Microstrategy Incorporated Stock Fair Value Calculation – MicroStrategy Continues to Invest in Bitcoin, Adds 1,045 More for $23.9M

April 6, 2023

Trending News 🌥️

MICROSTRATEGY ($NASDAQ:MSTR): MicroStrategy Incorporated, which is a leading worldwide provider of enterprise analytics and mobility software, continues to make investments in Bitcoin. It has achieved remarkable success by developing innovative solutions that focus on delivering customer value and helping organizations achieve their goals. In addition to its investments in Bitcoin, MicroStrategy also offers a suite of products and services designed to help businesses gain insights from their data. These include visual analytics and reporting solutions, mobile analytics platforms, data archiving and data warehouse solutions, and enterprise-wide search capabilities.

As a part of its strategy to remain competitive in the market, MicroStrategy has also been investing heavily in research and development, as well as in expanding its product portfolio. This recent investment in Bitcoin is yet another example of the company’s commitment to innovation and staying ahead of the curve.

Price History

On Wednesday, MICROSTRATEGY INCORPORATED stock opened at $303.4 and closed at $290.8, down by 2.7% from its prior closing price of 299.0. Despite this drop, the company continues to invest heavily in Bitcoin. On Thursday, MICROSTRATEGY INCORPORATED announced that it had purchased an additional 1,045 Bitcoin for a total of $23.9 million. Since then, the company has continued to invest in Bitcoin and has seen success from its decision.

The company’s CEO, Michael J. Saylor, has been a vocal supporter of Bitcoin and believes it will continue to be a profitable investment for MICROSTRATEGY INCORPORATED in the future. With the company’s latest purchase of 1,045 Bitcoins, it is clear that MICROSTRATEGY INCORPORATED is continuing to invest heavily in the digital currency. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Microstrategy Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 499.26 | -1.47k | -139.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Microstrategy Incorporated. More…

| Operations | Investing | Financing |

| 3.21 | -278.59 | 265.19 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Microstrategy Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.41k | 2.79k | -33.17 |

Key Ratios Snapshot

Some of the financial key ratios for Microstrategy Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.9% | 126.2% | 2.1% |

| FCF Margin | ROE | ROA |

| -57.5% | -2.3% | 0.3% |

Analysis – Microstrategy Incorporated Stock Fair Value Calculation

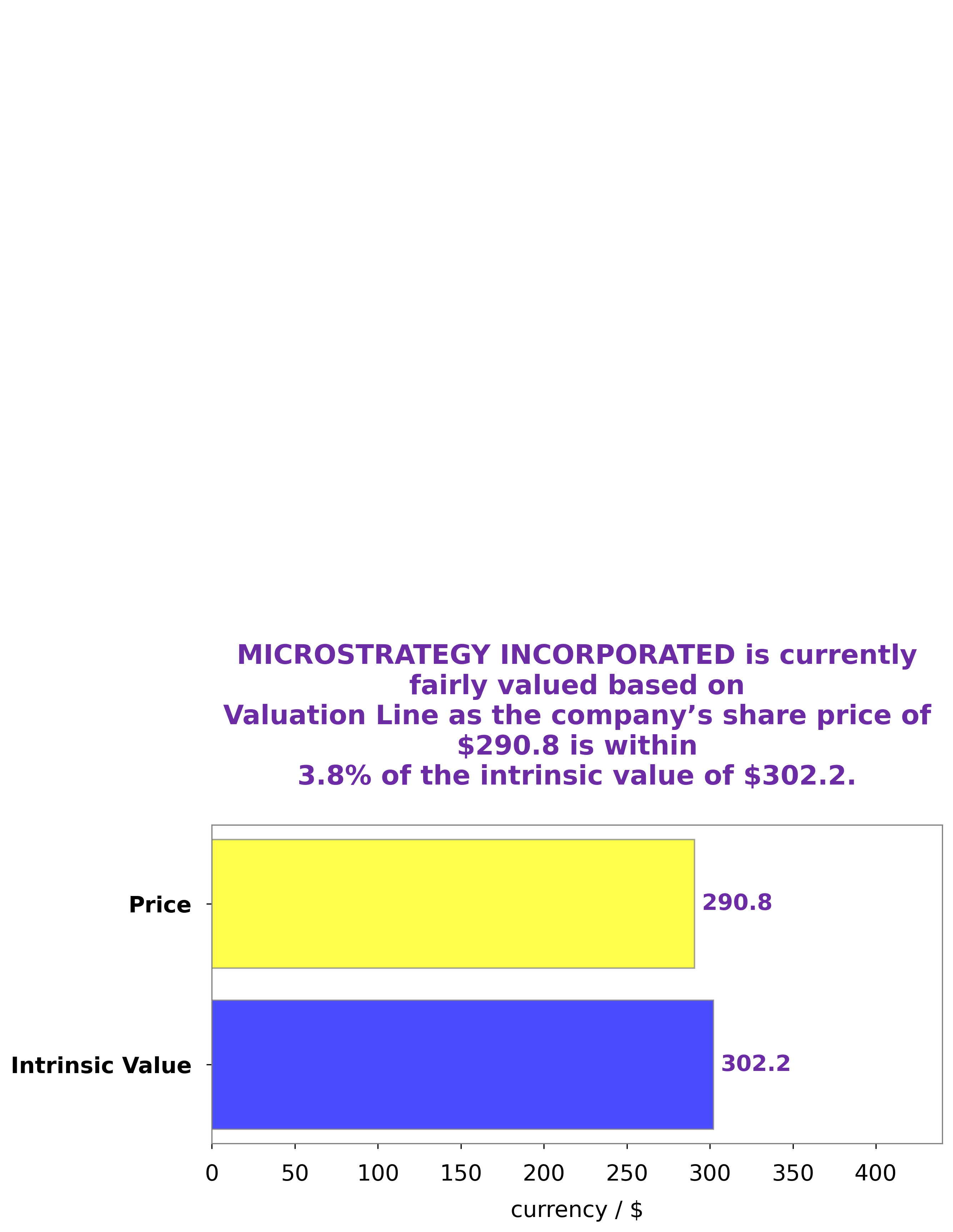

At GoodWhale, we have conducted an analysis of the financials of MICROSTRATEGY INCORPORATED. Our proprietary Valuation Line has arrived at a fair value of around $302.2 for the company’s stock. Currently, the stock is traded at $290.8, indicating that it is a fair price that is undervalued by 3.8%. This is an opportune time to invest in MICROSTRATEGY INCORPORATED if you are looking to take advantage of the undervalued prices. More…

Peers

The company’s main competitors are Coinbase Global Inc, Riot Blockchain Inc, Bakkt Holdings Inc.

– Coinbase Global Inc ($NASDAQ:COIN)

Coinbase Global Inc is a digital asset exchange company. The Company’s mission is to create an open financial system for the world. The Company operates a digital currency exchange platform for individual and institutional investors, traders, and developers. The Company offers its products and services through its online platform and mobile application. The Company serves customers in North America, Europe, Asia Pacific, South America, and the Middle East and Africa.

– Riot Blockchain Inc ($NASDAQ:RIOT)

Riot Blockchain Inc has a market cap of 893.37M as of 2022. The company’s ROE for the same year is -2.48%. Riot Blockchain Inc is a provider of blockchain technology solutions to the global financial markets. The company’s mission is to be the leading blockchain technology provider in the world.

– Bakkt Holdings Inc ($NYSE:BKKT)

Bakkt Holdings Inc is a company that provides digital asset custody, trading, and other financial services. As of 2022, the company had a market capitalization of 164.26 million and a return on equity of -26.03%. The company’s primary focus is on digital assets, such as Bitcoin, and providing custody, trading, and other financial services related to these assets.

Summary

MicroStrategy Incorporated recently made a large-scale investment in bitcoin, acquiring 1,045 coins worth $23.9 million. MicroStrategy CEO Michael Saylor has been vocal in his support of bitcoin, emphasizing its long-term potential as a hedge against inflation. Financial analysts have been bullish on the move, citing the increasing acceptance of crypto-assets in the global marketplace as well as the potential of blockchain technology. Given the market volatility associated with digital assets, investors should proceed with caution and do their own research before investing in the company.

Recent Posts