Livanova Plc Stock Intrinsic Value – Barclays PLC Reduces its Holdings in LivaNova PLC by 36.0% in 4th Quarter

June 12, 2023

🌥️Trending News

LIVANOVA ($NASDAQ:LIVN): LivaNova PLC is a medical device company that specializes in the development, manufacturing, and marketing of implants, devices, and therapies used to treat various medical conditions. During the 4th quarter, Barclays PLC decreased its stake in LivaNova PLC by 36.0%, as revealed in its most recent filing with the SEC. This indicates that Barclays sees less potential upside in LivaNova than it did at the start of the quarter. Barclays is not alone in reducing its exposure to LivaNova.

Over the past six months, several institutional investors have reduced their positions in the company. It will be particularly crucial for the company to demonstrate its ability to generate sales growth and increase profitability if it wants to win back investors’ favor.

Analysis – Livanova Plc Stock Intrinsic Value

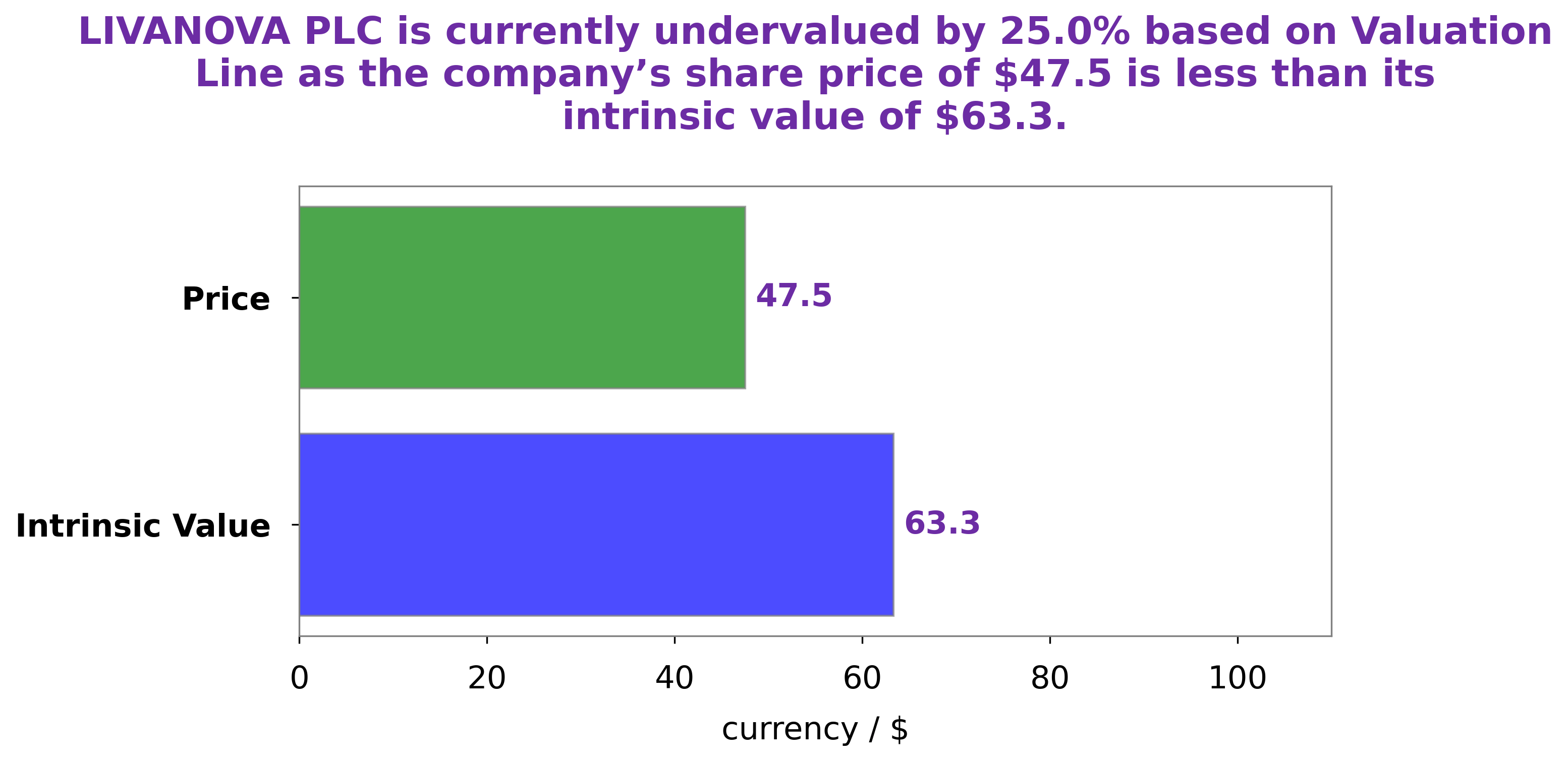

At GoodWhale, we recently conducted a comprehensive analysis of LIVANOVA PLC‘s wellbeing. After carefully assessing the company’s financial performance, we determined that the intrinsic value of LIVANOVA PLC share is around $63.3. This figure was calculated using our proprietary Valuation Line, which takes into account various factors such as cash-flow, earnings, debt, and other key financial indicators. Currently, the stock is being traded at $47.5, which is undervalued by 25.0%. Given the current market conditions and our assessment of the company’s performance, we believe that it is an excellent opportunity for potential investors to buy into the stock. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Livanova Plc. More…

| Total Revenues | Net Income | Net Margin |

| 1.05k | -81.84 | -4.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Livanova Plc. More…

| Operations | Investing | Financing |

| 64.9 | -44.43 | 60.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Livanova Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.29k | 1.07k | 22.55 |

Key Ratios Snapshot

Some of the financial key ratios for Livanova Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.0% | -15.9% | -1.6% |

| FCF Margin | ROE | ROA |

| 3.4% | -0.9% | -0.5% |

Peers

The company’s products include implantable cardioverter defibrillators, pacemakers, percutaneous transluminal coronary angioplasty catheters, stents, and thrombectomy devices. LivaNova PLC operates in Europe, the United States, Asia Pacific, the Middle East, and Africa. The company was formerly known as Sorin Group S.p.A. and changed its name to LivaNova PLC in February 2016. LivaNova PLC was founded in 1956 and is headquartered in London, the United Kingdom. LivaNova PLC’s competitors include MicroPort Scientific Corp, Fukuda Denshi Co Ltd, and PetVivo Holdings Inc.

– MicroPort Scientific Corp ($SEHK:00853)

MicroPort Scientific Corp is a medical device company that develops, manufactures, and markets a broad range of products and solutions for the treatment of cardiovascular diseases. The company has a market cap of 31.83B as of 2022 and a return on equity of -19.11%. MicroPort’s products and solutions are used in a variety of procedures, including coronary angioplasty, stenting, and valve replacement. The company’s products are sold in over 50 countries worldwide.

– Fukuda Denshi Co Ltd ($TSE:6960)

With a market cap of 114.93B as of 2022, Fukuda Denshi Co Ltd is one of the largest companies in Japan. The company produces a wide range of products, including medical equipment, electronic products, and communications equipment. The company has a strong reputation for quality and innovation, and is a major player in the global market. Fukuda Denshi Co Ltd has a return on equity of 9.95%, which is relatively high for a large company. The company’s strong financial performance is due in part to its efficient operations and sound management.

– PetVivo Holdings Inc ($NASDAQ:PETV)

PetVivo Holdings Inc is a pet health and wellness company that focuses on the development and commercialization of pet health products. The company has a market capitalization of $25.78 million and a return on equity of -79.79%. The company’s products include a line of CBD-based pet health products, as well as a line of pet supplements.

Summary

This implies that the company may not have provided investors with the expected returns or that Barclays PLC has become more risk-averse. Investors should do their own due diligence and research to determine if LivaNova remains a viable investment option. Furthermore, investors should be aware of any changes in the company’s financials and competitive environment in order to make the best investment decisions.

Recent Posts