Meritage Homes Stock Intrinsic Value – Meritage Homes Corporation’s Stock Soars 25% in the Last Year, Proving Market is Following Fundamentals.

March 30, 2023

Trending News 🌥️

The impressive performance of Meritage Homes ($NYSE:MTH) Corporation’s stock has caused many to wonder if the market is following fundamentals or simply riding the wave of the company’s success. Recent data shows that the company’s stock has increased by 25% in the past six months, indicating that something is driving the growth. Analysts believe that this impressive stock performance is largely due to Meritage Homes’ strong fundamentals. The company has maintained a consistently strong balance sheet, with healthy capitalization ratios and a strong credit rating.

In addition, Meritage Homes has experienced impressive growth in both revenues and profits in the past six months, driven by strong sales of their housing developments throughout the country. The success of Meritage Homes Corporation appears to be evidence that the market is heeding the fundamentals and rewarding the company for its impressive performance. The solid financials and impressive revenue and profits have led many investors to believe that the company is a sound long-term investment, and this has been borne out by the stock’s recent performance. As long as Meritage Homes continues to maintain strong financial performance, it appears that the stock will remain a sound long-term investment for its investors.

Share Price

The market’s confidence in the company has been validated through mostly positive media coverage and its stock’s impressive performance. On Monday, Meritage Homes Corporation opened at $115.0 and closed at $113.6, a nominal decrease of 1.0% from its prior closing price of 114.7. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Meritage Homes. More…

| Total Revenues | Net Income | Net Margin |

| 6.3k | 992.19 | 15.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Meritage Homes. More…

| Operations | Investing | Financing |

| 405.27 | -32.29 | -129.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Meritage Homes. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.77k | 1.82k | 108 |

Key Ratios Snapshot

Some of the financial key ratios for Meritage Homes are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.6% | 61.2% | 20.5% |

| FCF Margin | ROE | ROA |

| 6.0% | 21.1% | 14.0% |

Analysis – Meritage Homes Stock Intrinsic Value

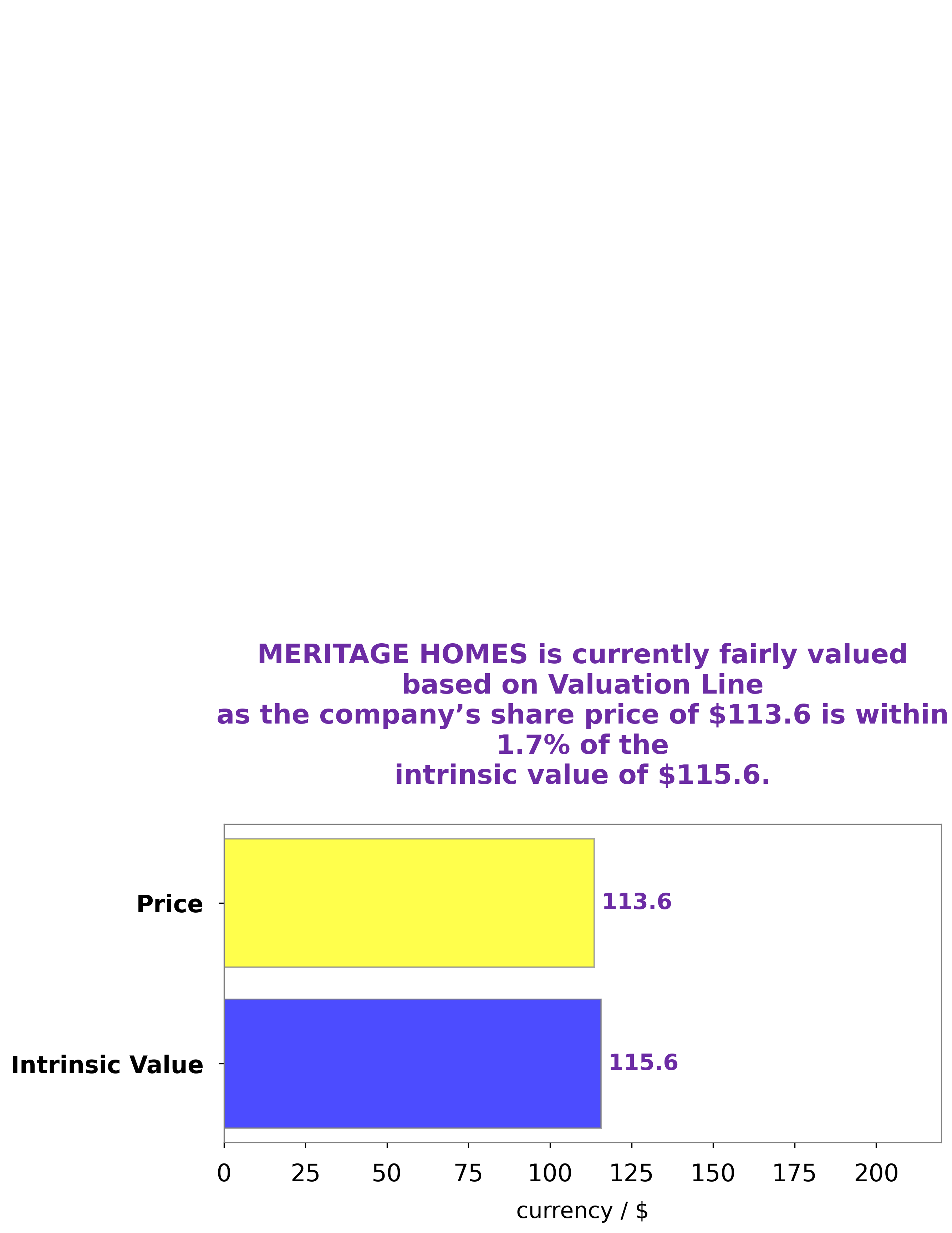

At GoodWhale, we recently analyzed the financials of MERITAGE HOMES, and our proprietary Valuation Line has determined that the intrinsic value of their shares is around $115.6. Currently, MERITAGE HOMES’ stock is traded at $113.6, giving it a fair price which is slightly undervalued by 1.7%. This presents a great opportunity for investors to purchase a reliable stock at an attractive price. More…

Peers

Beazer Homes USA Inc is a privately held company that is the tenth largest homebuilder in the United States. Skyline Champion Corp is a publicly traded company and the fifth largest builder in the United States. Taylor Morrison Home Corp is a publicly traded company and is the seventh largest homebuilder in the United States.

– Beazer Homes USA Inc ($NYSE:BZH)

Beazer Homes USA Inc is one of the largest homebuilders in the United States. The company has a market cap of 311.19M as of 2022 and a return on equity of 15.8%. Beazer Homes builds and sells single-family homes, townhomes, and condominiums in the United States. The company was founded in 1985 and is headquartered in Atlanta, Georgia.

– Skyline Champion Corp ($NYSE:SKY)

Skyline Champion Corporation is an American publicly traded company and one of the largest manufacturers of manufactured homes, modular homes, and park model RVs in North America. The company is headquartered in Elkhart, Indiana.

As of 2022, Skyline Champion Corporation has a market capitalization of 3.08 billion and a return on equity of 30.7%. The company’s primary business is the design, production, and sale of manufactured homes, modular homes, and park model RVs. Skyline Champion Corporation operates in three segments: Factory-Built Housing, Modular Buildings, and Park Models.

– Taylor Morrison Home Corp ($NYSE:TMHC)

Taylor Morrison Home Corporation is a homebuilder and land developer in the United States. The Company’s segments include Homebuilding and Financial Services. The Homebuilding segment builds and sells single-family detached and attached homes designed primarily for the entry-level and first move-up markets. This segment also provides mortgage banking and title services to homebuyers in its communities. The Financial Services segment provides mortgage banking and title services to third-party homebuyers in communities where it does not build homes, as well as to homebuyers of Taylor Morrison homes. The Company operates in Arizona, California, Colorado, Florida, Georgia, Illinois, North Carolina and Texas.

Summary

Meritage Homes Corporation has seen a 25% increase in their stock price over the past year, indicating that the market is favoring their underlying fundamentals. Analysts have expressed generally positive sentiment about the company, with many expecting further growth in the coming months. This suggests that investing in Meritage Homes could be a good option for those looking to add upside potential to their portfolio. Financial metrics such as earnings, revenue, and operating income should all be closely monitored when making an investment decision.

Additionally, investor sentiment should be taken into account to get a better understanding of the stock’s performance and future outlook.

Recent Posts