Marvell Technology Intrinsic Stock Value – Marvell Technology’s AI Journey: Examining the Hype and Valuation

June 14, 2023

🌥️Trending News

Marvell Technology ($NASDAQ:MRVL) is a leading provider of microprocessors and semiconductors, and has recently shifted its focus to artificial intelligence (AI). For many investors, the hype surrounding AI has created a high valuation for Marvell Technology’s stock, but a closer examination of the reality suggests that the valuation is not as inflated as one might think. The company has since become a leader in the development of microprocessors, storage, networking solutions, and other semiconductor components. Marvell Technology has also established itself as one of the leading AI providers in the tech industry, delivering innovative solutions to businesses of all sizes. The company’s investments in AI have led many investors to believe that Marvell Technology’s stock is particularly valuable.

However, a closer examination of the company’s performance and valuation suggests that the hype surrounding AI is overstated. Furthermore, the company’s AI products are still in the early stages of development, suggesting that investors should tread carefully when it comes to investing in Marvell Technology. Ultimately, Marvell Technology’s examination of the hype and valuation surrounding AI provides a reality check for potential investors. Although Marvell Technology has made great strides in the development of AI solutions, investors should be aware that the long-term performance of the company could be much lower than some expect. As such, it is important to invest in Marvell Technology with caution and to consider other elements of its performance before investing.

Share Price

Marvell Technology has announced a major push into the artificial intelligence (AI) market, creating hype around the company and its stock. On Monday, the stock opened at $60.9 and closed at $62.0, up by 3.4% from the prior closing price of $60.0. Marvell Technology is leveraging its deep pool of expertise in semiconductor layout and memory design to become a player in the AI space. The company has already announced the release of several AI-focused products, ranging from an AI accelerator to an AI software development kit. It has also invested heavily in the area, with its recent acquisition of Mantychore AI being particularly noteworthy.

Marvell Technology’s move into the AI market is not only beneficial for its customers, but also for its shareholders. AI technology is becoming increasingly important in today’s digital world, and Marvell Technology is well-positioned to take advantage of this trend. As more people become aware of the company’s foray into AI, its stock is sure to rise further. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Marvell Technology. More…

| Total Revenues | Net Income | Net Margin |

| 5.79k | -166.7 | -0.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Marvell Technology. More…

| Operations | Investing | Financing |

| 1.3k | -348.7 | -390.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Marvell Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 22.27k | 6.78k | 18.03 |

Key Ratios Snapshot

Some of the financial key ratios for Marvell Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.5% | 7.6% | 0.0% |

| FCF Margin | ROE | ROA |

| 17.6% | 0.0% | 0.0% |

Analysis – Marvell Technology Intrinsic Stock Value

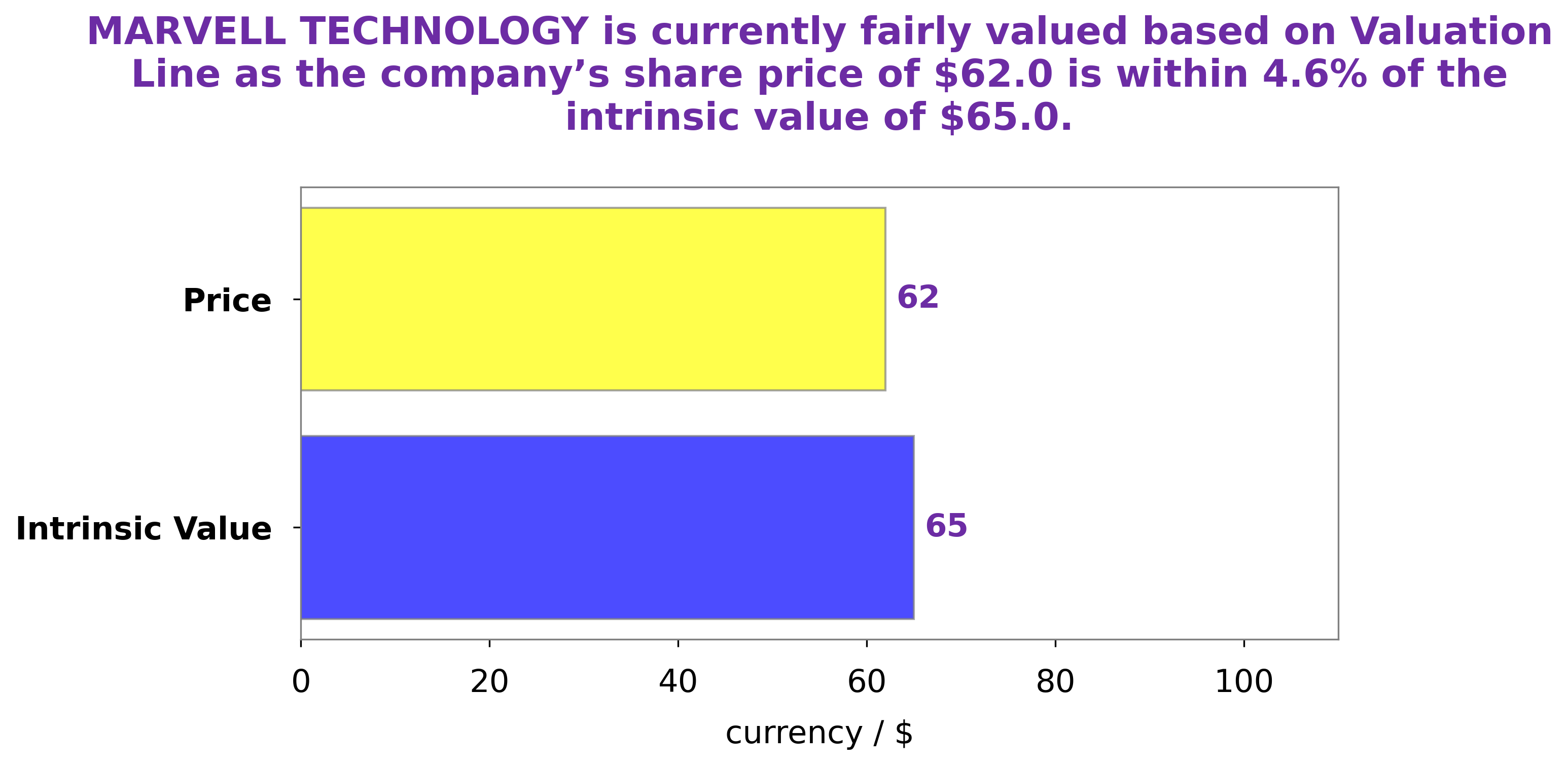

At GoodWhale, we have conducted an in-depth analysis of MARVELL TECHNOLOGY‘s financials. After taking into account the company’s current and expected performance, we have calculated that the fair value of MARVELL TECHNOLOGY share is around $65.0. To arrive at this number, we used our proprietary Valuation Line which combines intrinsic and relative valuations. From this, we can conclude that MARVELL TECHNOLOGY stock is currently undervalued, with a price of $62.0, representing a 4.6% discount to the fair value. More…

Peers

Marvell Technology Inc is a fabless semiconductor company that designs, develops, and markets analog, mixed-signal, digital signal processing, and embedded and standalone integrated circuits. Its main competitors are Advanced Micro Devices Inc, GLOBALFOUNDRIES Inc, and Intel Corp.

– Advanced Micro Devices Inc ($NASDAQ:AMD)

Advanced Micro Devices Inc is a technology company that designs and produces semiconductor products. The company has a market capitalization of 92.39 billion as of 2022 and a return on equity of 4.13%. The company’s products are used in a variety of electronic devices, including personal computers, game consoles, and servers.

– GLOBALFOUNDRIES Inc ($NASDAQ:GFS)

GLOBALFOUNDRIES Inc is a leading provider of semiconductor manufacturing services. The company has a market cap of 28.43B as of 2022 and a Return on Equity of 5.09%. The company offers a wide range of services, including manufacturing, design, and testing. GLOBALFOUNDRIES is a trusted partner for many of the world’s leading companies.

– Intel Corp ($NASDAQ:INTC)

Intel Corporation is an American multinational corporation and technology company headquartered in Santa Clara, California, in the Silicon Valley. It is the world’s largest and highest valued semiconductor chip manufacturer based on revenue, and is the inventor of the x86 series of microprocessors, the processors found in most personal computers (PCs). Intel supplies processors for computer system manufacturers such as Apple, Lenovo, HP, and Dell. Intel also manufactures motherboard chipsets, network interface controllers and integrated circuits, flash memory, graphics chips, embedded processors and other devices related to communications and computing.

Summary

Marvell Technology has seen its stock price move up in recent days. This appears to be in response to the company’s announcement of “Dance with AI”, an artificial intelligence program designed to improve operational efficiency. While the potential of this program is great, investors should be aware that the technology still has a long way to go before it is truly capable of having a meaningful impact on Marvell’s bottom line.

Therefore, investors should keep an eye on the progress of the program and evaluate any potential investments in Marvell accordingly. Ultimately, investors should weigh the potential risks and rewards when making their decision whether or not to invest in Marvell Technology.

Recent Posts