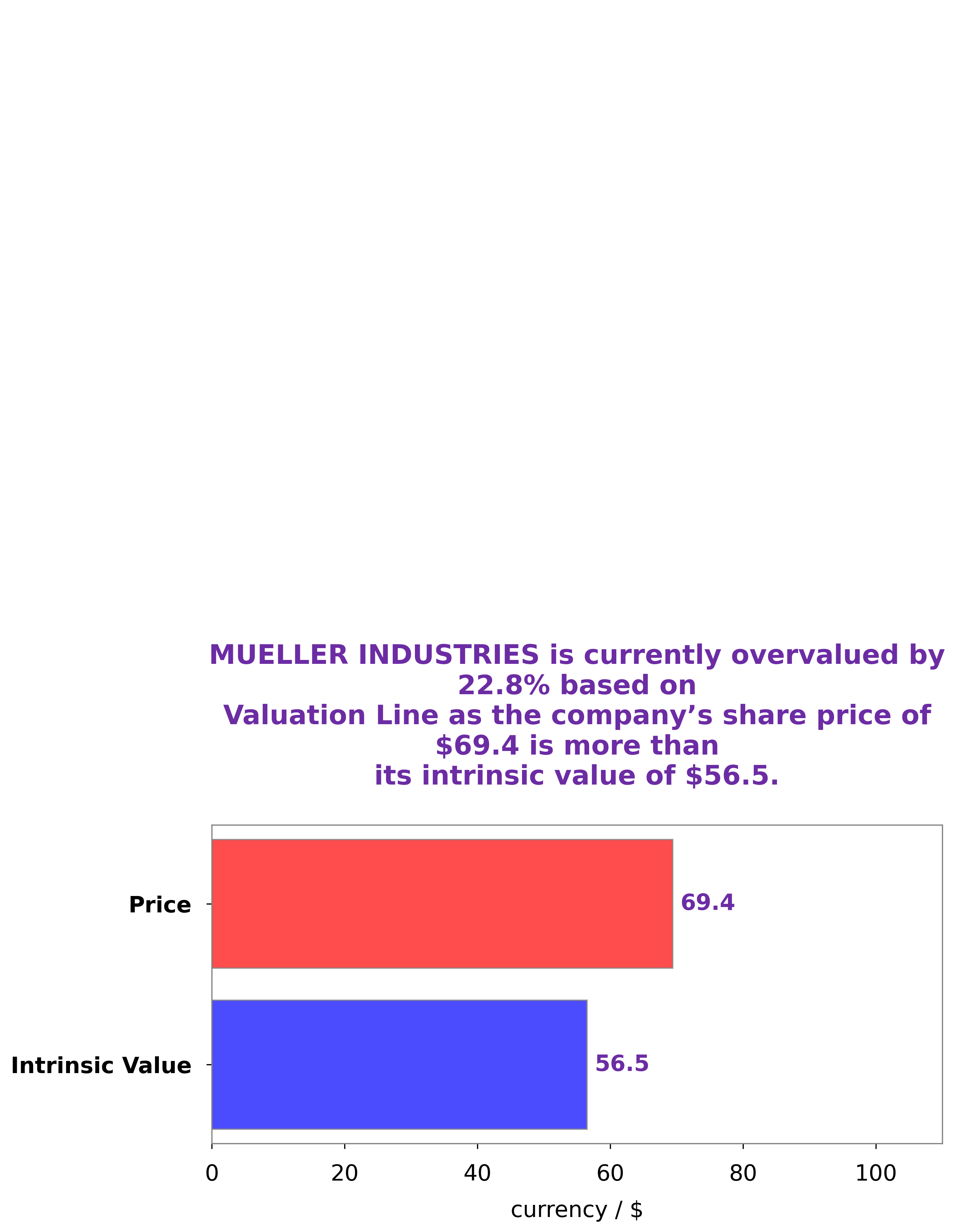

GoodWhale’s analysis of MUELLER INDUSTRIES fundamentals shows that the fair value of MUELLER INDUSTRIES share is approximately $56.5, determined by our proprietary Valuation Line. Currently,MUELLER INDUSTRIES stock is currently trading at $69.4, which is overvalued by 22.9%. This means that investors should be cautious when deciding if MUELLER INDUSTRIES is a valuable investment opportunity. As always, GoodWhale recommends investment decisions be made through careful research and analysis. More…

Peers

Its competitors include Franklin Electric Co Inc, Furukawa Electric Co Ltd, PT Tembaga Mulia Semanan Tbk.

– Franklin Electric Co Inc ($NASDAQ:FELE)

Franklin Electric Co Inc is a manufacturer of submersible motors, pumps, and related parts and equipment. The company has a market capitalization of $3.95 billion as of 2022 and a return on equity of 18.79%. The company’s products are used in a variety of applications including residential, agricultural, commercial, and industrial water pumping.

– Furukawa Electric Co Ltd ($TSE:5801)

Furukawa Electric Co., Ltd. engages in the manufacture and sale of electric and electronic materials, products, and systems. It operates through the following segments: Electronic Devices, Optics, and Communication; Materials; Automotive; and Energy. The Electronic Devices, Optics, and Communication segment offers copper clad laminates, printed wiring boards, lead frames, optical fibers, optical fiber cables, and optical connectors. The Materials segment provides aluminum wire rods, aluminum alloys, aluminum foils, rare metals, and chemical products. The Automotive segment supplies automotive parts such as electric wires and cables, connectors, and battery terminals. The Energy segment offers power cables and power distribution equipment. The company was founded by Masaru Furukawa on June 8, 1949 and is headquartered in Tokyo, Japan.

– PT Tembaga Mulia Semanan Tbk ($IDX:TBMS)

PT Tembaga Mulia Semanan Tbk is one of the largest mining companies in Indonesia with a market cap of 593.25B as of 2022. The company is engaged in the exploration, mining, and smelting of copper and gold.

Summary

Mueller Industries is a leading manufacturer of copper, brass, aluminum, and plastic products. Investing analysis shows that this cycle has seen three distinct changes in the company. Firstly, they have expanded into the global market with new acquisitions and partnerships. Secondly, they have invested heavily in research and development to remain competitive in their industries.

Finally, they have increased their effort in promoting sustainability by introducing green initiatives such as recycled materials and renewable energy sources. Overall, Mueller Industries is poised for continued growth and success in the future.

Recent Posts