MPW Intrinsic Value – Mutual Advisors LLC Increases Investment in Medical Properties Trust, (NYSE:MPW)

April 1, 2023

Trending News ☀️

Medical Properties Trust ($NYSE:MPW), Inc. (NYSE:MPW) is a real estate investment trust that specializes in the acquisition, redevelopment, and management of healthcare facilities. The company owns and leases medical facilities across the United States and the United Kingdom, focusing on acute care hospitals, inpatient rehabilitation hospitals, long-term acute care hospitals, and other medical and surgical facilities. Mutual Advisors LLC is an investment advisor that provides personalized asset management services to high-net-worth individuals, families, trusts, and foundations. With their new investment in MPT, Mutual Advisors is showing a sign of confidence in the company’s future growth and success.

Medical Properties Trust, Inc. (NYSE:MPW) has been consistently performing well in the stock market and has seen positive growth over the years. With Mutual Advisors LLC increasing their stake in the company, investors can expect to see more upward momentum for MPT in the near future.

Share Price

On Monday, MPW stock opened at $7.6 and closed at $7.5, representing a 0.9% decrease from the previous closing price of $7.5. This slight downturn in stock price has not deterred Mutual Advisors LLC from doubling down on their investment in the company. As more investors become aware of the company’s promising prospects, we can expect to see a surge in demand for its shares and a corresponding increase in its stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MPW. More…

| Total Revenues | Net Income | Net Margin |

| 1.54k | 902.6 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MPW. More…

| Operations | Investing | Financing |

| 739.01 | 396.06 | -1.34k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MPW. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.66k | 11.06k | 14.38 |

Key Ratios Snapshot

Some of the financial key ratios for MPW are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 65.1% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – MPW Intrinsic Value

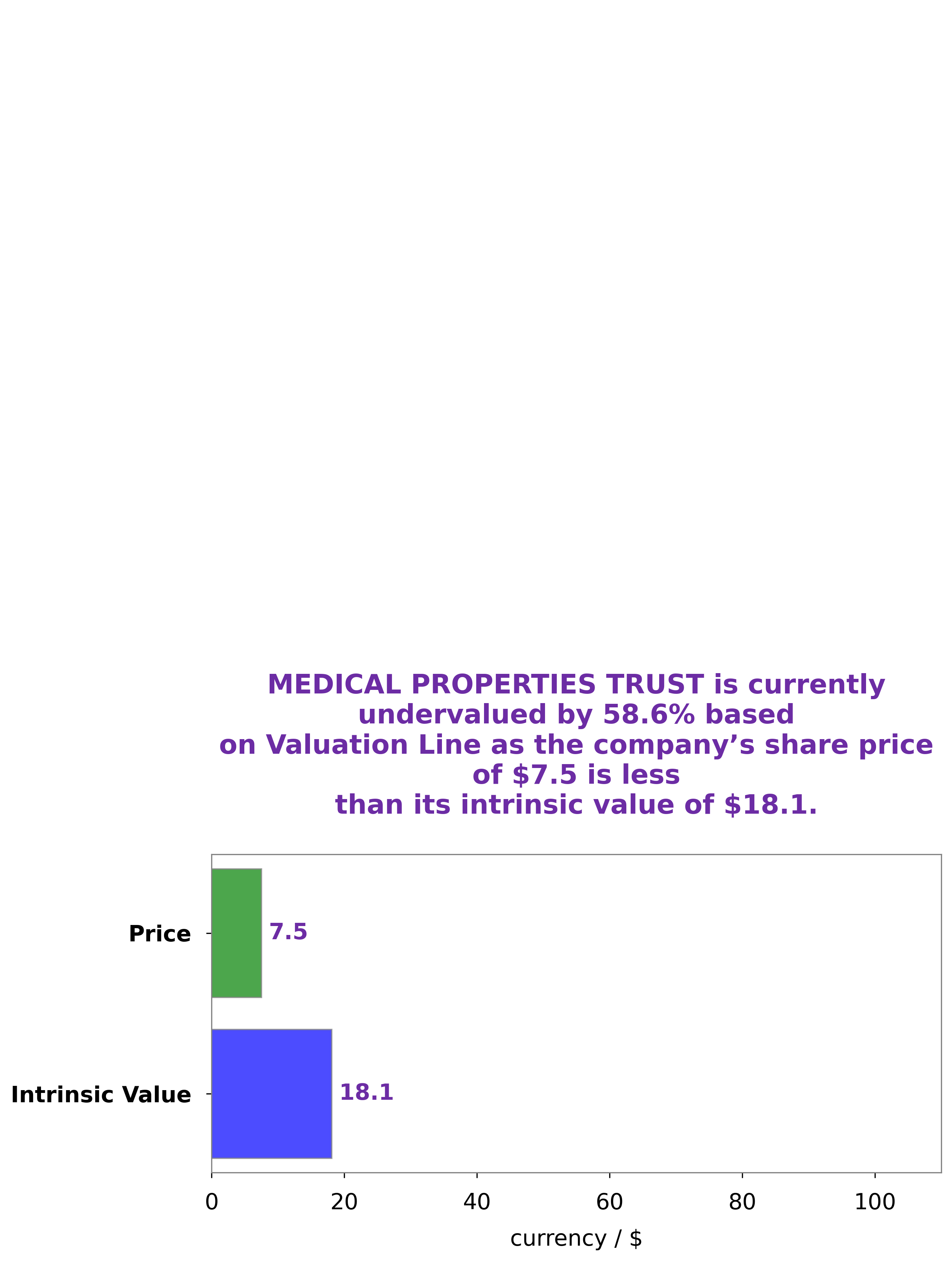

We at GoodWhale recently conducted an analysis of MEDICAL PROPERTIES TRUST’s wellbeing. After careful consideration, our proprietary Valuation Line provided us with an intrinsic value of around $18.1 per share. We found that the current stock price of MEDICAL PROPERTIES TRUST is $7.5, significantly lower than its intrinsic value. This means that the stock is currently undervalued by 58.6%. We believe that investing in such undervalued stocks can be a great way to virtually maximize returns. More…

Peers

The company operates in the United States, Germany, and the United Kingdom. The company was founded in 2003 and is headquartered in Birmingham, Alabama. Healthcare Trust of America, Inc. is a real estate investment trust that invests in healthcare-related real estate assets. The company owns and operates healthcare facilities across the United States. The company was founded in 2006 and is headquartered in Nashville, Tennessee. Vital Healthcare Property Trust is a real estate investment trust that invests in hospitals and other healthcare-related properties in New Zealand and Australia. The company was founded in 2002 and is headquartered in Auckland, New Zealand. Healthcare Trust Inc is a real estate investment trust that focuses on healthcare-related properties. The company operates in the United States and Canada. The company was founded in 2010 and is headquartered in Boston, Massachusetts.

– Healthcare Trust of America Inc ($NZSE:VHP)

Vital Healthcare Property Trust is a real estate investment trust that owns and operates healthcare facilities in New Zealand and Australia. The company has a market cap of 1.52 billion as of 2022. Vital Healthcare Property Trust’s portfolio consists of hospitals, medical centers, and aged care facilities.

– Vital Healthcare Property Trust ($OTCPK:HLTC)

As of 2022, Healthcare Trust Inc has a market cap of 694.19M. The company is a real estate investment trust that invests in healthcare properties, including hospitals, nursing homes, and medical office buildings.

Summary

Mutual Advisors LLC recently announced that it holds a $578,000 stock position in Medical Properties Trust, Inc. (NYSE: MPW). This is a significant investment in one of the top healthcare real estate investment trusts (REITs) in the US. Analysts have praised MPW for its strong portfolio of healthcare properties and its dividend-paying capability. Furthermore, analysts expect MPW to benefit from the increasing demand for healthcare real estate in the US due to an aging population and changes to the healthcare system.

A number of Wall Street firms have issued buy ratings on MPW and most analysts expect the stock to continue its upward trend. Investors should keep an eye on MPW’s performance as it looks to capitalize on the current favorable market conditions.

Recent Posts