MGM Intrinsic Value Calculation – MGM Resorts Looks to Establish Dominance in Japanese Gaming Market

April 18, 2023

Trending News ☀️

MGM ($NYSE:MGM) Resorts International, a leading global hospitality and entertainment company, is looking to establish itself as a leader in the Japanese gaming market. With the recent announcement of the Integrated Resorts Implementation Bill by the Japanese government, MGM has a unique opportunity to become one of the first companies to become involved in the development of casino resorts in Japan. The company’s vision is to create iconic gaming and entertainment experiences that drive value for its shareholders and create a positive economic impact in the communities in which it operates.

The company has been successful in a number of markets, from the U.S. and Europe to Macau and Singapore, and has experience in developing large-scale resorts that could be beneficial in Japan. MGM Resorts International owns and operates world-renowned resorts such as Bellagio, MGM Grand Las Vegas, and ARIA Resort & Casino Las Vegas, as well as some of the most recognized gaming brands in the world. With its extensive experience and resources, MGM is confident that it can successfully develop world-class Integrated Resorts in Japan.

Stock Price

On Monday, the company’s stock opened at $43.8 and closed at $43.9, representing an increase of 0.8% from its previous closing price of $43.6. This marks a continuation of a positive trend for MGM as it seeks to take advantage of the growing popularity of gaming in Japan. The company has already laid out plans to expand its presence in the Asian gambling hub through its joint venture with Orix Corporation, a major Japanese financial services group.

This partnership will see MGM assist in the development of integrated resort projects in various locations throughout Japan. With its vast experience in the gaming industry and its strong financial resources, the company is well-positioned to capitalize on the potential of the Japanese gaming market and establish itself as a leader in the region. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MGM. More…

| Total Revenues | Net Income | Net Margin |

| 13.13k | 1.44k | -3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MGM. More…

| Operations | Investing | Financing |

| 1.76k | 2.12k | -3.02k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MGM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 45.69k | 40.32k | 12.75 |

Key Ratios Snapshot

Some of the financial key ratios for MGM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.6% | -24.9% | 11.4% |

| FCF Margin | ROE | ROA |

| 7.6% | 19.4% | 2.1% |

Analysis – MGM Intrinsic Value Calculation

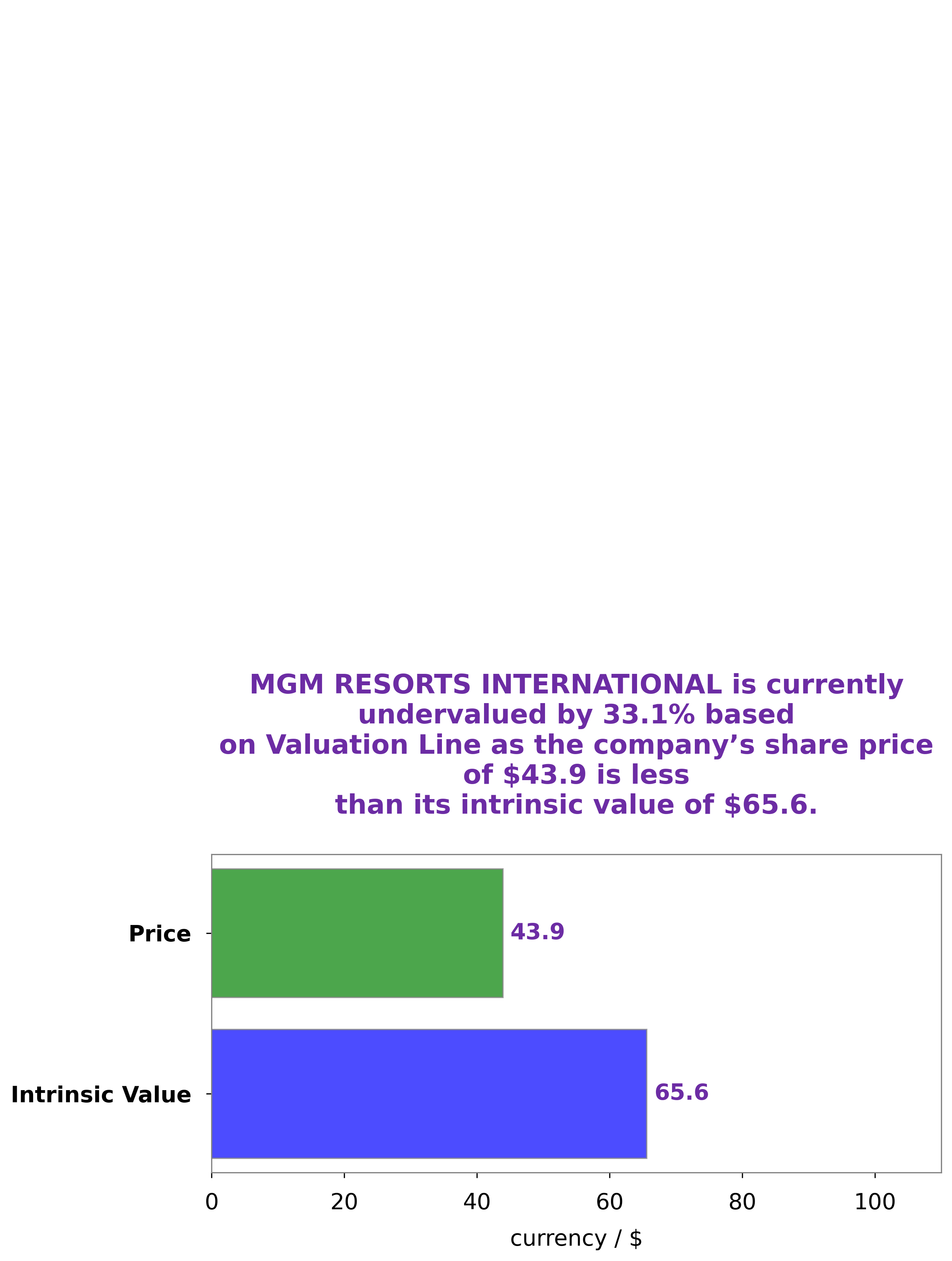

At GoodWhale, we recently conducted an analysis of MGM RESORTS INTERNATIONAL’s wellbeing. Our proprietary Valuation Line calculated the fair value of MGM RESORTS INTERNATIONAL’s share to be around $65.6. Yet, the stock is currently being traded at $43.9, indicating that it is undervalued by 33.1%. This discrepancy suggests that MGM RESORTS INTERNATIONAL’s stock offers a good opportunity for investment right now. More…

Peers

MGM Resorts International is one of the world’s leading global hospitality companies, operating a portfolio of destination resort brands including Bellagio, MGM Grand, Mandalay Bay, The Mirage, and more. The company’s competitors include SkyCity Entertainment Group Ltd, Wyndham Hotels & Resorts Inc, and Cruzani Inc.

– SkyCity Entertainment Group Ltd ($NZSE:SKC)

SkyCity Entertainment Group Ltd is a casino and hospitality company based in New Zealand. The company has a market cap of 2B as of 2022 and a Return on Equity of 3.48%. SkyCity operates four casinos in New Zealand, two in Australia, and one in Chile. The company also has a number of hotels, restaurants, and bars.

– Wyndham Hotels & Resorts Inc ($NYSE:WH)

Wyndham Hotels & Resorts, Inc. is one of the largest hotel companies in the world, with over 9,000 hotels across more than 80 countries. The company offers a variety of hotel brands, including Wyndham, Ramada, Days Inn, Super 8, and Howard Johnson. Wyndham Hotels & Resorts is headquartered in Parsippany, New Jersey. The company’s market cap is 6.2B as of 2022 and its ROE is 30.65%.

Summary

MGM Resorts International is a major player in the gaming and hospitality industry. As one of the largest gaming companies in the world, MGM has a strong presence in North America, and is looking to expand into the Japanese gaming market. Analysts suggest that MGM’s current financials make it an attractive investment, forecasting potential growth in the coming years. The company’s revenue has been steadily increasing over recent years, as well as its cash flow and net profit.

Additionally, MGM has a solid balance sheet and significant debt capacity, which could help fuel potential investments in Japan. With a wide variety of entertainment options, international presence, and strategic partnerships, MGM is well placed to take an early lead in the Japanese market.

Recent Posts