Livent Corporation Intrinsic Value Calculation – LIVENT CORPORATION: An Investment Opportunity Worth Waiting For

April 21, 2023

Trending News ☀️

LIVENT CORPORATION ($NYSE:LTHM) is an exciting investment opportunity worth considering. The company is a leading producer of performance lithium products and technologies, and their stock has been undervalued for some time. As a result, I believe now is the time to invest in Livent, and I am waiting for the right catalyst to do so. They produce lithium hydroxide, metal-based salts, and other compounds used in various industries. Their products are used in the automotive, aerospace, and energy storage sectors, among others. Not only do their products provide performance, but they also help reduce environmental impacts. As an investor, there are many reasons to be bullish on LIVENT CORPORATION. The company has a strong track record of growth and profitability, and their products are in high demand from major customers.

Additionally, their strategic partnerships with key players in the industry have enabled them to expand their reach and increase their market share. With the growing demand for lithium products and technologies, Livent is well positioned to capitalize on the opportunities ahead. The company has a proven track record of success and is well positioned to benefit from the rising demand for lithium products and technologies. With the right catalyst, Livent stock could be poised for long-term growth, making now a great time to invest.

Market Price

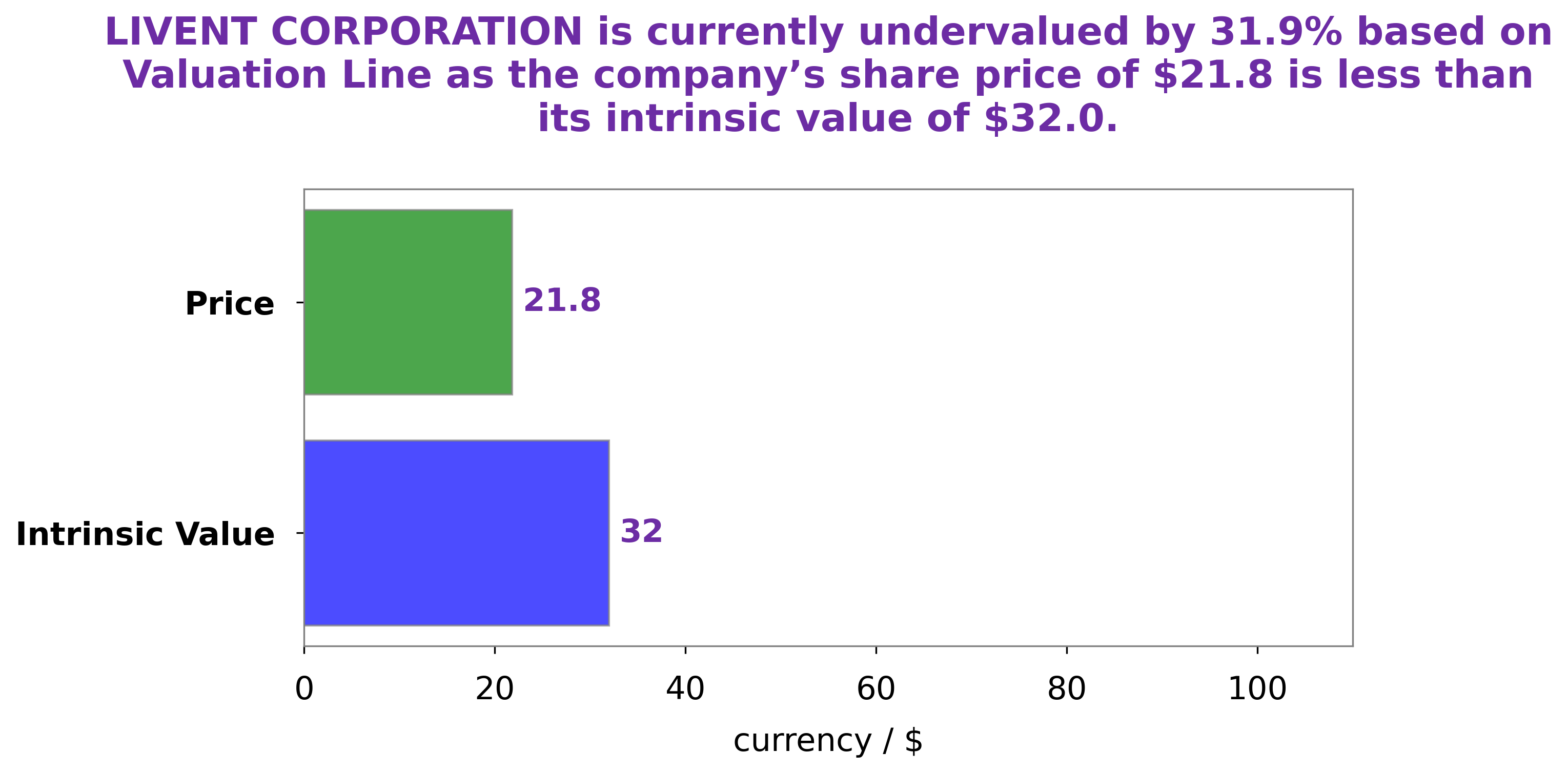

On Thursday, LIVENT CORPORATION stock opened at $22.1 and closed at $21.8, down by 3.7% from previous closing price of 22.7. This dip in the stock price presents a good opportunity for investors to enter the market. Investing in this company can bring good returns in the future as the company has a history of consistent growth and profitability.

The company is also well-positioned in the industry, with a strong presence in multiple markets and a committed management team. With a strong financial position and healthy fundamentals, LIVENT CORPORATION is an attractive option for investors seeking long-term growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Livent Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 813.2 | 273.5 | 34.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Livent Corporation. More…

| Operations | Investing | Financing |

| 454.7 | -364.7 | -12.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Livent Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.07k | 631.2 | 8.04 |

Key Ratios Snapshot

Some of the financial key ratios for Livent Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 27.9% | 67.7% | 41.2% |

| FCF Margin | ROE | ROA |

| 14.5% | 15.0% | 10.1% |

Analysis – Livent Corporation Intrinsic Value Calculation

At GoodWhale, we believe that LIVENT CORPORATION is an attractive investment opportunity. After conducting a thorough analysis of LIVENT CORPORATION’s fundamentals, our proprietary Valuation Line model gave an estimated fair value of $32.0 per share. This means that the current market price of $21.8 for LIVENT CORPORATION stock is undervalued by 31.8%. We believe this presents a great opportunity for investors to take advantage of this market inefficiency and benefit from the potential upside from the stock. More…

Peers

The lithium market is currently dominated by four major companies: Livent Corp, Albemarle Corp, Tianqi Lithium Industries Inc, and Ganfeng Lithium Co Ltd. These companies are in a constant state of competition with each other in order to maintain their respective market shares. The competition between these companies is fierce, and it is not likely to abate anytime soon.

– Albemarle Corp ($NYSE:ALB)

Albemarle Corporation is a publicly traded corporation headquartered in Charlotte, North Carolina that produces specialty chemicals. The company was founded in 1994 and has over 5,000 employees. Albemarle is a global leader in the production of lithium, bromine, and catalysts. The company has a market capitalization of over $31 billion and a return on equity of 2.69%. Albemarle is a publicly traded company on the New York Stock Exchange under the ticker symbol ALB.

– Tianqi Lithium Industries Inc ($SZSE:002466)

Tianqi Lithium Industries is a Chinese chemical company that produces lithium compounds. It is the world’s largest producer of lithium chemicals. The company has a market capitalization of $136.76 billion as of 2022 and a return on equity of 61.7%. Tianqi Lithium Industries produces a range of lithium compounds, including lithium carbonate, lithium hydroxide, and lithium chloride. The company is a major supplier of lithium to the electric vehicle industry.

– Ganfeng Lithium Co Ltd ($SZSE:002460)

Ganfeng Lithium Co Ltd is a leading producer of lithium. The company has a market capitalization of 144.54 billion as of 2022 and a return on equity of 28.99%. Ganfeng Lithium is a vertically integrated producer of lithium, with operations spanning mining, refining, and production of lithium chemicals. The company has a strong presence in the global lithium market, with a significant market share in China, the world’s largest lithium market.

Summary

Livent Corporation is an undervalued stock that has potential to increase in value. The stock price has recently moved down, making it a great time to invest. Investors should consider a few key factors when deciding whether to buy stock in Livent Corporation.

First, they should look at the company’s fundamentals, such as financial performance and management. Second, they should analyze any potential catalysts that could drive the stock price up, such as a potential merger or acquisition. Third, they should evaluate the market conditions to ensure they make a sound investment decision. Ultimately, investors should consider all these factors before making a final decision on whether or not to invest in Livent Corporation.

Recent Posts