Marten Transport Stock Fair Value Calculator – Marten Transport Hits New Low of $17.84

November 1, 2023

🌧️Trending News

Marten Transport ($NASDAQ:MRTN), a Wisconsin-based truckload carrier, has recently hit a fresh 52-week low of $17.84. The company’s stock has been declining over the past year due to several factors, including a volatile trucking market and a general downturn in the economy. They provide temperature-controlled, dry van and logistics services for customers throughout the United States, Canada and Mexico. With such a large and established presence in the trucking industry, it is surprising that Marten Transport has recently hit such a new low.

Market Price

On Monday, MARTEN TRANSPORT stock hit a new low of $17.84, opening at $17.5 and closing at $17.7, up by 1.8% from prior closing price of 17.4. This downturn in stock price follows a few weeks of general declines in the stock, though it is still higher than it was in June of last year. MARTEN TRANSPORT is a leading temperature-sensitive truckload carrier, servicing the top retailers in the United States with reliable and efficient service. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Marten Transport. More…

| Total Revenues | Net Income | Net Margin |

| 1.23k | 95.54 | 7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Marten Transport. More…

| Operations | Investing | Financing |

| 219.02 | -188.59 | -18.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Marten Transport. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1k | 264.06 | 9.11 |

Key Ratios Snapshot

Some of the financial key ratios for Marten Transport are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.6% | 15.3% | 9.0% |

| FCF Margin | ROE | ROA |

| 8.2% | 9.5% | 6.9% |

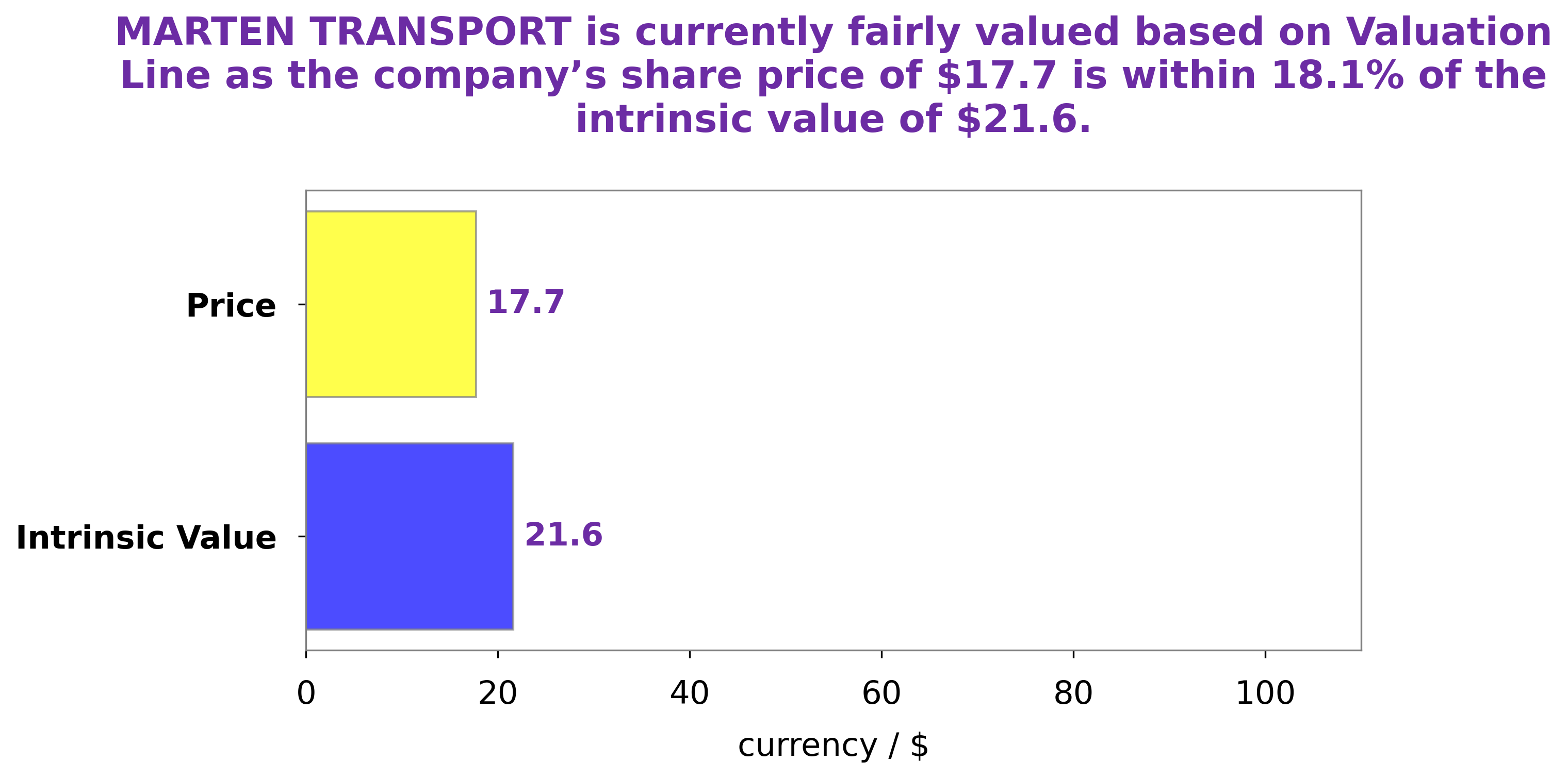

Analysis – Marten Transport Stock Fair Value Calculator

GoodWhale is pleased to present our analysis of MARTEN TRANSPORT‘s wellbeing. We calculated the intrinsic value of MARTEN TRANSPORT shares to be around $21.1 with our proprietary Valuation Line. Currently, MARTEN TRANSPORT stock is traded at $17.7, making it a fair price considering it is undervalued by 16.1% at the moment. More…

Peers

The trucking industry is highly competitive, with Marten Transport Ltd competing against P.A.M. Transportation Services Inc, Heartland Express Inc, and Saia Inc. All of these companies are vying for market share in the trucking industry, and each company has its own strengths and weaknesses.

– P.A.M. Transportation Services Inc ($NASDAQ:PTSI)

P.A.M. Transportation Services Inc is a trucking company that operates in the United States, Mexico, and Canada. The company has a market cap of 633.44M as of 2022 and a Return on Equity of 31.87%. P.A.M. Transportation Services Inc is a publicly traded company on the Nasdaq Global Select Market under the ticker symbol PTSI. The company was founded in 1980 and is headquartered in Tontitown, Arkansas.

– Heartland Express Inc ($NASDAQ:HTLD)

Heartland Express Inc is a publicly traded company with a market capitalization of 1.3 billion as of 2022. The company’s return on equity is 16.4%. Heartland Express is a trucking company that operates in the United States, Canada, and Mexico. The company offers a variety of services, including transportation of general commodities, refrigerated goods, and hazardous materials. Heartland Express also provides logistics services, such as warehousing and distribution.

– Saia Inc ($NASDAQ:SAIA)

Saia Inc. is a leading transportation and logistics company with a focus on regional shipping. The company operates through a network of terminals and intermodal facilities across the United States. Saia Inc. has a market cap of 6.11B as of 2022 and a return on equity of 20.38%. The company has a strong focus on regional shipping and operates through a network of terminals and intermodal facilities across the United States.

Summary

Marten Transport, Ltd. (MRTN) recently set a new 52-week low of $17.84, offering a good potential entry point for investors. Marten Transport has also generated positive year-over-year earnings growth in the past five years.

Furthermore, the company has recently been expanding its operations through acquisitions, which could further bolster its future performance. Overall, Marten Transport appears to be an attractive investment opportunity.

Recent Posts