Li-cycle Holdings Stock Fair Value – Li-Cycle and VinES Energy Collaborate to Advance Battery Recycling

April 13, 2023

Trending News ☀️

LI-CYCLE ($NYSE:LICY): Li-Cycle Holdings Inc. is a vertically integrated battery recycling company that offers lithium-ion battery recycling solutions for the Electric Vehicle (EV) and Energy Storage System (ESS) industries. Recently, Li-Cycle and VinES Energy have announced a long-term agreement for battery recycling. Through this partnership, Li-Cycle will provide its patented and advanced technology to recycle large-format lithium-ion batteries from electric vehicles and energy storage systems. The two companies are committed to advancing the development of meaningful recycling solutions to ensure the safe and efficient recovery of lithium-ion batteries at end-of-life. The collaboration between Li-Cycle and VinES Energy will create a sustainable platform in which lithium-ion battery materials can be recovered, reused and recycled.

The agreement allows Li-Cycle to further expand its network of service providers and customers, while providing the industry with a reliable recycling solution. With the help of this partnership, Li-Cycle will be able to provide sustainable, efficient and cost-effective solutions for the recovery of lithium-ion batteries. This collaboration will help to reduce the environmental impact of lithium-ion battery disposal and create a circular economy for the EV and ESS industries.

Share Price

This news sent their stock price to open at $5.7, however it closed the day at $5.6, a decrease of 0.4% from last closing price of 5.6. With this collaboration, Li-Cycle looks to create a comprehensive battery recycling solution for electric vehicle batteries, consumer electronics, and industrial batteries. Li-Cycle’s technology is set to break down battery components into raw materials that can be recycled and reused, thus creating a circular economy for batteries.

VinES Energy on the other hand will provide Li-Cycle with their patented thermal conversion process to reduce the volume of waste and increase the collection of metals and rare earths contained in the batteries. This collaboration is expected to benefit both companies as Li-Cycle’s technology and VinES Energy’s thermal conversion process complements each other, allowing Li-Cycle to provide a complete recycling solution for batteries. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Li-cycle Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 13.4 | -53.7 | -907.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Li-cycle Holdings. More…

| Operations | Investing | Financing |

| -72.6 | -190.1 | 244.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Li-cycle Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 882.3 | 388.2 | 2.81 |

Key Ratios Snapshot

Some of the financial key ratios for Li-cycle Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 552.8% | – | -272.4% |

| FCF Margin | ROE | ROA |

| -1960.4% | -4.5% | -2.6% |

Analysis – Li-cycle Holdings Stock Fair Value

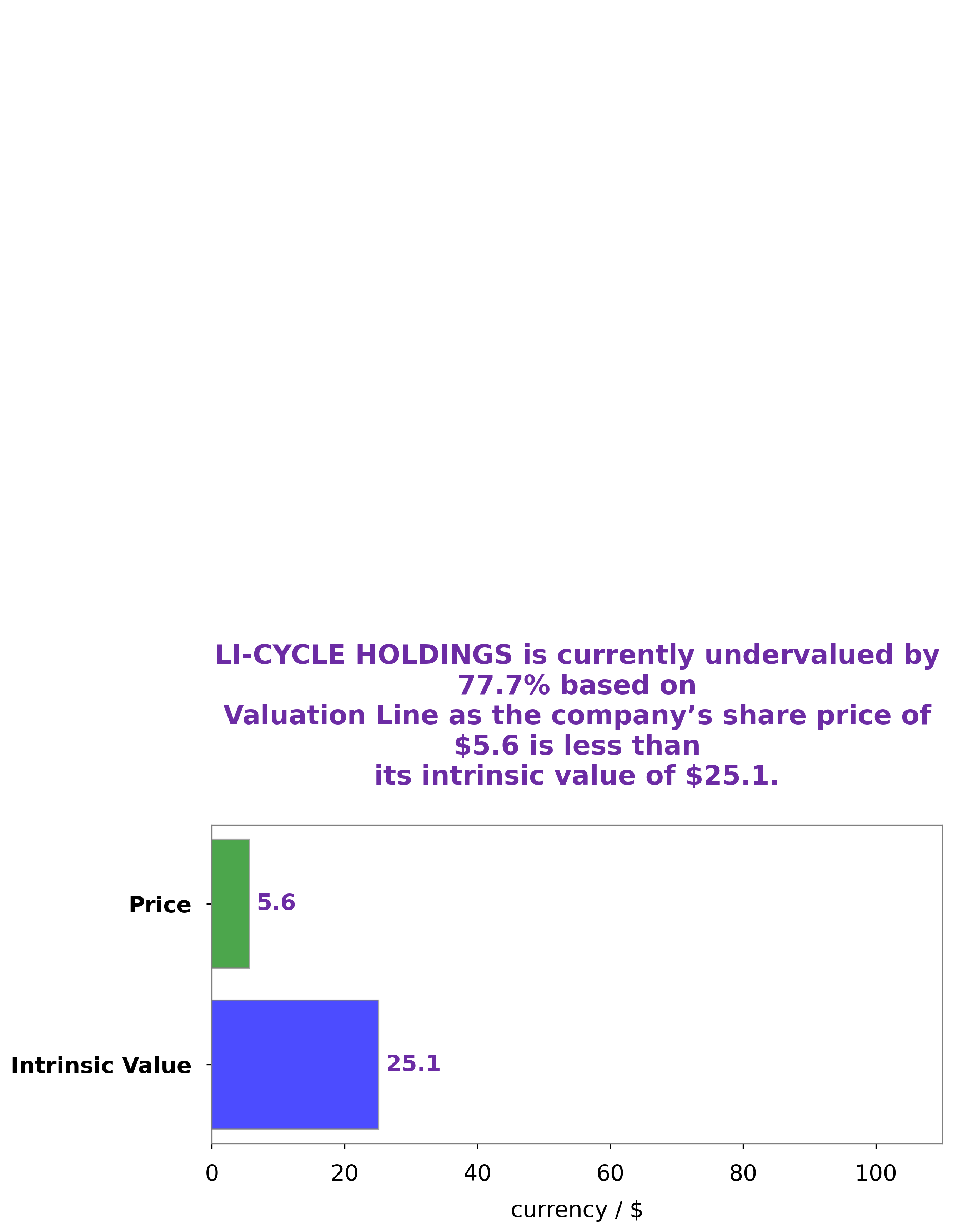

At GoodWhale, we believe that understanding the fundamentals of LI-CYCLE HOLDINGS is essential to making an informed decision about whether or not to invest in the company. That’s why we’ve made it easy to analyze LI-CYCLE HOLDINGS’s financials and business operations on our platform. Our proprietary Valuation Line suggests that the fair value of LI-CYCLE HOLDINGS’s share is around $25.1. However, the stock is currently trading at only $5.6, making it undervalued by 77.6%. As a result, GoodWhale believes that there is potential for significant returns from investing in LI-CYCLE HOLDINGS. More…

Peers

In recent years, the competition between Li-Cycle Holdings Corp and its competitors has intensified. Guangzhou Great Power Energy&Technology Co Ltd, Flux Power Holdings Inc, and Beijing Easpring Material Technology Co Ltd have all been striving to gain market share in the lithium-ion battery recycling industry. While each company has its own strengths and weaknesses, Li-Cycle Holdings Corp has emerged as the clear leader in terms of market share and profitability.

– Guangzhou Great Power Energy&Technology Co Ltd ($SZSE:300438)

The company’s market capitalization is 31.9 billion as of 2022, and its return on equity is 7.8%. The company is engaged in the development, manufacture and sale of batteries, energy storage systems and other related products.

– Flux Power Holdings Inc ($NASDAQ:FLUX)

Founded in 2006, Flux Power Holdings, Inc. is a developer, manufacturer and marketer of advanced battery solutions for industrial applications, including electric forklifts, airport ground support equipment and other commercial electric vehicles. The company’s lithium-ion batteries are designed to provide safer and longer lasting performance than lead-acid batteries, as well as a lower total cost of ownership. Flux Power’s products are sold through a network of industrial equipment dealers and battery distributors.

As of 2022, Flux Power Holdings Inc had a market cap of 49.59M and a return on equity of -63.65%.

– Beijing Easpring Material Technology Co Ltd ($SZSE:300073)

Beijing Easpring Material Technology Co Ltd is a Chinese company that produces and sells materials for use in the semiconductor industry. The company has a market capitalization of $33.32 billion as of 2022 and a return on equity of 11.52%. Beijing Easpring is a leading supplier of silicon wafers, epitaxial wafers, and other semiconductor materials. The company’s products are used in the manufacture of integrated circuits, optoelectronic devices, and other semiconductor products.

Summary

LI-CYCLE Holdings Inc. (LI-CYCLE) recently entered into a long-term agreement with VinES Energy AG to collaborate on battery recycling. This partnership is set to bolster LI-CYCLE’s already strong presence in the battery recycling landscape, and could provide significant benefits for investors. The agreement is expected to provide LI-CYCLE with increased capital and access to new markets, whilst VinES Energy will benefit from LI-CYCLE’s proprietary technology. Moreover, the agreement contains provisions for an exclusive research and development collaboration with VinES Energy. The combination of LI-CYCLE’s existing technology and VinES Energy’s expertise should give LI-CYCLE a competitive edge in the rapidly growing battery recycling market. Investors can therefore expect benefits from this agreement, including increased profits and revenue growth.

In addition, the agreement may also lead to a rise in LI-CYCLE’s stock price as demand for recycled batteries increases. Given its potential advantages, this agreement is a smart move by LI-CYCLE and investors should take note.

Recent Posts