MPW Intrinsic Value Calculator – Don’t Let Medical Properties Trust’s Apparent Success Fool You

April 22, 2023

Trending News ☀️

Medical Properties Trust ($NYSE:MPW) (MPT) is a real estate investment trust that specializes in healthcare-related properties. While MPT may appear to be a successful investment vehicle, it is important to look beyond the surface and consider all factors when evaluating the company. At first glance, MPT seems like a safe bet. The company has consistently grown its dividend payments since its founding and has a long track record of healthy returns.

However, there are some red flags that investors should be aware of.

First, MPT’s portfolio is heavily concentrated in the United States, leaving it exposed to possible changes in government regulations or policy that could affect the value of its properties.

Additionally, MPT is dependent on third-party operators for the majority of its rental income, which could pose a risk if these operators become unable to pay their rent. Ultimately, investors should take the time to research MPT and make an informed decision before investing. Don’t let the company’s apparent success fool you; there are risks that must be taken into account before committing to an investment. It is important to remember that real estate investments carry certain risks and should not be taken lightly. Additionally, investors should look at the company’s long-term prospects and consider their individual financial goals. A thorough evaluation of MPT will help investors determine if the investment is right for them.

Price History

Medical Properties Trust has had a seemingly successful day on Friday, with its stock opening at $8.2 and closing at $8.3, up 1.0% from the prior closing price of 8.2. However, it is important to note that this apparent success should not be taken as a sign of a strong performance in the long-term. While it might seem like Medical Properties Trust is having a good day, it is important to look beyond the surface and consider the overall market performance of the company. In order to make an informed decision about Medical Properties Trust, it is essential to look at its long-term financial health and track record for success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MPW. More…

| Total Revenues | Net Income | Net Margin |

| 1.54k | 902.6 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MPW. More…

| Operations | Investing | Financing |

| 739.01 | 396.06 | -1.34k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MPW. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.66k | 11.06k | 14.38 |

Key Ratios Snapshot

Some of the financial key ratios for MPW are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 65.1% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – MPW Intrinsic Value Calculator

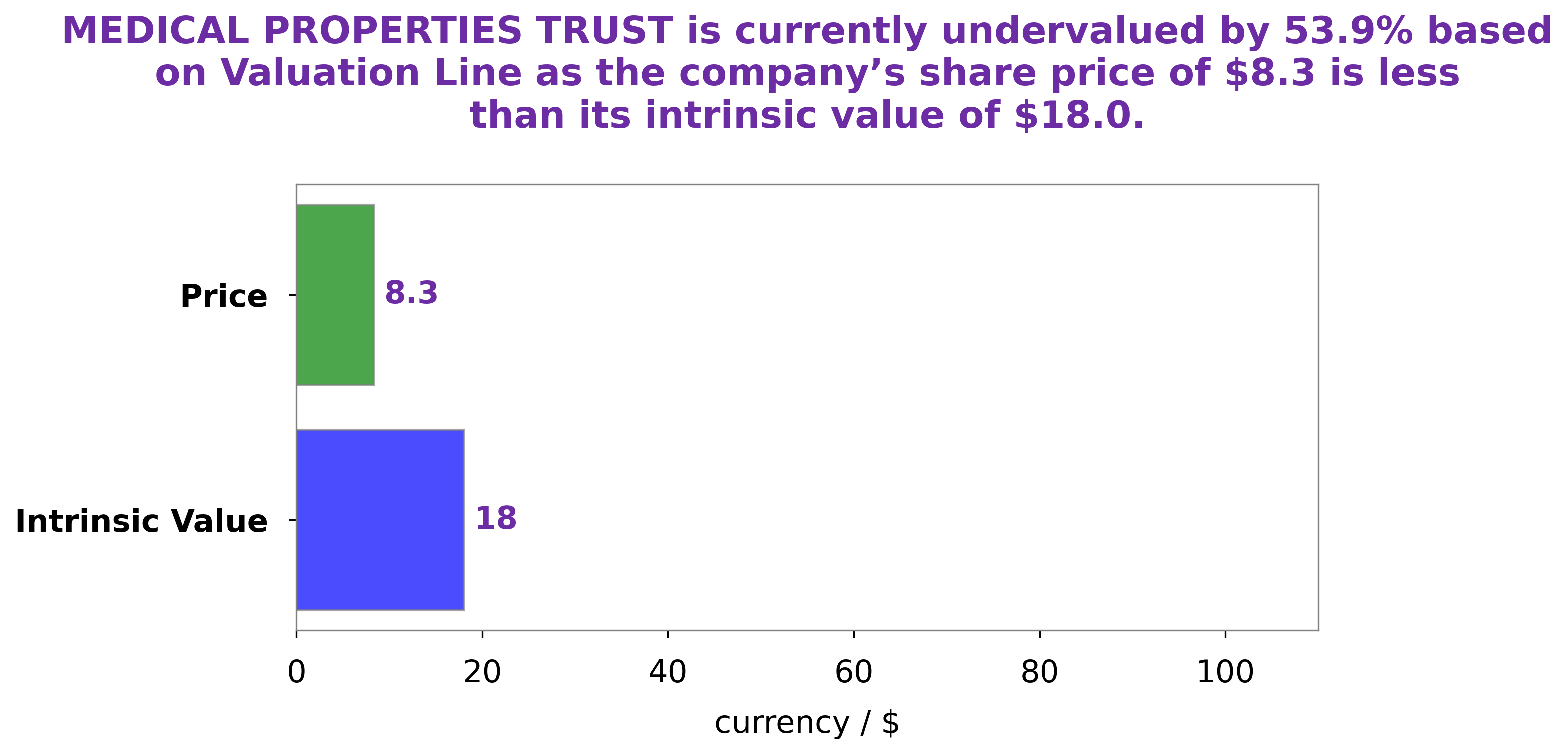

At GoodWhale, we recently performed an extensive analysis of MEDICAL PROPERTIES TRUST’s long-term wellbeing. Our proprietary Valuation Line showed that the intrinsic value of their stock is around $18.0. Currently, MEDICAL PROPERTIES TRUST shares are being traded at $8.3, which is a 53.9% discount to their intrinsic value. This means that there is a great opportunity for investors to buy in at a discount price and benefit from the potential growth of the stock in the future. More…

Peers

The company operates in the United States, Germany, and the United Kingdom. The company was founded in 2003 and is headquartered in Birmingham, Alabama. Healthcare Trust of America, Inc. is a real estate investment trust that invests in healthcare-related real estate assets. The company owns and operates healthcare facilities across the United States. The company was founded in 2006 and is headquartered in Nashville, Tennessee. Vital Healthcare Property Trust is a real estate investment trust that invests in hospitals and other healthcare-related properties in New Zealand and Australia. The company was founded in 2002 and is headquartered in Auckland, New Zealand. Healthcare Trust Inc is a real estate investment trust that focuses on healthcare-related properties. The company operates in the United States and Canada. The company was founded in 2010 and is headquartered in Boston, Massachusetts.

– Healthcare Trust of America Inc ($NZSE:VHP)

Vital Healthcare Property Trust is a real estate investment trust that owns and operates healthcare facilities in New Zealand and Australia. The company has a market cap of 1.52 billion as of 2022. Vital Healthcare Property Trust’s portfolio consists of hospitals, medical centers, and aged care facilities.

– Vital Healthcare Property Trust ($OTCPK:HLTC)

As of 2022, Healthcare Trust Inc has a market cap of 694.19M. The company is a real estate investment trust that invests in healthcare properties, including hospitals, nursing homes, and medical office buildings.

Summary

Medical Properties Trust is a real estate investment trust (REIT) focused on investing in healthcare facilities. It primarily invests in acute care, specialty surgical and rehabilitation hospitals, long-term acute care hospitals, and other medical and healthcare-related facilities. Analyzing the company for investing purposes requires a thorough review of its financial and operating performance, as well as its competitive position in the industry. As a REIT, it is important to evaluate the quality of its real estate portfolio and its ability to generate stable returns and cash flows.

Additionally, investors should consider the management team’s experience and reputation, dividend yield and sustainability, and growth potential. Analysis should also include a review of the company’s liquidity, credit and debt profile, price-to-earnings ratio, and overall profitability. Overall, Medical Properties Trust offers an attractive investment opportunity and appears to be well-positioned to capitalize on future growth opportunities.

Recent Posts