Mckesson Corporation Intrinsic Value Calculation – McKesson Sees Positive Q4 Outlook Despite Lackluster Year-To-Date Performance

May 6, 2023

Trending News ☀️

MCKESSON ($NYSE:MCK): McKesson Corporation is a global leader in healthcare services and pharmaceutical distribution, providing an array of healthcare solutions to thousands of customers around the world. Despite lackluster performance throughout the year-to-date, McKesson is expecting improved results in the fourth quarter of 2023. The company is confident that their investments in new technologies and processes will lead to greater efficiency and financial success. McKesson has made several strategic changes to improve their operations and increase their profitability. This includes investing in new technologies to streamline its supply chain and delivery systems, as well as implementing cost-cutting measures to reduce overhead costs. These efforts have already begun to pay off as McKesson’s performance for the year-to-date has been lackluster.

However, the company remains optimistic about the fourth quarter, expecting their efforts to bear fruit in the form of increased revenue and profits. McKesson’s upcoming quarter is expected to be profitable due to its enhanced operational capabilities, which should lead to improved financial results. This will undoubtedly be a welcome turn of events for the company, as it has been struggling to compete with its larger competitors in recent years. If McKesson can continue its trajectory of improving profitability and efficiency, there is no doubt that the company will remain a leader in healthcare services and pharmaceutical distribution for years to come.

Share Price

Despite a lackluster year-to-date performance, MCKESSON CORPORATION is seeing a positive fourth quarter outlook. On Friday, the company’s stock opened at $356.9 and closed at $365.9, representing a 3.0% increase from its prior closing price of 355.0. This performance indicates growing confidence in the outlook for the fourth quarter and beyond for the pharmaceuticals and healthcare services provider.

Analysts are expecting higher revenue and earnings growth in the coming months, which has helped to drive up share prices. As MCKESSON CORPORATION continues to adapt its business strategies to the changing healthcare industry, the company expects to see further positive momentum in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mckesson Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 273.9k | 3.14k | 1.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mckesson Corporation. More…

| Operations | Investing | Financing |

| 4.72k | -115 | -5.17k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mckesson Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 62.69k | 64.78k | -17.93 |

Key Ratios Snapshot

Some of the financial key ratios for Mckesson Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.8% | 15.5% | 1.7% |

| FCF Margin | ROE | ROA |

| 1.5% | -134.9% | 4.5% |

Analysis – Mckesson Corporation Intrinsic Value Calculation

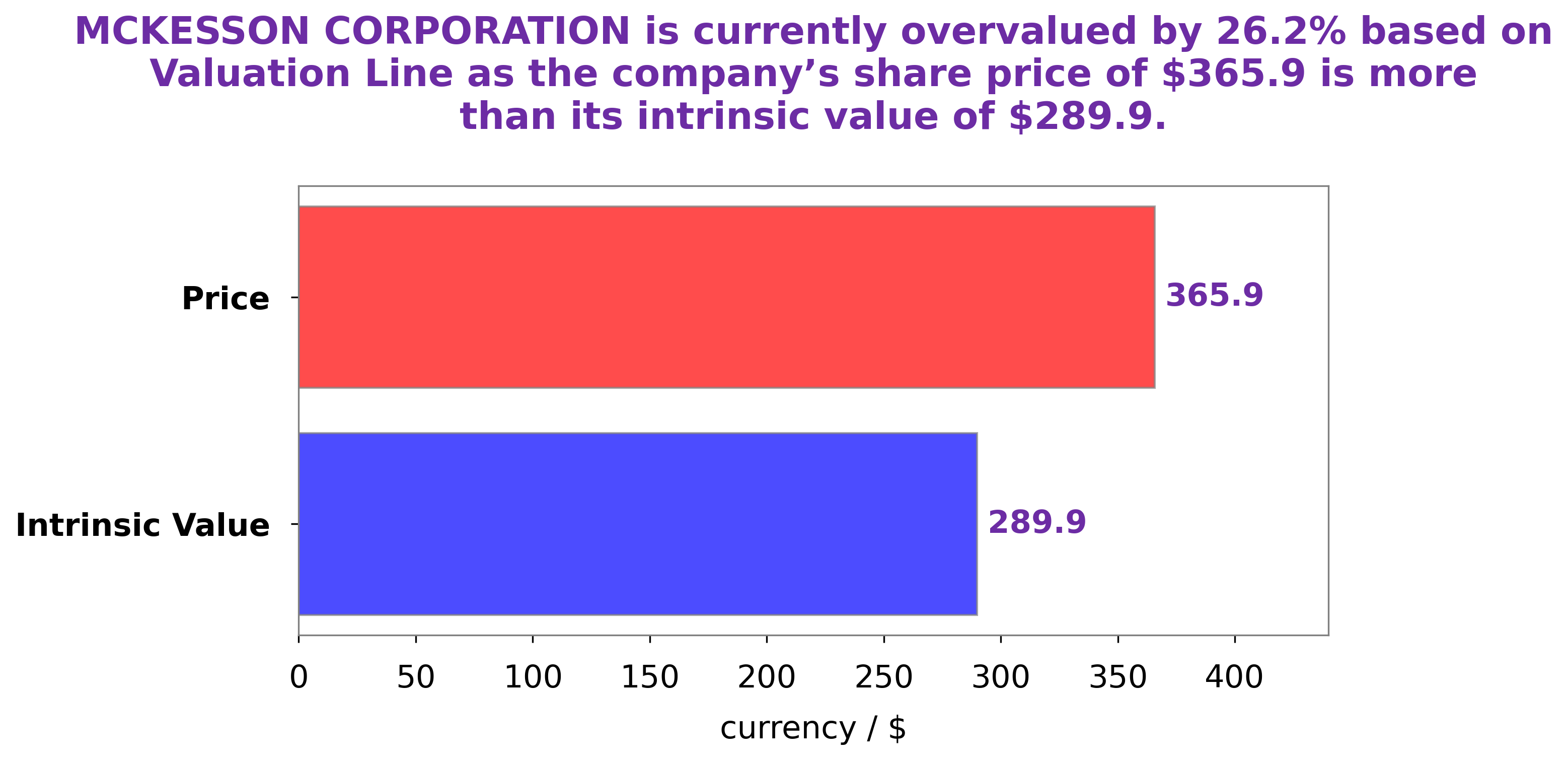

At GoodWhale, we have performed a comprehensive analysis of the wellbeing of MCKESSON CORPORATION. Based on our proprietary Valuation Line, we have calculated the intrinsic value of MCKESSON CORPORATION shares to be $289.9. Currently, MCKESSON CORPORATION stock is trading at $365.9, which is overvalued by 26.2%. This suggests that, if investors were to purchase MCKESSON CORPORATION stock at this current price, they would not be receiving the optimal value for their investment. More…

Peers

In the healthcare sector, McKesson Corp competes against Cardinal Health Inc, AmerisourceBergen Corp, and Sigma Healthcare Ltd. These companies are all major players in the healthcare industry, and each one brings something unique to the table. However, McKesson Corp is the largest of these companies, and its size gives it a significant competitive advantage.

– Cardinal Health Inc ($NYSE:CAH)

Cardinal Health Inc is a healthcare services and products company that operates in two segments: Pharmaceutical and Medical. The company’s Pharmaceutical segment includes sales of branded, generic and over-the-counter pharmaceutical products, as well as nuclear pharmacy services. The Medical segment provides a range of medical products and services, including surgical and medical products, medical devices and laboratory products and services. Cardinal Health Inc has a market cap of 18.55B as of 2022. The company’s Return on Equity for the same period is 55.12%.

– AmerisourceBergen Corp ($NYSE:ABC)

AmerisourceBergen is one of the world’s largest pharmaceutical services companies. It offers a range of services and products to healthcare providers and pharmaceutical companies. The company has a market cap of 29.64B as of 2022 and a return on equity of 417.0%. AmerisourceBergen is a publicly traded company listed on the New York Stock Exchange.

– Sigma Healthcare Ltd ($ASX:SIG)

Sigma Healthcare is a leading full-line wholesale and distribution company that services pharmacies across Australia. The company has a market capitalisation of $693.83 million as of March 2022 and a return on equity of 0.46%. Sigma Healthcare is a diversified healthcare company with operations in both pharmacy and hospital sectors. The company’s primary activities include the wholesale distribution of pharmaceuticals, medical and surgical supplies. Sigma Healthcare also owns and operates a number of community pharmacies across Australia.

Summary

On the same day, its stock price moved up, suggesting that investors are optimistic about the company’s performance. An analysis of MCKESSON Corporation shows that the company operates through three business segments: U.S. Pharmaceutical and Specialty Solutions, International Pharmaceutical and Specialty Solutions, and Medical-Surgical Solutions. Its U.S. segment includes the services of a major pharmaceutical distributor, and its International segment distributes pharmaceuticals and medical products to healthcare facilities.

Its Medical-Surgical segment provides medical products and services for hospitals and other healthcare providers. With its diversified product portfolio, MCKESSON Corporation has the potential to generate higher returns for long-term investors.

Recent Posts