Masimo Corporation Stock Intrinsic Value – Apple One Juror Away from Victory in Masimo Trade-Secret Theft Case.

May 4, 2023

Trending News 🌥️

Masimo Corporation ($NASDAQ:MASI) is a medical device company based in California, specializing in the development of innovative noninvasive monitoring technologies. Recently, Apple Inc. has accused Masimo of stealing its trade secrets and filed a lawsuit against the company. The lawsuit alleges that Masimo has stolen proprietary information from Apple, including trade secrets that involve the development and production of Apple’s health-related products, such as the Apple Watch. With one jury member still undecided, Apple appears to be one juror away from victory in the Masimo trade-secret theft case.

After hearing arguments from both sides, the jurors have reportedly been debating for days, trying to come to a unanimous decision. If the jury rules in favor of Apple, it would be a major victory for the company, granting them full financial compensation for the intellectual property theft by Masimo.

Stock Price

On Tuesday, MASIMO CORPORATION experienced a downturn in their stocks, opening at $180.0 and closing at $183.3, a 3.0% decrease from the prior closing price of 189.1. The case is centered around alleged theft of MASIMO’s pulse oximetry technology, which is used to measure oxygen levels in the blood. If the jury rules in favor of Apple, it could have a major impact on MASIMO’s stock price. However, it could also provide MASIMO with an opportunity to expand its market share and gain more recognition in the medical technology sector. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Masimo Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.04k | 143.5 | 6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Masimo Corporation. More…

| Operations | Investing | Financing |

| 29.4 | -1.06k | 520.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Masimo Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.21k | 1.87k | 25.45 |

Key Ratios Snapshot

Some of the financial key ratios for Masimo Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.5% | -1.7% | 10.8% |

| FCF Margin | ROE | ROA |

| -1.3% | 10.6% | 4.3% |

Analysis – Masimo Corporation Stock Intrinsic Value

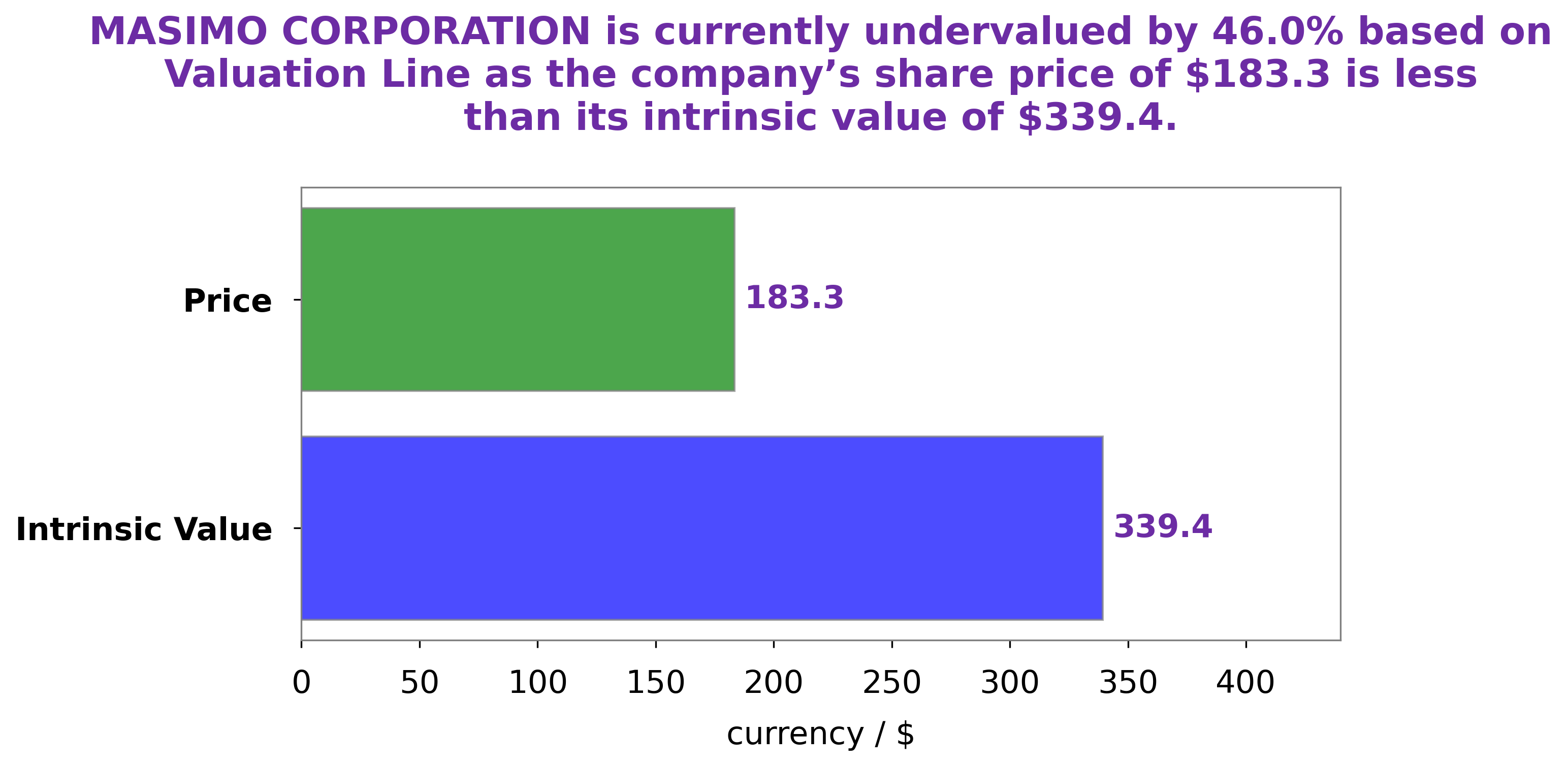

We recently performed an analysis of MASIMO CORPORATION‘s wellbeing and our proprietary Valuation Line has determined that the fair value of MASIMO CORPORATION share is around $339.4. However, currently MASIMO CORPORATION stock is trading at $183.3, which is an undervaluation of 46.0%. This discrepancy presents an interesting opportunity for investors to take advantage of in the near future. More…

Peers

In the medical device industry, there is intense competition between Masimo Corp and its rivals Elekta AB, Essilorluxottica, and Compumedics Ltd. While all four companies offer innovative products and services, each has its own unique strengths and weaknesses. As a result, the competition between them is fierce, and it is often difficult for one company to gain a significant advantage over the others.

– Elekta AB ($OTCPK:EKTAY)

Despite a challenging year for the company, Elekta’s market cap has grown to 2.09B as of 2022. This is due in part to the company’s strong return on equity, which stands at 11.86%. Elekta is a leading provider of radiation therapy solutions for the treatment of cancer. The company’s products are used in over 6,000 hospitals and clinics around the world, and its solutions are backed by a team of over 3,000 employees.

– Essilorluxottica ($LTS:0OMK)

EssilorLuxottica is a French-Italian multinational corporation that designs, manufactures, and markets ophthalmic lenses, instruments, and equipment. The company has a presence in over 130 countries and employs more than 140,000 people. The company was formed in 2018 through the merger of Essilor International and Luxottica.

– Compumedics Ltd ($ASX:CMP)

Computedics Ltd is a technology company that provides computing and analytics solutions. The company has a market cap of 42.52M as of 2022 and a Return on Equity of 1.53%. Computedics Ltd provides computing and analytics solutions to businesses and organizations worldwide. The company offers a range of services, including data storage, cloud computing, data analysis, and security. Computedics Ltd is headquartered in Sydney, Australia.

Summary

Masimo Corporation is a medical technology company that has been involved in a trade secret theft case with Apple Inc. Investors should be aware of the potential impact of this case on the company’s stock price. On the day the news was released, Masimo Corporation’s stock price dropped, suggesting that investors may be uncertain about the potential outcome of the case. It is important for investors to stay up-to-date on any new developments regarding the case in order to properly weigh the risks and rewards associated with investing in Masimo Corporation.

Recent Posts