Liberty Global Intrinsic Value Calculation – Gateway Investment Advisers LLC Exits Liberty Global plc (NASDAQ:LBTYK) Position with 198906 Shares Sold

April 1, 2023

Trending News ☀️

Liberty Global ($NASDAQ:LBTYA) plc (NASDAQ:LBTYK) recently saw Gateway Investment Advisers LLC divest 198906 shares of Liberty Global plc (NASDAQ:LBTYK). Liberty Global plc is an international cable and telecommunications company, serving both residential and business customers across Europe, Latin America, and the Caribbean. It owns and operates cable networks and offers a range of entertainment and communications services that include broadband internet services, television, voice, and mobile services. The company is headquartered in London, United Kingdom and its shares are traded on the NASDAQ Global Select Market. Through its subsidiaries, Liberty Global controls large stakes in numerous digital TV providers, including Virgin Media in the UK and Telenet in Belgium.

It also has a large stake in VodafoneZiggo, a joint venture between Liberty Global and Vodafone Group in the Netherlands. The company is focused on expanding its presence in Europe and Latin America through strategic investments, acquisitions, and partnerships. Liberty Global is committed to delivering a great customer experience by offering innovative products, services, and experiences.

Market Price

The sale was made on Friday, with the stock opening at $18.4 and closing at $18.5, representing a decrease of 0.6% from its previous closing price of $18.6. The company has been aggressively investing in its network infrastructure to expand its offerings and further penetrate the European market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Liberty Global. More…

| Total Revenues | Net Income | Net Margin |

| 7.2k | 1.47k | -23.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Liberty Global. More…

| Operations | Investing | Financing |

| 2.84k | 1.28k | -3.28k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Liberty Global. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 42.9k | 20.32k | 50.18 |

Key Ratios Snapshot

Some of the financial key ratios for Liberty Global are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -14.6% | -36.4% | 28.0% |

| FCF Margin | ROE | ROA |

| 21.3% | 5.5% | 2.9% |

Analysis – Liberty Global Intrinsic Value Calculation

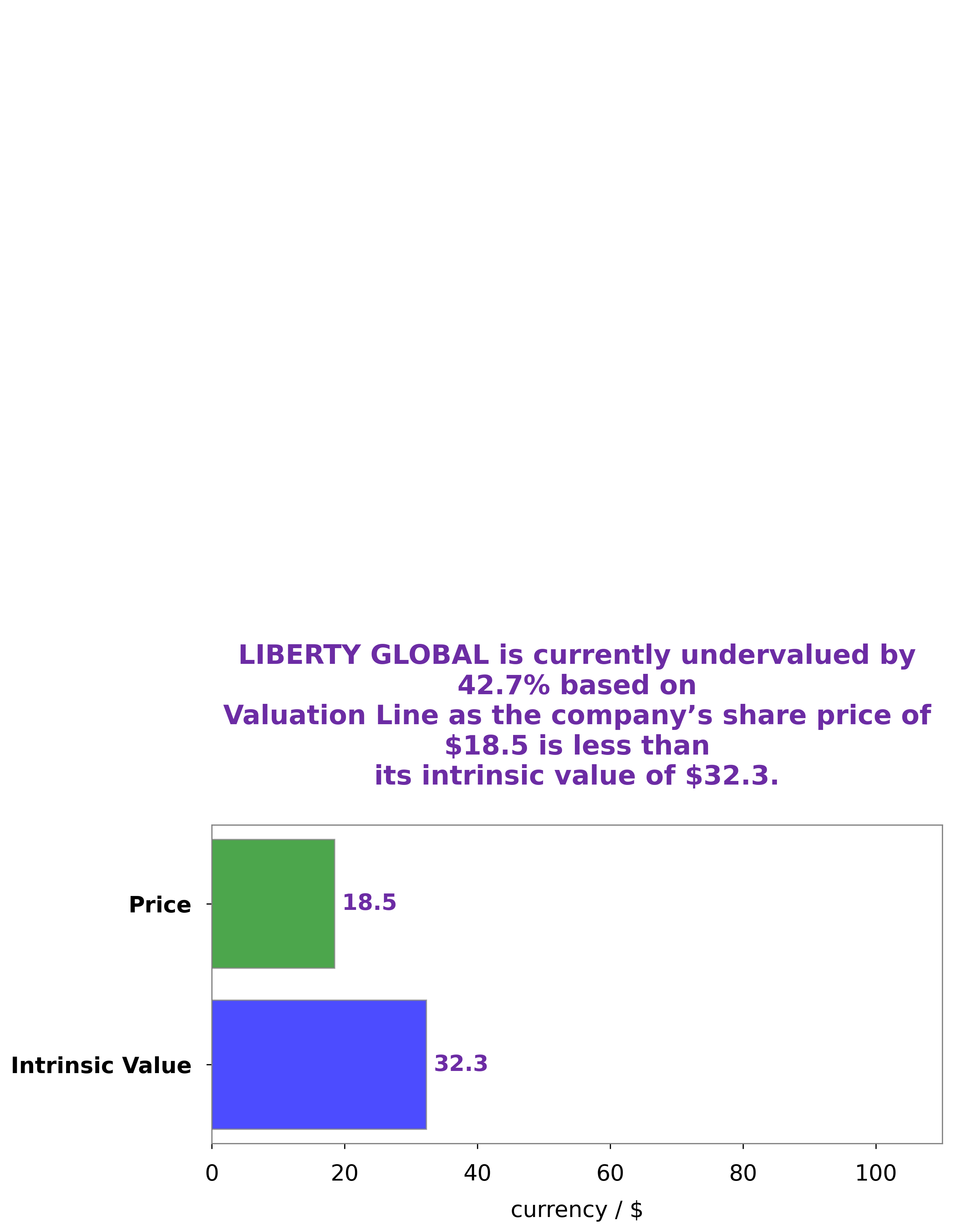

At GoodWhale, we have conducted a thorough analysis of LIBERTY GLOBAL‘s financials. Our proprietary Valuation Line algorithm has calculated the intrinsic value of LIBERTY GLOBAL shares at approximately $32.3. However, the current price of LIBERTY GLOBAL shares is $18.5, representing a significant 42.8% undervaluation based on our calculations. More…

Peers

Liberty Global PLC is one of the world’s leading broadband providers. It has operations in 14 countries and over 27 million customers. Its main competitors are Comcast Corp, Paramount Global, Megacable Holdings SAB de CV.

– Comcast Corp ($NASDAQ:CMCSA)

Comcast is a publicly traded company that provides communication, information, and entertainment products and services. The company has a market capitalization of 137.22 billion as of 2022 and a return on equity of 9.26%. Comcast operates in four segments: cable communications, cable networks, broadcast television, and filmed entertainment. The company’s products and services include video, high-speed Internet, voice, and home security and automation. Comcast is headquartered in Philadelphia, Pennsylvania.

– Paramount Global ($NASDAQ:PARA)

Paramount Global is a leading provider of global e-commerce and online marketing solutions. The company has a market cap of 12 billion as of 2022 and a return on equity of 13.69%. Paramount Global provides a suite of integrated e-commerce and online marketing services that enable businesses to reach their customers worldwide. The company offers a full range of services, including website design and development, search engine optimization, pay per click management, email marketing, social media marketing, and web analytics. Paramount Global has a team of experienced online marketing professionals who are dedicated to helping businesses grow their online presence and reach their target audiences.

– Megacable Holdings SAB de CV ($OTCPK:MHSDF)

As of 2022, Megacable Holdings SAB de CV has a market cap of 3.65B and a Return on Equity of 11.33%. Megacable Holdings SAB de CV is a Mexican telecommunications company that provides cable television, broadband Internet, and telephone services in Mexico.

Summary

Gateway Investment Advisers LLC recently sold 198906 shares of Liberty Global plc (NASDAQ:LBTYK). When considering an investment in this company, investors should assess the current stock price and its potential for growth. Specifically, they should consider the company’s financials, industry trends, and competitive advantages.

Additionally, the company has a long history of successful mergers and acquisitions, strategic partnerships, and expanding into new markets. Furthermore, Liberty Global’s business model is focused on delivering value to customers through a wide range of products, services, and offerings. Taken together, these factors make Liberty Global a good opportunity for long-term investors.

Recent Posts