MGM Stock Fair Value Calculation – MGM Resorts International Stock Soars on Thursday, Outperforms Market

November 4, 2023

🌥️Trending News

On Thursday, MGM ($NYSE:MGM) Resorts International stock experienced a significant rise in value, outperforming the overall market. MGM Resorts International is an American global hospitality and entertainment company operating destination resorts in Las Vegas, Mississippi, Maryland, and Michigan, including such iconic brands as MGM Grand, Bellagio, Mandalay Bay, and The Mirage. The company also owns and operates the MGM Macau resort in China. MGM Resorts International has recently experienced success with its online gambling platform, BetMGM. This new addition to the company has allowed MGM Resorts to stay competitive in the ever-changing gaming industry.

In addition, MGM Resorts International has an expansive list of partnerships with various companies including Amazon, Apple, Coca Cola, and NBC Universal. These partnerships have allowed the company to expand its reach and appeal to a larger audience. MGM Resorts International is well-positioned for continued success, as the company has diversified its portfolio across multiple industries and markets. With strong revenue streams, innovative partnerships, and a growing online gaming platform, MGM Resorts International is positioned to continue outperforming the overall market.

Market Price

The stock opened on Friday at $37.0 and closed at $38.2, up from its last closing price of $36.2. Investors appear to be taking advantage of the relative stability of MGM Resorts International’s business, as well as the company’s strong financial position. The company is well-positioned to capitalize on the gradual reopening of U.S. casinos, especially in light of its aggressive cost-cutting measures earlier this year. With a strong balance sheet and a positive outlook for the future, MGM Resorts International stock appears to be a smart option for investors looking to capitalize on the current market environment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MGM. More…

| Total Revenues | Net Income | Net Margin |

| 14.82k | 365.69 | -3.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MGM. More…

| Operations | Investing | Financing |

| 2.1k | -167.52 | -3.81k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MGM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 42.91k | 38.06k | 12.52 |

Key Ratios Snapshot

Some of the financial key ratios for MGM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.9% | -24.9% | 1.4% |

| FCF Margin | ROE | ROA |

| 8.0% | 2.9% | 0.3% |

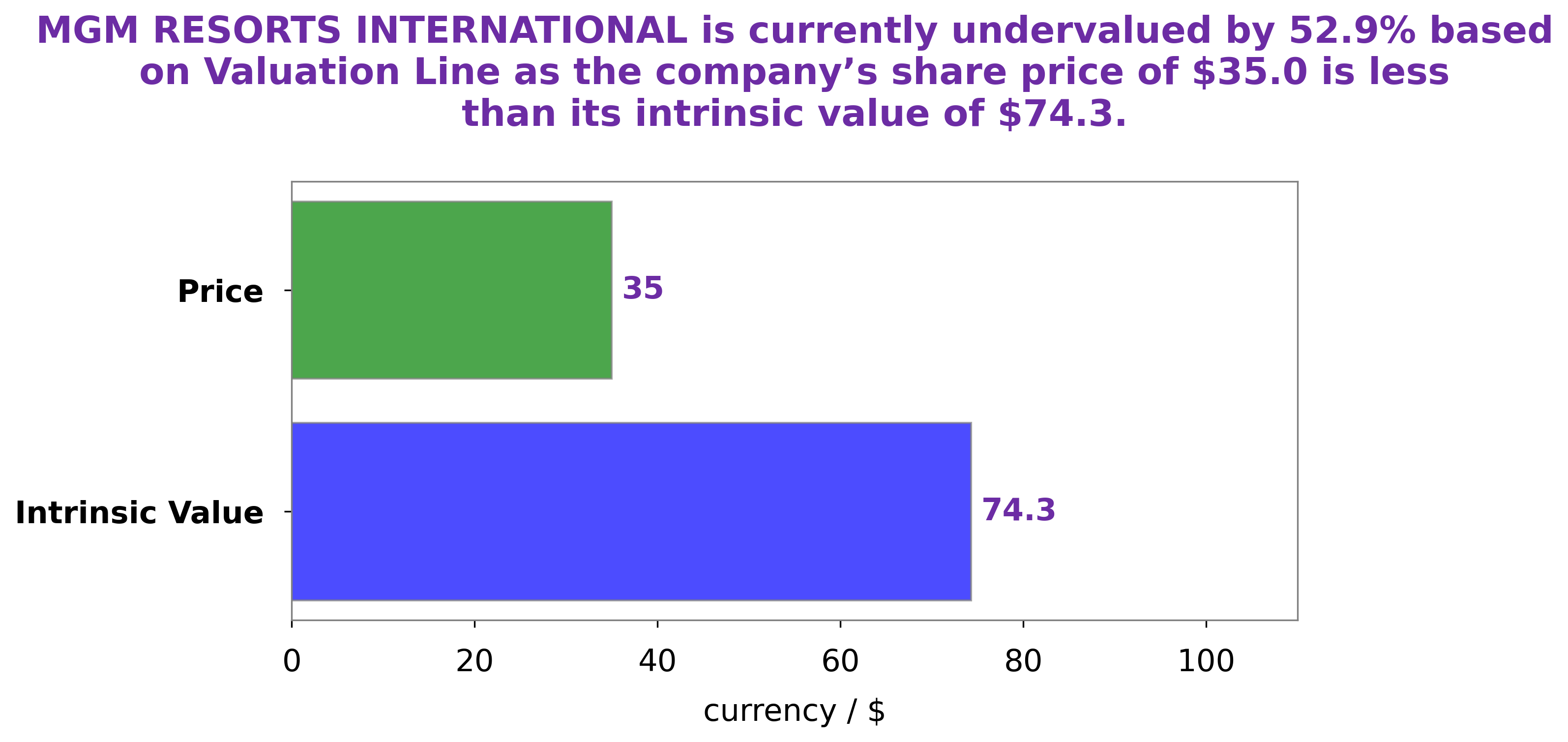

Analysis – MGM Stock Fair Value Calculation

At GoodWhale, we conducted an analysis of MGM RESORTS INTERNATIONAL’s wellbeing. After careful consideration, our proprietary Valuation Line revealed that the fair value of MGM RESORTS INTERNATIONAL’s share is approximately $75.5. Interestingly, MGM RESORTS INTERNATIONAL’s share is currently being traded at a much lower price of $38.2, undervalued by a staggering 49.4%. We’d recommend further analysis of the company before investing in its shares, for those seeking to take advantage of this situation. More…

Peers

MGM Resorts International is one of the world’s leading global hospitality companies, operating a portfolio of destination resort brands including Bellagio, MGM Grand, Mandalay Bay, The Mirage, and more. The company’s competitors include SkyCity Entertainment Group Ltd, Wyndham Hotels & Resorts Inc, and Cruzani Inc.

– SkyCity Entertainment Group Ltd ($NZSE:SKC)

SkyCity Entertainment Group Ltd is a casino and hospitality company based in New Zealand. The company has a market cap of 2B as of 2022 and a Return on Equity of 3.48%. SkyCity operates four casinos in New Zealand, two in Australia, and one in Chile. The company also has a number of hotels, restaurants, and bars.

– Wyndham Hotels & Resorts Inc ($NYSE:WH)

Wyndham Hotels & Resorts, Inc. is one of the largest hotel companies in the world, with over 9,000 hotels across more than 80 countries. The company offers a variety of hotel brands, including Wyndham, Ramada, Days Inn, Super 8, and Howard Johnson. Wyndham Hotels & Resorts is headquartered in Parsippany, New Jersey. The company’s market cap is 6.2B as of 2022 and its ROE is 30.65%.

Summary

MGM Resorts International saw its stock prices move up on Thursday, outperforming the market. This can be seen as a positive sign for investors in the company, as it suggests that there is confidence in the company’s future prospects. Furthermore, the stock’s performance could be the result of various factors such as improving fundamentals of the company, a rise in demand for the company’s services, and favorable macroeconomic conditions.

Investors should also take into account the potential risks associated with investing in MGM Resorts International, such as changes in the competitive landscape and potential regulatory issues. All in all, given the strong stock performance and positive outlook, MGM Resorts International appears to be an attractive investment option.

Recent Posts