MSGE Intrinsic Stock Value – MSGE Stock Soars as Company Plans to Sell Former Hulu Theater for $1B

May 19, 2023

Trending News 🌥️

Madison Square Garden ($NYSE:MSGE) Entertainment (MSGE) has been making waves in the stock market recently, with its stock prices soaring following a better-than-expected financial report. The company is now planning to add to its success by selling its former Hulu Theater for an estimated $1B. MSGE is a media and entertainment company based in New York City. They manage and invest in sports, music, entertainment, live events, and other related activities. MSGE also owns two professional sports franchises, the New York Knicks and the New York Rangers, and they own the world’s most famous arena, Madison Square Garden.

This deal is expected to bring MSGE a huge windfall and will undoubtedly further bolster their impressive stock performance. The sale of the Hulu Theater is just the latest in a series of successful investments and deals that have helped MSGE’s stock skyrocket over the past few months. With this latest transaction, MSGE looks set to continue their streak of success in the market.

Share Price

On Thursday, MADISON SQUARE GARDEN ENTERTAINMENT (MSGE) stock opened at $32.1 and experienced a 12.8% increase from its previous closing price of $31.7, closing at $35.8. The sale will enable MSGE to realign its resources and focus more heavily on its other business ventures, such as investing further in live entertainment, virtual reality, and gaming. The company’s stock surge indicates that investors are optimistic about MSGE’s future prospects and its ability to successfully generate higher returns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MSGE. More…

| Total Revenues | Net Income | Net Margin |

| 1.96k | -94.61 | -0.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MSGE. More…

| Operations | Investing | Financing |

| 63.52 | -1.05k | 256.42 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MSGE. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.85k | 3.64k | 55.2 |

Key Ratios Snapshot

Some of the financial key ratios for MSGE are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.7% | – | -4.4% |

| FCF Margin | ROE | ROA |

| -52.0% | -2.7% | -0.9% |

Analysis – MSGE Intrinsic Stock Value

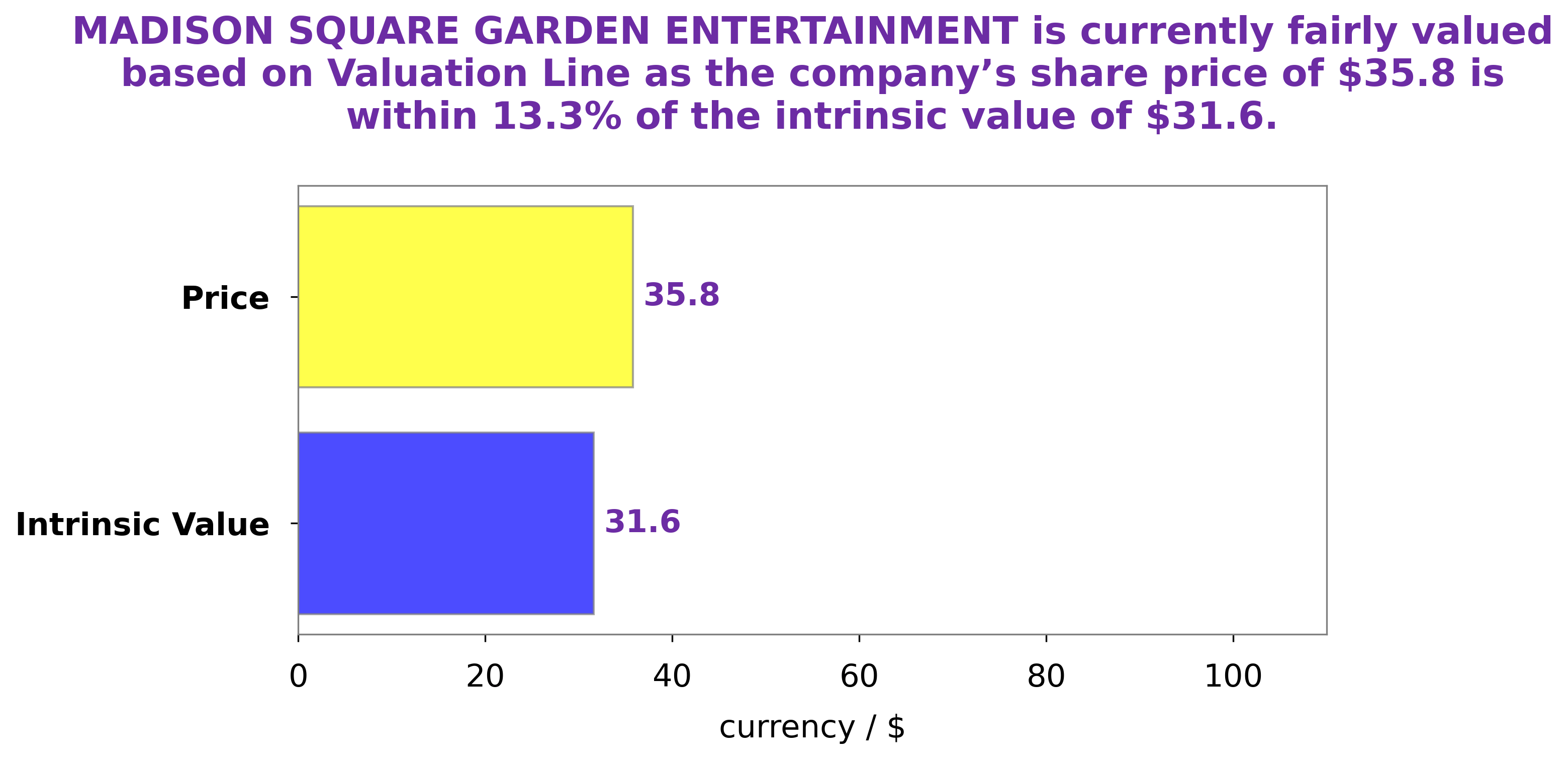

At GoodWhale, we offer fundamental insights into MADISON SQUARE GARDEN ENTERTAINMENT based on our proprietary Valuation Line. Our analysis shows that the fair value of MADISON SQUARE GARDEN ENTERTAINMENT’s share is around $31.6. Currently, MADISON SQUARE GARDEN ENTERTAINMENT stock is traded at $35.8, which puts it at a 13.1% premium over its fair value. More…

Peers

The competition between Madison Square Garden Entertainment Corp and its competitors is fierce. Madison Square Garden Sports Corp, Lions Gate Entertainment Corp, and Seoul Broadcasting System Co Ltd are all vying for a piece of the pie, and each company has its own unique strengths and weaknesses.

– Madison Square Garden Sports Corp ($NYSE:MSGS)

Madison Square Garden Sports Corp owns and operates sports and entertainment venues. The company has a market cap of $3.62B and a ROE of -33.12%. The company owns and operates Madison Square Garden, the Hulu Theater at Madison Square Garden, Radio City Music Hall, the Beacon Theatre, and the Chicago Theatre. The company also owns and operates the New York Knicks, the New York Rangers, and the New York Liberty.

– Lions Gate Entertainment Corp ($NYSE:LGF.B)

Lions Gate Entertainment Corp is a Canadian entertainment company with a market cap of 1.49B as of 2022. The company has a Return on Equity of -66.97%. The company is involved in the production and distribution of films and television shows.

– Seoul Broadcasting System Co Ltd ($KOSE:034120)

Seoul Broadcasting System Co Ltd is a South Korean national radio and television broadcasting company. It is the largest broadcaster in the country with 17 radio and television networks, including the flagship SBS TV channel. The company also operates several cable TV channels and radio stations. In addition to its broadcasting business, SBS also has a large production arm that produces some of the country’s most popular television shows and movies.

Summary

Madison Square Garden Entertainment (MSGE) is a diversified entertainment company that recently released robust financial results. Analysts have responded positively to this news, with the stock price moving up the same day. MSGE has also announced plans to sell its former Hulu Theater for a reported $1 billion, which is seen as another strong sign of the company’s financial health. This positive news has attracted increased investor attention, making MSGE an attractive option for those looking for good returns from a well-established firm.

Recent Posts