Microstrategy Incorporated Intrinsic Value Calculator – Prominent Investor Expresses Pessimism Towards MicroStrategy, Bearish Sentiment Follows in Options Market

June 29, 2023

🌧️Trending News

MICROSTRATEGY ($NASDAQ:MSTR): On June 26th, 2023, a prominent investor expressed pessimism towards MicroStrategy Incorporated, the world’s leading enterprise intelligence and analytics platform provider. This investor’s negative outlook seemed to have a ripple effect throughout the options market as more investors adopted a bearish attitude towards the company. MicroStrategy Incorporated is a Nasdaq-listed public company that leverages its cutting-edge technology to help organizations make informed decisions and gain real-time insights into their operations. The company provides software and services for optimizing and managing data, deploying analytics applications, and creating secure mobile dashboards.

In addition to its core products, the company also offers a suite of enterprise tools to help firms optimize their customer engagement and improve their marketing strategies. Since the investor’s bearish sentiment was released, MicroStrategy’s stock has been on a downward trend. It is yet to be seen how this bearish sentiment will play out in the long run.

Stock Price

On Tuesday, a prominent investor expressed pessimism towards MicroStrategy Incorporated, causing the stock to open at $312.3 and close at $324.9, a rise of 6.3% from its previous closing price of 305.7. The bearish sentiment that followed in the options market weighed on the company’s stock. Analysts have expressed caution that the stock could continue to slide in the short-term, as investors re-evaluate their positions in the wake of this pessimistic outlook. Investors are closely watching the stock in light of this news, waiting to see if the company can make the necessary changes to bounce back from this dip or if it will continue to suffer from bearish sentiment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Microstrategy Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 501.9 | -877.85 | -7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Microstrategy Incorporated. More…

| Operations | Investing | Financing |

| -3.07 | -242.22 | 245.52 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Microstrategy Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.03k | 2.58k | 34.25 |

Key Ratios Snapshot

Some of the financial key ratios for Microstrategy Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.3% | -1.1% | 40.1% |

| FCF Margin | ROE | ROA |

| -51.2% | 418.6% | 4.2% |

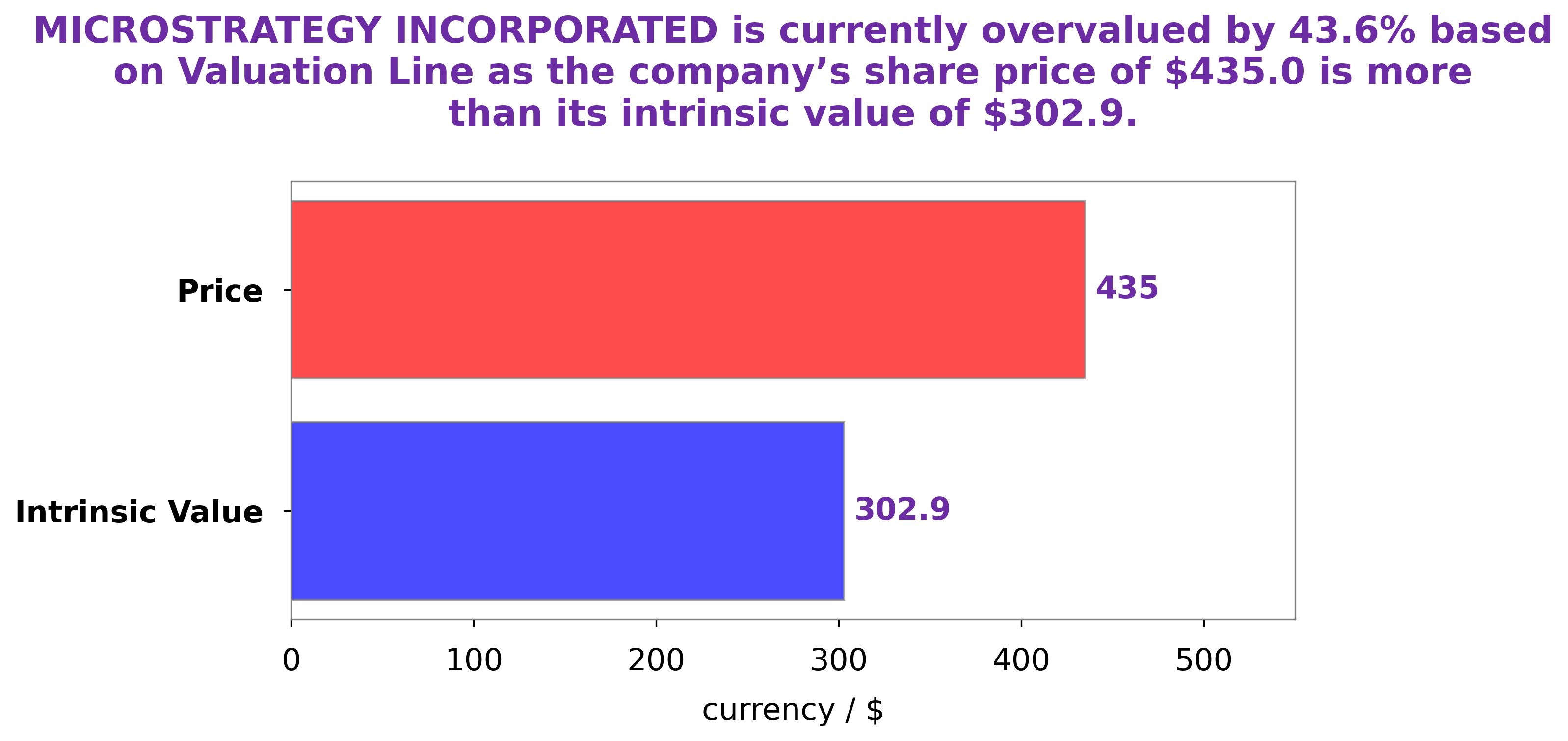

Analysis – Microstrategy Incorporated Intrinsic Value Calculator

As GoodWhale, we have conducted an analysis of MICROSTRATEGY INCORPORATED‘s financials. Our proprietary Valuation Line has calculated the intrinsic value of MICROSTRATEGY INCORPORATED share to be around $317.5. At present, the stock is trading at $324.9, which is a fair price but slightly overvalued by 2.3%. More…

Peers

The company’s main competitors are Coinbase Global Inc, Riot Blockchain Inc, Bakkt Holdings Inc.

– Coinbase Global Inc ($NASDAQ:COIN)

Coinbase Global Inc is a digital asset exchange company. The Company’s mission is to create an open financial system for the world. The Company operates a digital currency exchange platform for individual and institutional investors, traders, and developers. The Company offers its products and services through its online platform and mobile application. The Company serves customers in North America, Europe, Asia Pacific, South America, and the Middle East and Africa.

– Riot Blockchain Inc ($NASDAQ:RIOT)

Riot Blockchain Inc has a market cap of 893.37M as of 2022. The company’s ROE for the same year is -2.48%. Riot Blockchain Inc is a provider of blockchain technology solutions to the global financial markets. The company’s mission is to be the leading blockchain technology provider in the world.

– Bakkt Holdings Inc ($NYSE:BKKT)

Bakkt Holdings Inc is a company that provides digital asset custody, trading, and other financial services. As of 2022, the company had a market capitalization of 164.26 million and a return on equity of -26.03%. The company’s primary focus is on digital assets, such as Bitcoin, and providing custody, trading, and other financial services related to these assets.

Summary

Microstrategy Incorporated has recently seen an influx of bearish sentiment in the options market, as a prominent investor has expressed a pessimistic outlook on the company. Despite this, their stock price rose on the same day, suggesting that the market may be taking the long view, unfazed by short-term pessimism. Investors should take note of this, as it could be a signal of investor confidence in the company’s future prospects. Nevertheless, it is always important to stay vigilant and perform thorough research before making any investments.

Recent Posts